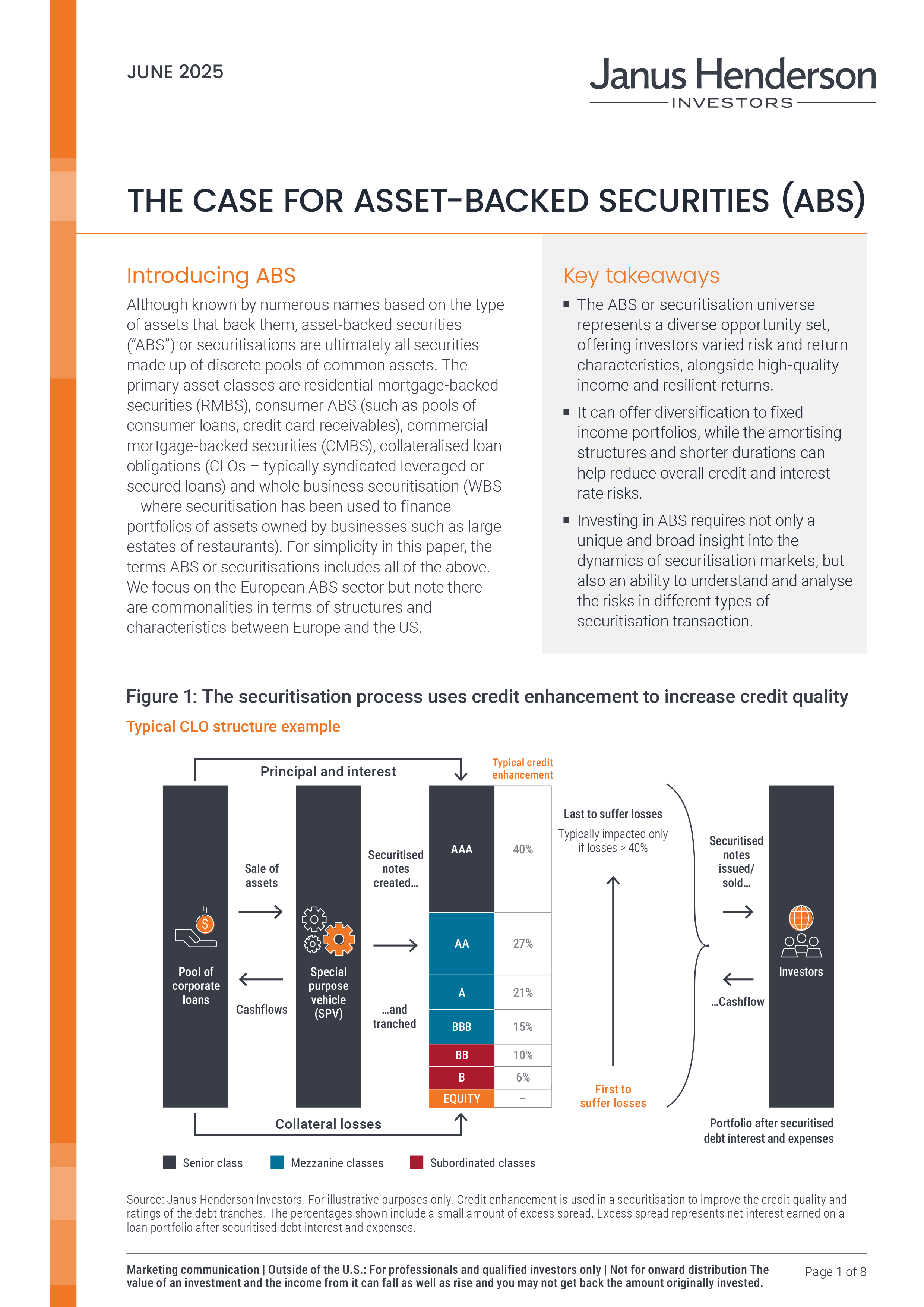

Although known by numerous names based on the type of assets that back them, asset-backed securities (“ABS”) or securitisations are ultimately all securities made up of discrete pools of common assets.

Securitisation structures can be thought of as analogous to a “mini bank” that makes only one type of loan. Like a bank it funds these loans via a mixture of different classes of debt and equity (each with different risk and return profiles). However, securitisation has a number of positive distinguishing features versus a typical bank:

- Less complexity and governance risk – Investors enjoy greater transparency on the loans being made and tight controls over how those loans can change over time.

- Matched funding of assets and liabilities – Securitised debt usually does not need to be repaid before the assets repay.

- Limited interest rate risk – Generally securitisations just pass through the income they earn on the loan portfolio to pay the securitised debt interest. If there is any mismatch between say a fixed rate loan portfolio returns and variable rate securitised debt interest, this will be hedged via swaps embedded within the structure.

In this Case for ABS, we take a deep dive into the sector and evaluate each of its distinguishing features that enable the asset class to be combined successfully with other fixed income in diversified portfolios.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.