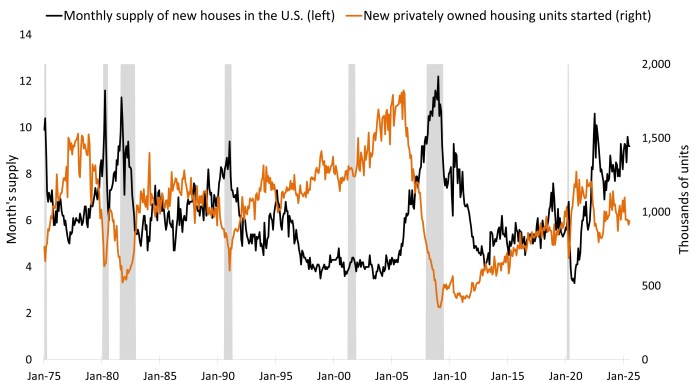

Chart to Watch: All eyes on homebuilder inventory shift

New home inventory has hit recession-level highs, but builders are responding. See how falling construction starts could pave the way for inventory relief and market stabilization.

3 minute read

Key takeaways:

- Homebuilders have cut housing starts by -14% since February as the monthly housing supply reached over nine months, approaching recession-level inventory buildup.

- Reduced housing starts typically precede inventory normalization, creating early-cycle investment opportunities as homebuilder stocks have potential to outperform before fundamentals visibly improve.

- We’re monitoring homebuilder fundamentals and housing sector trends for confirmation that inventory moderation is taking hold and a potential cycle recovery is sustainable.

Source: U.S. Census Bureau. U.S. Department of Housing and Urban Development via FRED. Shaded areas indicate U.S. recessions.

Homebuilder stocks have rebounded and outperformed the S&P 500® Index by roughly 11% over the last three months following a period of underperformance dating back to September 2024.1

What’s driving investor optimism? We’re finally seeing builders react to extreme supply levels. The monthly supply of new houses in the U.S. (black line, left axis) has been trending higher since early 2024 and sitting above nine months since May. This level approaches what we typically see during recessions. New home inventory has jumped as existing home inventory and sales have fallen, with affordability hitting 30-year lows.

Housing starts (orange line, right axis), meanwhile, have declined -14% since February. Why does this matter? Fewer starts are a precursor to inventory moderation. Historically, we’ve seen housing starts decline in reaction to increases in monthly supply, particularly during economic downturns (shaded area indicates U.S. recessions). A gradual pullback in starts should help relieve supply pressure, assuming demand continues at a decent pace.

We’ve also seen mortgage rates ease to a 10-month low of 6.56%. This should help from a demand dynamic, but likely continue to hold back existing home supply as current mortgage holders have rates averaging around 4%. Rates may need to fall to around 5% to meaningfully unlock existing supply, which should allow homebuilders to continue to compete unencumbered by significant increases in existing home inventory.

Historically, we’ve observed an inverse correlation between peaks in new home inventory and when homebuilders typically begin to outperform. This early cycle behavior suggests builders may be entering a new growth phase, though this outlook needs confirmation through improving fundamentals. This dynamic extends beyond homebuilders to related industries like home improvement and furniture, where high mortgage rates and affordability constraints have pressured big-ticket purchases.

We turned more cautious on homebuilders in late 2024 due to supply growth concerns, but now the precursor for inventory moderation – fewer starts – is in place. The market is anticipating relief and is not going to wait for inventories to get in line. While some investors are jumping ahead and anticipating the cycle turn, more time may be needed before confirming the next growth phase.

1 Source Bloomberg. Total return over three-month period 30 May 2025 to 29 August 2025. S&P 500 Index compared to S&P Homebuilders Select Industry Index.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

IMPORTANT INFORMATION

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.