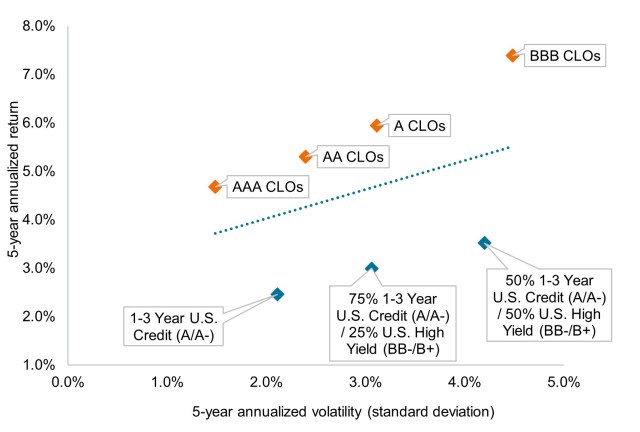

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

To gain perspective on recent volatility, we believe investors need to understand the magnitude of the AI transformation and how it will invariably impact every corporate sector

Ali Dibadj joins Luke Newman and Robert Schramm-Fuchs to discuss Europe’s investment outlook, risks, and underappreciated opportunities.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Why active management, fundamental research, and selectivity across sectors are key to identifying opportunities while managing volatility in fixed income.

Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

Where to find climate adaptation investment opportunities in an era of rising physical risks.

Explore our 2026 sustainable investment outlook: AI-driven industrialisation, clean tech momentum, climate challenges, and key trends shaping markets and sustainability.

As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

Discover the factors reshaping consumer behaviour as Michelle Dunstan and her team at Janus Henderson explore emerging trends in health, wellness, and technology, alongside the economic impact of GLP-1 inhibitors and ultra-processed foods. Learn how these dynamics influence market valuations and investment strategies.

Victory Park Capital discuss the opportunities and risks in this dynamic area of private credit.