The summer months of 2025 thus far have been characterised by significant equity market movements, reflected in notable rotation at a sector level, and among counter-momentum favourites. It is easy to put this down to the ‘Trump factor’, given the uncertainty around tariffs. But it is also important to note that this kind of market behaviour has been a consistent feature in every July over the past five years.

If we look back to 2024, we saw a sharp rotation away from mega-cap tech stocks towards small-cap names, supported by favourable US inflation numbers and more protectionist rhetoric. If we go further back to 2023, fears that high inflation and rising interest rates could weigh on growth fed a more risk-averse stance, triggering rotation towards larger companies more likely to be perceived as a safe haven.

The jury is still out on what exactly drove the July ‘great stock market rotation’ of 2025, but much like the usual annual turnover around the turn of the calendar year (the ‘January effect’), one might argue that it is now consistent enough to be worth factoring in going forward. We have already added a reminder to our diaries for late June 2026. And, as we saw in prior years, August kicked off with a reassertion of those previously dominant themes.

Even an imperfect deal can help settle nerves

In our view, the argument supporting a slow broadening out of the European equity bull market still holds. Despite concerns over the terms of the proposed US-EU trade deal, clarity has helped to dispel some of the ‘will they, won’t they’ noise that has plagued investor sentiment, reflected in elevated stock market volatility.

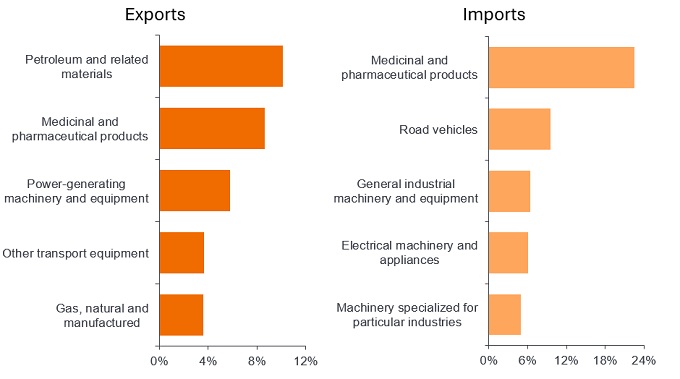

Disagreements remain over some of the details of the deal, with both sides releasing conflicting statements, and the European Commission describing it as a ‘road map’ for further negotiation and development. While it does not constitute a signed trade agreement, it has averted the threat of higher tariffs, providing certainty for key industries on both sides (Exhibit 1).

Exhibit 1: Most traded goods between the US and EU (% of all goods)

Source: LSEG Datastream, EuroStat, Janus Henderson Analysis, as at 31 May 2025. Shows top product groups, as a percentage of all goods, in 2024. Data is categorised by the Standard International Trade Classification (SITC).

And while it established a 15% tariff ceiling on most European exports, including pharmaceuticals, ostensibly paid for by US-based importers, this was a lower tariff than the 30% initially threatened. This seems good enough for the wider European economy and we expect investors to move forward on that basis.

More dovish indicators

We see progress in deregulation as a positive indicator across Europe and the US. At the UK Chancellor’s annual Mansion House speech in July, the UK finance minister pledged to cut regulation, including banking reforms aimed at freeing up capital for banks to invest in the UK.

Despite the reluctance of some key regulators in the EU, we expect politicians in the region to press for a similar accommodative line, pushing the Financial Services Commission and the European Central Bank to cut regulation and capital requirements for EU banks. This aligned with rhetoric from the US Federal Reserve (Fed) which hosted its ‘Integrated Review of the Capital Framework for Large Banks Conference’ in late July.

The Fed has thus far resisted pressure from US President Trump to cut interest rates, in line with its dual mandate on maximum employment and price stability. However, recent weakness in the US labour market has moved the dial, increasing the prospects of interest rate cuts later in 2025. The likely appointment of a more dovish candidate to fill a recent vacancy on the Fed Board of Governors suggest support for more accommodative monetary policy ahead. With global financial conditions already reasonably accommodative, hopes for an economic rebound in the second half of 2025 and into 2026 are likely to gather steam.

