Why active management, fundamental research, and selectivity across sectors are key to identifying opportunities while managing volatility in fixed income.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Four reasons to be bullish on MBS in 2026.

Modest economic growth should support high yield bonds but rich valuations demand selectivity.

Alex Veroude explains why the credit cycle in fixed income still has further to run in 2026, but investors should build some resilience into their portfolios.

John Lloyd shares why he believes multi-sector fixed income is poised for continued strong performance in his 2026 investment outlook.

Why we believe the strategic case for AAA CLOs remains compelling amid Fed rate cuts.

What does President Javier Milei’s mid-term election victory mean for Argentina's credit trajectory?

A discussion on why active management is critical to navigating complexity in today’s fixed income markets.

Conversations with clients on fixed income at JHI's Madrid Investment Summit.

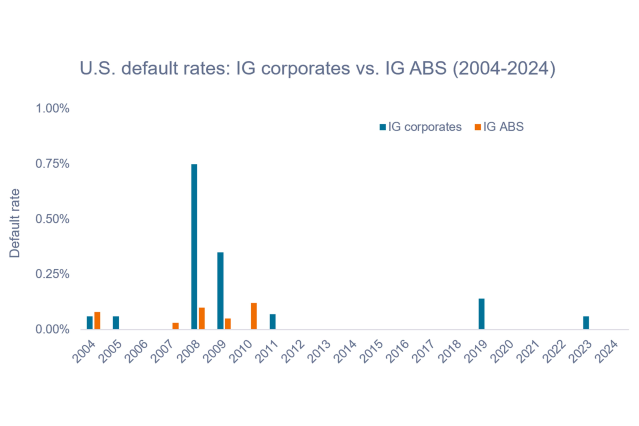

The historically low default rates in the U.S. IG ABS market can be ascribed to consistent underwriting standards and several investor protections inherent within ABS structures.

Reasons why asset-backed securities may complement corporate bond allocations.