The audacious move by the U.S. to extract President Maduro from Venezuela to face charges in the U.S. shocked the world, but it is not the first time that the U.S. has intervened in other countries and it is unlikely to be the last. While the development carries symbolic weight, its immediate impact on global markets is likely to be modest. The bigger story may lie in what it signifies longer term, as part of a broader macroeconomic driver of geopolitical realignment.

Short term market ripples

The unfortunate impact of the economic and political difficulties Venezuela has faced for the past two decades on top of sanctions means that many developed market companies have completely exited the market. For the few with residual exposure to Venezuela (e.g. Chevron, Repsol, Telefónica) a more stable policy backdrop could provide incremental relief.

In the near term, Venezuelan bonds may see initial support as markets price in the prospect of policy normalisation (assuming the country avoids chaos – early indications are that the U.S. may be willing to work pragmatically with the existing Venezuelan authorities after the challenges faced in Iraq and Afghanistan). Oil markets could also react, though not necessarily in the direction one might expect. While geopolitical uncertainty often pushes prices higher, an eventual increase in Venezuelan supply would exert downward price pressure on crude – once shipping routes stabilize and sanctions pathways become clearer.

Refuelling global supply: Why Venezuela matters

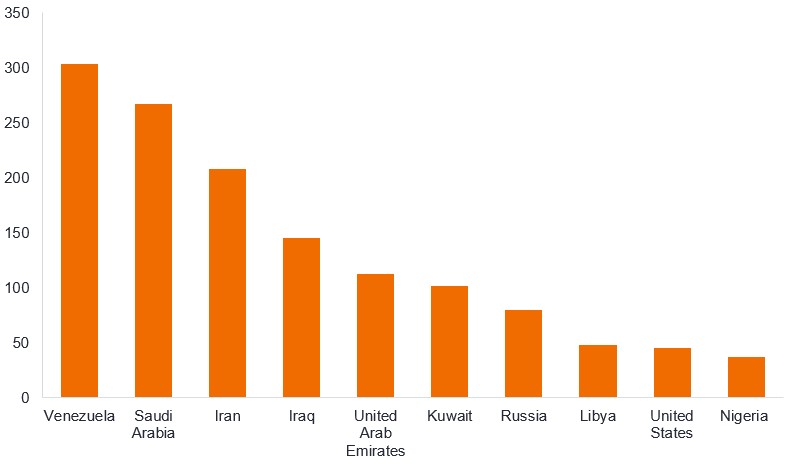

Despite holding the world’s largest proven oil reserves, Venezuela’s output has collapsed from around 3 million barrels per day in the early 2000s to less than a third of that in recent years.1 Sanctions, chronic underinvestment, and deteriorated infrastructure have curtailed production sharply.

Venezuela’s proven attraction

Proven crude oil reserves by country (billion barrels)

Source: OPEC Annual Statistical Bulletin 2025, proven crude oil reserves by country at end 2024. Excludes oil sands. There is no guarantee that past trends will continue, or forecasts will be realized.

A transition towards a pro-Western government might ease sanctions, enable foreign investment (although this may require a change in attitude among Venezuela’s current regime or a change of regime altogether), and increase output. It is possible that with outside help and favorable political conditions, Venezuela could double production to 2 million barrels/day within two years2 and meaningfully more in the longer run. Such an expansion would alter the global oil balance. It is not difficult to see why Venezuela moving under the aegis of the U.S. could improve energy security for the U.S and by extension the West.

Longer-term political repercussions – fresh focus on spheres of influence

Beyond immediate market considerations, the shift in Venezuela may carry longer term geopolitical consequences. If the U.S. asserts itself unilaterally to advance economic or political objectives, it may set precedents that reverberate across other regions. It also makes it harder for the U.S. to condemn similar actions by others in the future.

A return to a world of delineated “spheres of influence” is plausible: China exerting dominance in Asia, the U.S. reinforcing its position across the Americas, and Europe continuing to navigate complex dynamics with Russia. Venezuela’s transition may therefore be a microcosm of a broader global realignment and one to which investors may need to actively adjust.

Looking ahead

Venezuela’s political shift is unlikely to drive broader market repricing in the very near term. Yet its implications – for energy supply, emerging market sovereign bonds, geopolitical tensions and supply chain diversification – warrant continued attention.

1Source: OPEC Annual Statistical Bulletin 2025.

2Source: Wood Mackenzie, ‘What could change in Venezuela mean for oil production?’, 5 December 2025.

There is no guarantee that past trends will continue, or forecasts will be realized.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Hegemon: A dominant person or country that holds significant power and influence over others.

Sanction: Sanctions, in law and legal definition, are penalties or other means of enforcement used to provide incentives for obedience with the law or other rules and regulations. Economic or trade sanctions are penalties aimed at changing a country’s policy or behaviour, through tools such as restrictions on trade or movement of capital.

Sphere of influence: A country or region in which another country has power to affect developments although it has no formal authority.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.