Costa Rica’s recent election outcome strengthens the country’s path toward investment grade by lowering governance and execution risk. While the macro framework remains unchanged, improved governability makes continued market friendly and reform oriented policies more likely, reinforcing the credibility of the existing fiscal and institutional framework.

Last Sunday, Laura Fernández Delgado won the presidency outright in the first round with approximately 48.5% of the vote, while her ruling Sovereign People’s Party (PPSO) secured 31 of 57 congressional seats – the first time since 1990 that one party took both the presidency and control of the legislature in Costa Rica. A simple majority was achieved, but still short of the 38‑vote qualified majority, preserving checks on constitutional or radical policy changes.

Early policy signals: continuity and improved delivery

Initial messaging from the president‑elect aligns closely with our expectations Importantly, Fernández’s tone has been less confrontational than the Chaves administration, suggesting fewer institutional clashes and a smoother policy process – an underappreciated credit positive that strengthens policy credibility. The election outcome therefore does not change already improving economic fundamentals for Costa Rica; rather, it makes the positive credit story more credible.

Costa Rica already enters this new administration from a position of strength:

- Growth: Real Gross Domestic Product (GDP) growth expected to be 3.6% in 2026[1], driven by manufacturing and resilient Foreign Direct Investment (FDI) despite external headwinds.

- FDI: Structurally high at around 5% of GDP[2], well above regional peers and anchored in free‑trade zones.

- External balance: A benign current account deficit, fully funded by FDI.

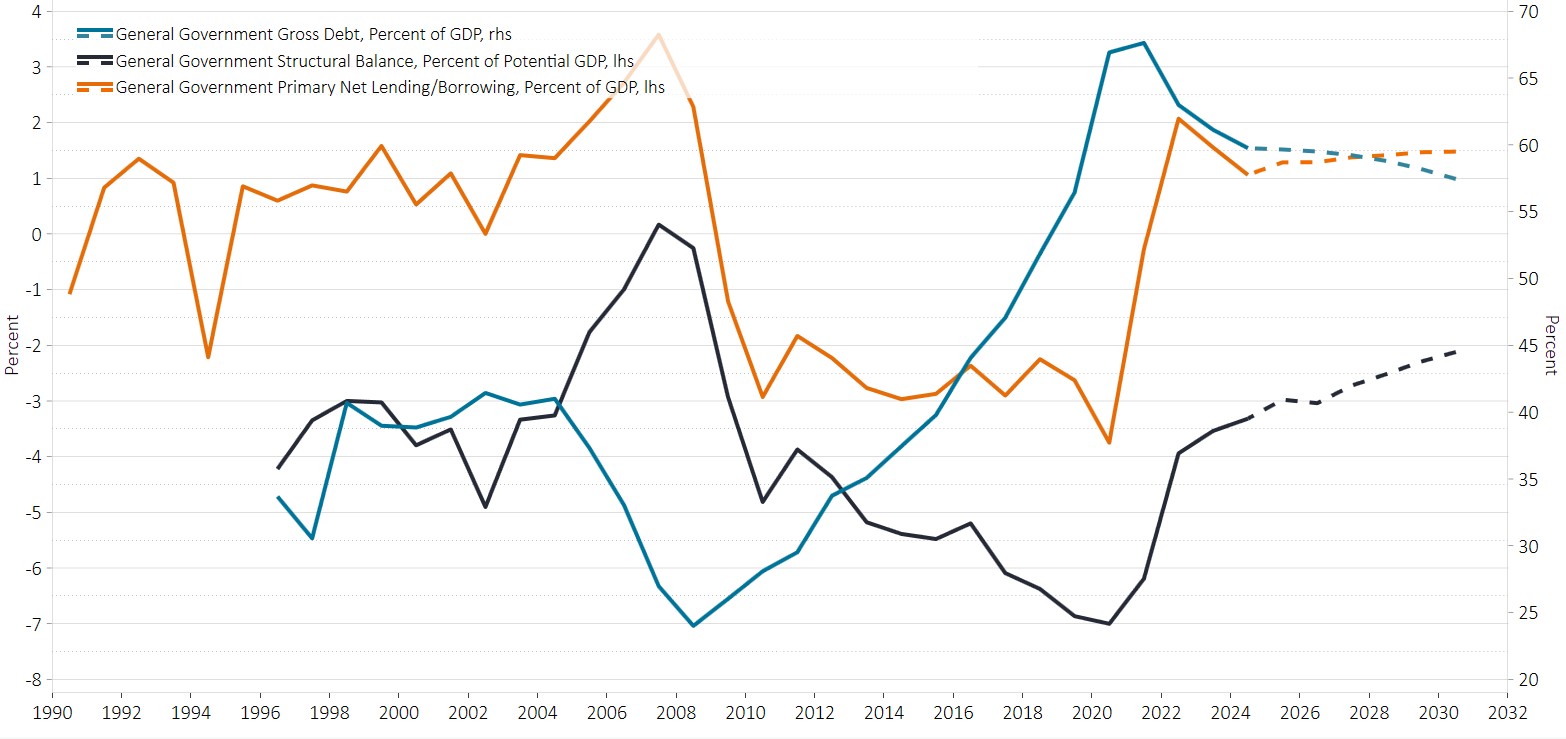

- Fiscal position: Primary surplus of roughly 1–1.3% of GDP, with debt-to-GDP ratios on a gradual downward path toward the high‑50s (Figure 1).

- Inflation and policy: Inflation remains low to negative; monetary conditions are still perceived as restrictive domestically but are likely to ease as funding shifts away from over‑reliance on the domestic market.

