Tennis is a sport of precision, agility, and strategic thinking. When investors aim to build a thematic investment, a strategic and thorough approach in terms of portfolio construction is key to success. Thematic investing presents equity investors with the unique opportunity to gain exposure to forces that are rapidly reshaping the global economy, with technology,

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

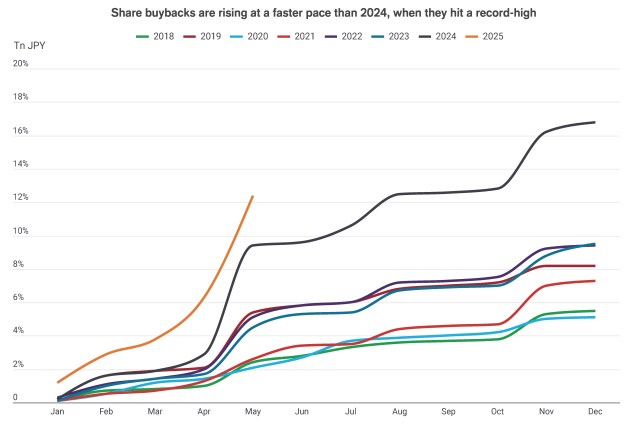

Growing share buybacks support the modernisation of Japanese corporates.

Dinesh Kuhadas, Credit Analyst on the Australian Fixed Interest Team, discusses the renewed appeal of corporate subordinated debt for both issuers and investors, highlighting its benefits and emphasising the importance of active management to capitalise on opportunities within this evolving market segment.

How has Emerging Markets Debt (EMD) matured over the decades?

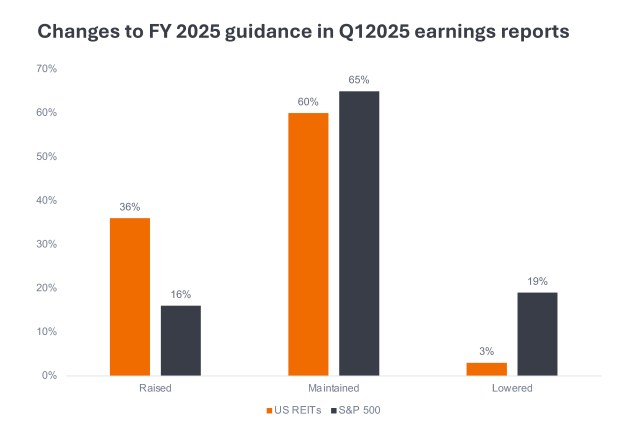

Listed REITs can offer lower volatility and better earnings visibility versus broader equities.

How AI and accelerating technology adoption is disrupting sports.

Ali Dibadj, CEO, spoke with Richard Clode and Agustin Mohedas about AI’s potential to unlock opportunities in trillion-dollar markets.

Can the EU's securitisation reforms stimulate growth in the economy, while still safeguarding financial stability?

How this year's Wimbledon championships are embracing AI.

A trip to this year’s Computex trade show in Taipei reinforced our team’s bullish view on AI.

Integrating ABS in portfolios is like core-strengthening exercises, enhancing their stability, flexibility, and resilience, while optimising risk-adjusted returns.