‘Big and beautiful’

Fiscal stimulus packages seem to be the strategy for 2025 among the world’s biggest economies, from the ‘Big Beautiful Bill’ in the US to China’s ramped-up stimulus push to develop infrastructure, boost consumption and recapitalise banks. These domestically focused strategies build on the ongoing trend towards repatriation and onshoring.

In Europe, Germany’s uninspiringly named – but undeniably significant – ‘Special Fund for Infrastructure and Climate Neutrality’, is a €500 billion, 12-year investment plan designed to bypass the country’s debt brake rules. July also saw the launch of ‘Made for Germany’, a three-year €631bn private cross-industry investment commitment that brought together 61 leading companies and investors in Germany. This sum includes planned and new capital investments, research and development spending, as well as contributions from international investors. We see input on this scale as an encouraging sign of renewed commitment from Germany to tackling some of Europe’s most pressing issues.

Not entirely clear skies – but more encouraging

August and September tend to be seasonally weak months in markets, and we remain cognisant of the risks of further rotation and volatility from further negotiations on tariffs. Growth forecasts have been revised down for 2025, relative to where they were at the start of the year, with trade tensions inevitably disrupting global supply chains. But April – when US President Trump first announced his tariff plan – seems to have marked a low point, from which the International Monetary Fund (IMF) has upgraded its global predictions.

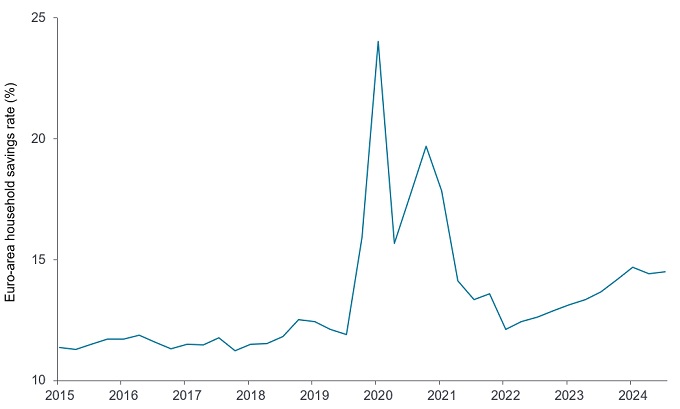

Beyond these near-term observations, we see a more benign environment for Europe’s economies than we have seen in recent years, which we see as a supportive backdrop. More time is undoubtedly needed for true structural reforms to enhance Europe’s competitiveness, and to harness corporate and government investment. Europe has a high savings rate (Exhibit 2), and diverting a higher percentage of excess savings from cash/sight deposits into more productive forms of savings could go a long way for the economy and stock markets. As such, the scale of ongoing initiatives across multiple areas – such as easing financial regulation, capital markets union, and the reduction of general bureaucracy – is encouraging.

Exhibit 2: A high savings rate can reflect uncertainty and low consumer confidence

Source: LSEG Datastream, EuroStat, Janus Henderson Investors, as at 31 May 2025. Data is seasonally adjusted.

Bull market: A bull market is one in which the prices of securities are rising, especially over a long period of time.

Capital markets union (CMU): A plan to create a single integrated market regime for capital in the EU to ease the movement of investment and savings across the bloc to benefit consumers, investors and companies.

Fiscal stimulus: Fiscal measures are those related to government policy regarding setting tax rates and spending levels. Fiscal stimulus refers to an increase in government spending and/or a reduction in taxes.

Germany’s debt brake: A law designed to limit a structural budget deficit at a federal level to 0.35% of GDP, thereby limiting the issuance of government debt.

Monetary policy: The policies of a central bank aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money.

Tariffs: A tax or duty imposed by a government on goods imported from other countries.

Volatility: The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility, the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.