Market review

Australian bond markets were relatively contained, amid global volatility. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 0.33%. The Reserve Bank of Australia (RBA) lowered the cash rate to 3.60%, as was expected. Three-month bank bills were down 11 basis points (bps), to 3.57% by month end. Six-month bank bill yields fell 12bps to 3.66%. Australia’s three-year government bond yields ended the month 2bps lower, at 3.40%, while 10-year government bond yields were 1bp higher at 4.27%.

The relatively limited month end moves belie some big global events through the month. Markets are taking time to assess changes in the US Administration’s management of the US Federal Reserve, and the Bureau of Labour Statistics, after a member of the former was fired, and the head of the latter, replaced. Concerns regarding central bank independence and data quality are legitimate, but the implications long-term and there are still pathways to work out. A lack of significant market reaction shouldn’t be taken as a lack of importance.

Through the fundamental data, there are the early signs of a lifting in tariff related inflation, in the US, alongside a weakening labour market. These are a difficult set of data to navigate. The Chinese economy remains stagnant, with policy maker “anti-involution” push acting to limit manufacturing expansion. Fiscal concerns are hampering the UK and Europe’s ability to support economic growth.

Australia is navigating this difficult global backdrop relatively well. The RBA remain cautious, amid its easing. The labour market remains steady. One-offs and data timing mismatches have shown heightened inflation concerns, but these are anticipated to reverse in future releases. The monthly CPI stands at 2.8%yoy, and the unemployment rate at 4.2%. Both business and consumer confidence have risen from low levels, which should underpin an expected modest pickup in economic activity.

Market outlook

There has been little change in market pricing over the month, with a low in the cash rate priced at 3.02% in July 2026. This remains close to our base case for the RBA to ease a further 75bps to 2.85%. Our low case reflects a weaker economic outcome and the RBA easing by a total of 250bps. We allocate a modest weight to the low case. We hold a small, long duration position to take advantage of some of the lift in yields, while we remain vigilant through the volatility to take advantage of two-way mispricing.

Monthly focus – Housing dynamics

Australia has long faced a structural shortage of housing. Structural building reform and lower mortgage rates are hoped to encourage overall housing sector rebalancing. We find that the undersupply could exist for some time, while house price affordability may play off against lower interest rates.

