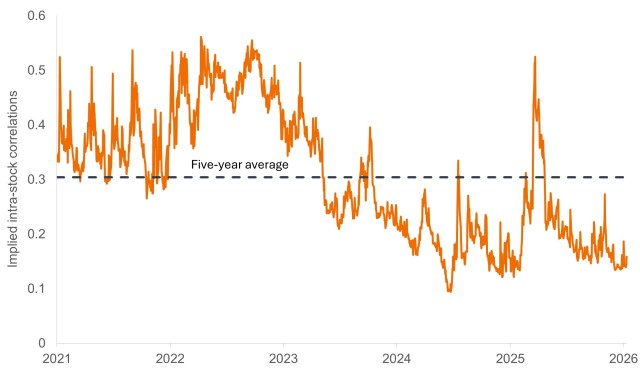

We view the lack of systemic risk priced into the market as the culprit for correlations among U.S. equities being near historic lows.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Why rational pricing and rising dispersion represent a rare opportunity for absolute return investors.

While options markets indicate a relatively sanguine 2026 for equities, investors should take note of a potentially worrisome absence of systemic risk.

Victory Park Capital discuss the opportunities and risks in this dynamic area of private credit.

Introducing some of the factors supporting the case for absolute return at a time when disruption is becoming the norm.

Why absolute return strategies are set to play a pivotal role in 2026, offering diversification and resilience to offset uncertainty and evolving market dynamics.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

Tokenization's potential to revolutionize investing.

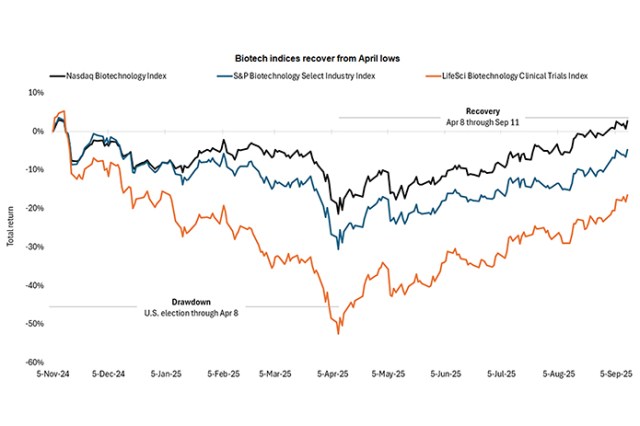

Optimism is returning to the biotech space, and we see durable drivers behind the recent performance recovery.

Ali Dibadj speaks with Victory Park Capital's co-founder Brendan Carroll about the successful integration of asset-backed private credit into portfolios.

Are shifting market dynamics building the need for real diversification in investors’ portfolios?