Figure 1: Fiscal position on an improving trajectory

Costa Rica, IMF, WEO

Source: Janus Henderson Investors, Macrobond, International Monetary Fund, World Economic Outlook (WEO), as at 4 February 2026. Gross debt-to-GDP: a government’s total outstanding debt to its annual economic output, expressed as a percentage. Structural balance. Primary/Net Lending/Borrowing: a government’s fiscal health, calculated as revenue minus total expenditure excluding interest. Structural balance: a general government’s actual fiscal balance (surplus/deficit) adjusted for the economic cycle and one-off, temporary, or non-structural, budgetary measures. There is no guarantee that past trends will continue, or forecasts will be realised.

Early policy signals point to continuity:

- The fiscal rule[3] remains the anchor of macroeconomic stability, with continued primary surpluses and declining debt‑to‑GDP ratios.

- Eurobond authorisation (congressional approval of the issuance of Eurobonds) and improvements to the external debt approval framework are emerging as near‑term priorities.

- Respect for the institutional autonomy of the central bank has been clearly reaffirmed.

What the election materially improves is the speed of policy delivery. Fernández’s first round victory and the PPSO’s simple majority meaningfully reduce legislative gridlock and institutional friction. This lowers political and execution risk, a key constraint previously highlighted by credit rating agencies, without altering the country’s market friendly economic framework.

Improved credibility of positive credit story

In summary, we believe the most important credit implications are:

- A higher probability of Eurobond issuance authorisation, reducing reliance on domestic funding and mitigating crowding‑out risks.

- Improved debt‑management flexibility, with more predictable access to external markets, supporting lower interest costs and a longer debt maturity profile.

- Lower governance and execution risk, reducing political noise around the fiscal framework – an important positive for the ratings trajectory.

While structural reform progress is likely to remain gradual, improved governability makes reform more feasible and enhances the credibility of existing institutions.

The Fernández victory does not transform Costa Rica’s already positive credit story, but it materially improves its credibility. By lowering political risk and strengthening confidence in policy execution, the election appears to reinforce Costa Rica’s medium-term path toward investment grade.

We have upgraded our view on Costa Rica’s ability and willingness to implement credit positive policies. Market pricing already reflects that Costa Rica is headed in this direction towards investment grade. However, in clear positive ratings stories, investors often over reward momentum as upgrades materialise, as shown by our analysis and experience over the years.

Rising stars emerge in EM

We therefore expect a gradual compression of risk premia (related to the government’s ability to create and execute policy), further supported by supply-demand tailwinds as investment grade status attracts new investors. This would eventually place Costa Rica alongside “rising stars” EM investment grade peers, such as Paraguay and Oman.

The improvement in Costa Rica therefore highlights the continued upgrade in quality taking place across EM. Combined with a still attractive yield backdrop and a constructive growth outlook, this reinforces EM as an asset class we believe offers attractive investment opportunities. When compared with the risk return profile of US high yield, EM sovereign hard currency debt is not only compelling but increasingly attractive, supported by stronger fundamentals and improving credit trajectories. For investors seeking portfolio diversification, the asset class may potentially serve as a high quality alternative that preserves yield while offering meaningful credit improvement over time.

Footnotes

[1] Source: Bloomberg median growth estimates, as at 4 February 2026.

[2] Source: Macrobond, as at 4 February 2026.

[3] Costa Rica’s fiscal rule, enacted in 2020 via Law 9635 (Law on Strengthening Public Finances), is a budgetary mechanism designed to control public debt by capping year-over-year growth in government expenditure based on the country’s debt-to-GDP ratio and average nominal GDP growth.

* Execution risk for governments refers to the danger that policy, programme, or project implementation fails to deliver intended outcomes due to operational, financial, or political obstacles.

** Risk premia represent the expected additional return (excess return) an investor requires for holding a risky asset rather than a risk-free one, compensating for potential losses.

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Risk premia represent the expected additional return (excess return) an investor requires for holding a risky asset rather than a risk-free one, compensating for potential losses.

Sovereign: Typically refers to debt issued by a national government. Sovereign bonds are backed by the country’s creditworthiness and ability to repay.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

Current account deficit: A current account deficit, as defined by the International Monetary Fund (IMF), occurs when a country’s total imports of goods, services, and transfers exceed its total exports and income received from abroad

Debt-to-GDP ratios: The debt-to-GDP ratio is a financial metric comparing a country’s total government debt to its gross domestic product (GDP), indicating its ability to repay debt.

Debt maturity profile: A debt maturity profile is a, usually visual, representation of a company’s total outstanding debt, broken down by the specific year or period that each debt component is due.

Eurobond: An international debt instrument issued by governments or corporations in a currency different from the local currency of the country where it is issued

External financing: External financing for sovereigns refers to funds borrowed by national governments from foreign lenders.

Fiscal policy: Describes government policy relating to setting tax rates and spending levels. Fiscal policy is separate from monetary policy, which is typically set by a central bank. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Fiscal position: A fiscal position refers to the overall financial health of a government, reflecting the balance between its revenues (taxes, assets) and expenditures (spending) at a specific time.

GDP: A measure of the size and heath of a country’s economy over a specific period, usually either quarterly or yearly. is a measure of the size and heath of a country’s economy over a specific period, usually either quarterly or yearly. Real GDP (Gross Domestic Product) is the total market value of all final goods and services produced within a country in a specific period, adjusted to remove the effects of inflation or deflation.

Inflation: The rate at which the prices of goods and services are rising in an economy. The consumer price index (CPI) and retail price index (RPI) are two common measures; the opposite of deflation.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, which is reflected in the higher rating given by credit ratings agencies.

Monetary conditions: These represent the combined effect of short-term interest rates and exchange rates on an economy,

Primary Surplus: A primary surplus occurs when a government’s total revenue exceeds its non-interest expenditures

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.