踏入2025年之時,我們曾提出,儘管預計市場將難免波動,但環球股票展望整體樂觀。經濟硬著陸得以避免,通脹放緩為放寬政策利率創造了條件,及即將上任的特朗普政府提供了在全球最大經濟體實施促進經濟增長的政策議程的可能性。

儘管路途中經歷一些意外轉折,即市場低估了特朗普總統關稅提案的規模,但目前看來最劇烈的波動性時期已成過去,且一連串有利環球股票的互補性趨勢正在顯現。 其中包括以下幾方面的推斷: 對等關稅將不會高至最初宣稱的水平;鑑於關稅引發通脹的最壞情境的發生概率已經減弱,聯儲局有望繼續減息;及歐洲及亞洲出現一些對市場有利的發展。

儘管這些因素的相互作用有望推動股票回報持續擴闊,但地緣政治及宏觀不確定性或會導致短期內出現額外波動性。 然而,這類市場錯置可能為增長股提供具吸引力的進入點,在過去兩年內的大部分時間,增長股處於帶動大市走向的領先地位,導致其估值可能已經偏離基本因素。

不再是美國一枝獨秀

美國的貿易可能遭受衝擊,但其他地區繼續優先關注貨品自由流通的裨益。 數十年前,歐元區正是為此目標而設立。 美國針對長期貿易夥伴設置新壁壘,可能促使歐洲領導人啟動必要的促進經濟增長的改革措施。 該方面的情況有所改善。 放寬歐元區金融業的繁重監管,可能會使資本更容易流向生產效率更高的企業。

增加國防領域的投資,以應對地緣政治格局轉變帶來的挑戰,是另一項刺激經濟的發展。 德國等國家接受更高的預算赤字,使得增加國防支出變得切實可行。

亞洲方面,日本致力推行有利股東的改革及中國近期以消費為重點的刺激措施皆有望利好該地區股市。

美國情況亦如出一轍,貿易方面取得一定進展,應當會讓環球各國央行能夠靈活減息,從而支持疲乏的經濟。 上述政策扶持及有利市場的改革措施,或許有助緩解環球經濟在離開全球化高峰期時面臨的壓力。與此同時,近岸外包及製造業回流等興起的趨勢,為一眾企業帶來風險及機遇。 環球供應鏈重構使其遠離成本最低的生產地,加上設置更高的准入門檻,雖會帶來經濟成本,但跨國公司留下的缺口,將有可能由本地或區域供應商填補,從而為投資者創造了識別新機制下贏家的機會。

政策及經濟前景分化,可能標誌著美國逐步失去在市場的主導地位。 一種常見論據是,基於美國股市廣泛涉足包括AI在內的重大投資主題,根本不太需要投資美國以外的地區。然而,科技創新將不可避免地滲透環球經濟的各個領域,從而提高不同地區及行業的企業生產力。

