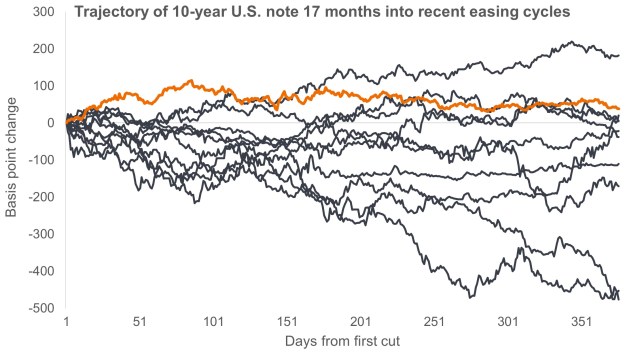

10-year U.S. Treasury yields charting a different course than what we’ve seen in recent easing cycles may indicate that this time could indeed be different.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

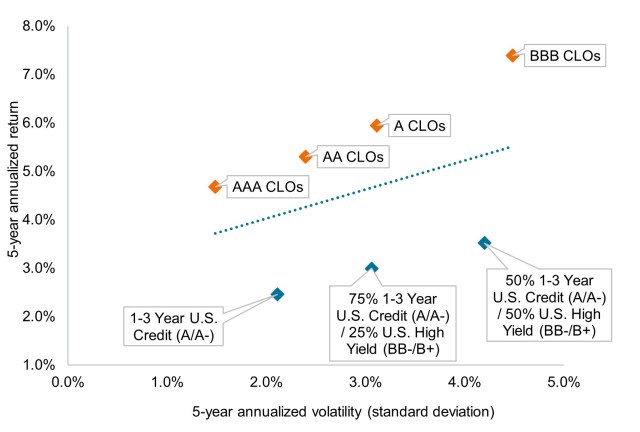

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.

To gain perspective on recent volatility, we believe investors need to understand the magnitude of the AI transformation and how it will invariably impact every corporate sector

Ali Dibadj joins Luke Newman and Robert Schramm-Fuchs to discuss Europe’s investment outlook, risks, and underappreciated opportunities.

Three essential elements to consider for an effective balanced strategy, plus trends to watch in equities and fixed income in 2026.

Why the market may be overpaying for growth, and how a shifting market structure creates both risks and opportunities for fundamental investors.

How interest rates, AI trends, and evolving policy dynamics are influencing the outlook for the energy and financial sectors.

Wide dispersion in 2026 is creating a strong backdrop for selective global small cap investing.

The recent selloff in software stocks in the wake of advancements in native AI ignores many of these businesses’ inherent strengths.

Discover why portfolio structure, not bubble timing, determines resilience. Learn how equity income strategies help investors capture AI-driven growth while reducing volatility and protecting capital during downturns.

Today’s ABS structures provide better transparency and investor protections.