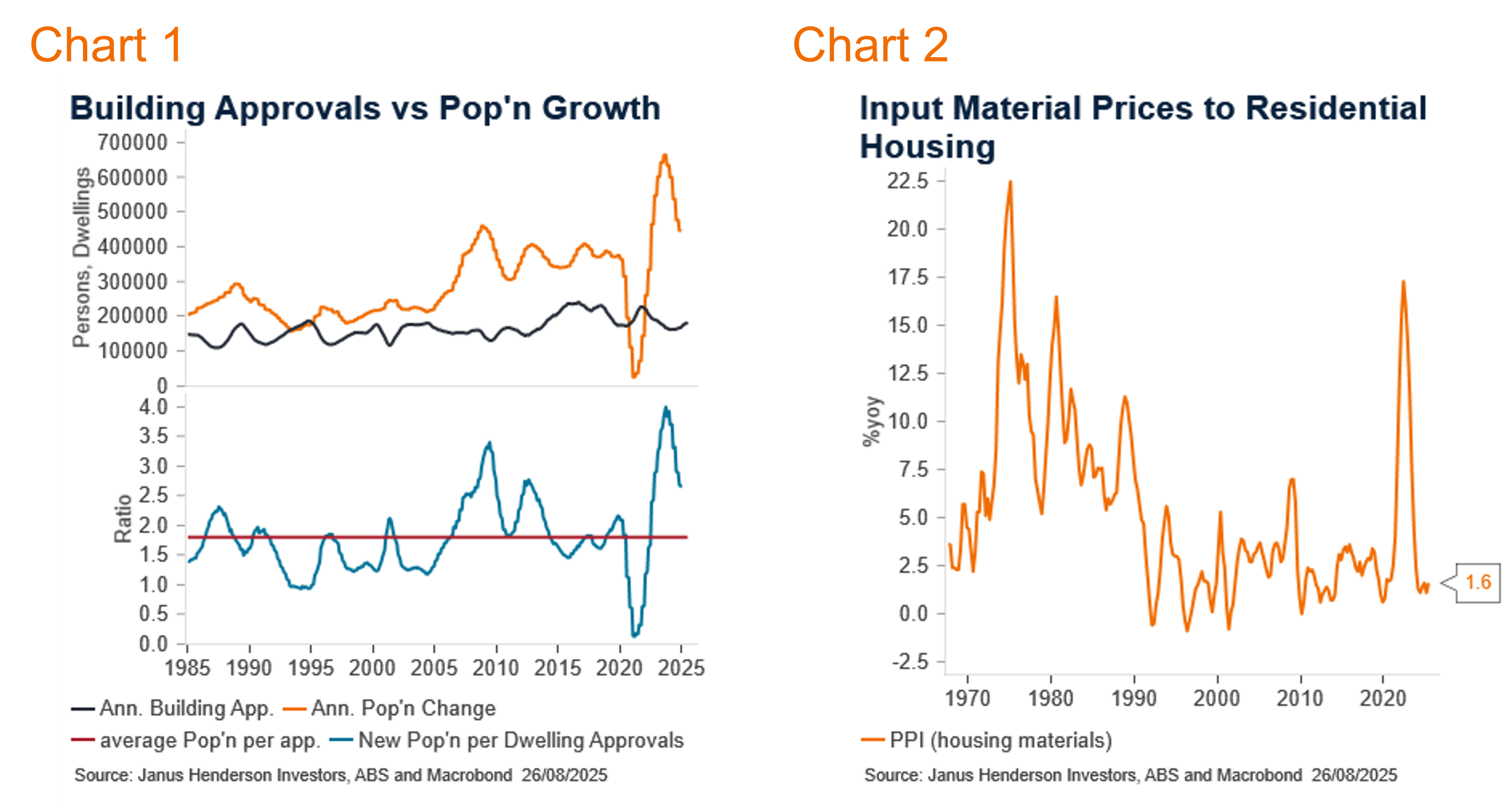

Australia has not been able to build enough houses to accommodate the rising population in the post- pandemic environment. New housing approvals have been soft for a number of years, with only a temporary pick up during the pandemic stimulus. However, population growth was rapid post-pandemic and remains above average. Historically, there is an average of 1.8 new people in Australia per housing approvals (Chart 1). That ratio peaked at 4 in late 2023 and remains a, still high, 2.6. This points to the structural shortfall of new housing to accommodate population growth. Some of the shortfall is addressed through a rising household formation ratio, i.e. more people per house, but to solve the structural supply versus demand problem, more housing is needed. This factor will continue to pressure housing prices as the shortfall is worked through. Policies to increase housing density and speed approvals are taking place at multiple levels of government across Australia but take time to implement.

Building approvals are rising, as mortgage costs moderate and stimulate demand. Building cost growth is also normalising. Through the pandemic, input costs to residential housing peaked at 17% year on year (yoy), a level not seen since the 1970’s (Chart 2). That growth rate is now a more modest 1.6%yoy, supporting greater demand. However, while overall approvals are rising, single dwelling approvals remain moribund, while multi-dwelling approvals are strong. This may help achieve the number of dwellings needed more quickly, but a shortage of single dwelling properties is likely to remain.

The approvals split, between multi dwellings and single housing, is likely reflective of regulatory support for multi-dwellings but also the differences in investors over owner-occupier segments. Housing finance data shows approvals for owner occupiers remains modest, while the investor sector is experiencing more signs of confidence. Investor demand for housing credit has grown strongly this year (6.6%yoy), and now outpaces the very steady owner occupier loan growth (5.7%yoy).

These trends are also representative of the cost of housing. High mortgage costs and limited new supply have combined to produce very low levels of housing affordability. This increases demand for smaller, multi-dwelling apartments over larger single-dwelling houses. The HIA housing affordability index hit its worse level in the index’s history in Q1 2024 at 55.3. The index currently sits at 56.9; only a modest improvement. Even with lower mortgage rates, housing affordability may remain a headwind for cyclical demand. House prices are rising. Cotality capital city prices rose 0.8%mom in August. Lower interest rates, structural supply shortages for new housing and low turnover of existing housing, are contributing to a price recovery, particularly in soft markets such as Melbourne and Canberra.

House price increases hampers already stretched affordability, and somewhat offsets lower mortgage costs. Until the supply shortage is addressed, the housing market is likely to see somewhat higher prices, contributing to positive wealth effects, as well as rising construction demand. But affordability will remain a constraint.

Views as at 1 September 2025.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.