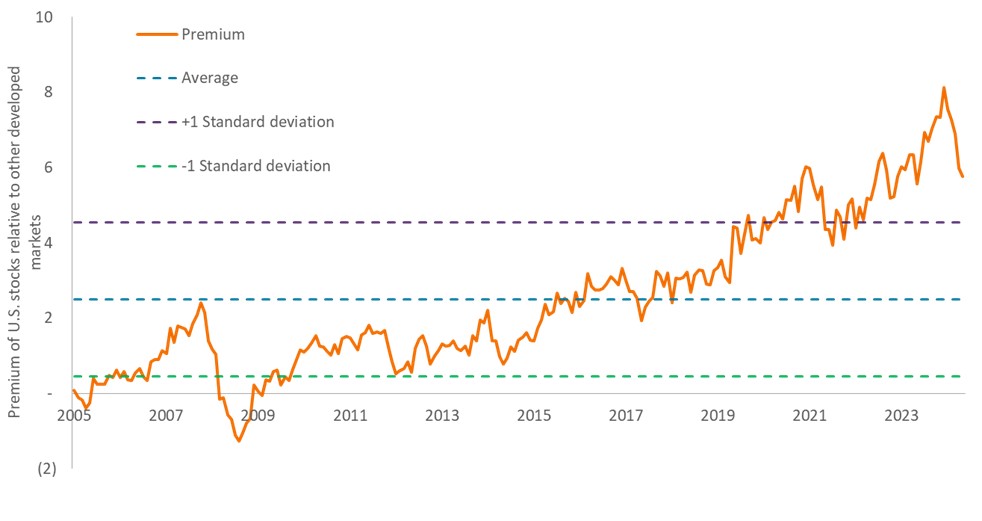

基於多項因素利好國際股票,投資者可能會發現,要想證明美國股票相較國際股票仍接近歷史高位的估值溢價的合理性,將會變得日益困難。 儘管美國股市的主導地位在頗大程度上憑藉其經濟的持續增長,但市場動態同樣起到一定作用,其中環球資金的流入推高美股估值。 美國股市於年初至今表現落後,可能削弱這個利好因素。

美國股票相對於國際股票仍存在較大的估值溢價

儘管美國大型股的預測市盈率已從高位回落,但相對於美國以外的股票而言仍然遠高於其歷史區間,這個差距或會為尋求投資於促進經濟增長的國際主題的投資者,提供具吸引力的進入點。

資料來源:彭博、駿利亨德森投資。 截至2025年4月30日。

創新加速

大約每隔20年,世界就會出現一次創新浪潮,這促使企業重新調整其業務模式。 AI有潛力成為這一連串創新浪潮中最具顛覆力量的驅動因素之一。 在過去兩年的大部分時間,尋求投資於AI的投資者關注其生態系統,即把該項技術推向市場所必須的平台及硬件。 我們認為,對投資者而言,下一波機遇在於物色能夠最有效地利用AI力量以拓展市場、開發新產品及提高營運效率的公司。 正如每一次創新浪潮,部分公司將取得成功,但一些公司則未能抓緊這個重大機遇。

創新並不局限於科技。 健康護理領域方面,GLP-1藥物在治療越來越多的疾病方面,繼續取得不少成效。 它不僅拯救了患者生命,而且還創造了經濟效益,例如因病損失的工作日數減少及患者職業生涯得以延長。 對於肥胖率較高及人口結構欠佳的發達國家而言,上述治療成果將尤其令人鼓舞。

截至目前,健康護理板塊於2025年的表現落後於大市,美國的政策不明朗是其中一個原因。然而,鑑於這個板塊近期的表現(包括在基因療法、生物製劑及免疫療法方面取得進展),我們認為當局將不會對健康護理創新施加限制。

