A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Why active management, fundamental research, and selectivity across sectors are key to identifying opportunities while managing volatility in fixed income.

Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

What are the implications for risk appetite, emerging markets and geopolitics after Trump’s ousting of Venezuela’s Maduro?

What will U.S. action and the presidential change in Venezuela mean for investors?

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

As we step into 2026, global markets are entering a new era where geopolitics and policy priorities increasingly overshadow traditional market forces. Jay Sivapalan, Head of Australian Fixed Interest shares the investment outlook for 2026 and explores the opportunities for investors.

Alex Veroude explains why the credit cycle in fixed income still has further to run in 2026, but investors should build some resilience into their portfolios.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

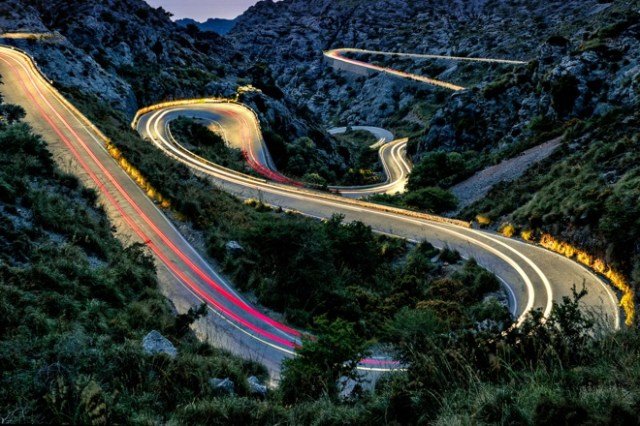

Conversations with clients on fixed income at JHI's Madrid Investment Summit.