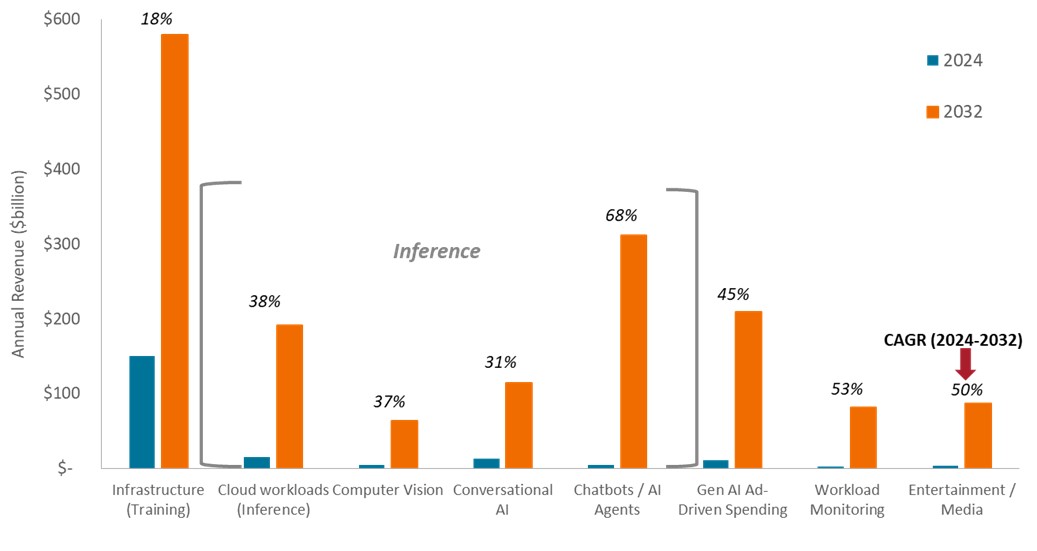

AI已準備就緒,有望大力提升環球經濟的效率

幾乎所有地區及行業都致力運用該項技術以發展市場、提高生產力及加強盈利,一系列AI應用程式預計將於未來幾年迎來增長,足以證明這一點。

資料來源:彭博行業研究,截至2025年3月24日。 所提供的例子為假設性,增長率基於2032年的估計收入水平。 恕不保證任何預測會實現。 CAGR =複合年增長率。

小型股回升

儘管我們預期的市場升勢擴闊已經開始顯現,但小型股(尤其是在美國)尚未完全參與其中。 市場日益擔憂,在加徵關稅之後,美國可能出現滯脹環境,從而使小型股錯失經濟擴張及利率下降的效益,而這兩項因素往往被證實利好小型股的表現,導致美國小型股表現受壓。 隨著貿易局勢更加明朗,加上聯儲局會恢復貨幣寬鬆政策,這為對利率變動敏感的小型股帶來支持,上述不利因素或將是短暫存在。 環球股市方面,小型股可能從先前討論的兩大趨勢中進一步受惠:近岸外包及AI的廣泛應用。

在波動市場環境中保持積極主動

受制於地緣政治及政策不確定性,環球市場的近期前景仍有欠明朗。 然而,隨著決策官員開始意識到過高的貿易壁壘可能拖累環球經濟增長,事態發展變得有利於投資者。 由於環球經濟框架仍然充滿變數及市場波動不定,股票投資者應優先考慮能夠在各種經濟環境中實現盈利增長且參與可持續的長期主題的穩健型公司。

投資者無法預測下一次創新浪潮興起的領域,但其必然將會到來,而到來之時將顛覆舊有的業務模式及行業。 在當前這樣的顛覆性時期,投資者應當積極應對波動性,物色最具改進業務模式潛力的公司。 波動性還可能導致價格錯置,從而產生具吸引力的進入點,使投資者有機會投資被公認將從顛覆式發展中受惠的公司。 執行這些策略意味著,投資者必須願意偏離基準,因為基準既無法體現與眾不同的觀點,又不具備在轉型時期進行汰弱留強所需的靈活性。

倘若英文版本與中文版本出現歧異,概以英文版為準。

重要資料

股票證券面對市場風險等各類風險。回報將視乎發行人、政治和經濟形勢而波動。

外國證券須承受額外風險,包括貨幣波動、政治和經濟不明朗因素、波幅較大、流動性較低以及財務和資訊報告標準的差異,上述風險在新興市場較為嚴重。

健康護理產業受制於政府監管和報銷率以及當局對產品和服務的審批,這些因素可能對價格和供應造成重大影響,亦可能受到迅速過時和專利到期的重大影響。

與較大型市值的證券比較,較小型市值的證券可能較不穩定,亦較容易受到不利形勢影響,而且可能較為波動,流通性亦較低。

科技產業或會受到現有科技過時、產品週期短、價格和利潤下跌、市場新對手帶來競爭,以及整體經濟環境的重大影響。集中投資單一產業的波幅或會高於集中程度較低的投資和市場整體的表現。

溢價/折讓顯示證券目前的交易價格是高於(溢價)還是低於(折讓)其資產淨值。

市盈率(P/E)用於衡量投資組合內一隻或多隻股票的股價與每股盈利之比率。

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

波幅 / 波動性是指投資組合、證券或指數價格升跌的速度和幅度。倘若價格大幅上下擺動,表明其波動性高。倘若價格變動更為緩慢且幅度更小,表明其波動性較低。波動性較高意味著投資風險較高。