The three habits of successful bond investors

Head of U.S. Securitized Products John Kerschner discusses three habits bond investors can adopt as they seek better risk-adjusted returns.

6 minute read

Key takeaways:

- While macroeconomic events tend to dominate news headlines, we believe investors should focus their attention on things they can control.

- In our view, investors do not need to make big bets on the outcome of these events to achieve their investment goals.

- Sound portfolio management is the culmination of thousands of small decisions that add up to a robust portfolio, irrespective of what happens in the macro environment.

Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas. -Paul Samuelson, American economist

It is human nature to be captivated by unbelievable stories, great victories, and thrilling endings. One could argue that we have a penchant for the dramatic.

Consider the world of professional sport, where fans live for moments of high drama and climactic endings – the buzzer-beating 3-pointer to win the National Championship or the last-minute touchdown drive to win the Superbowl. These are the moments that stick with us because they make for great stories.

In the realm of investing, too, we can be drawn to these epic, world-famous plays, such as George Soros netting a $1 billion profit on a bet against the British Pound in 1992, or Michael Burry and Steve Eisen making billions from their short positions on the U.S. housing market in 2008. Or, more recently, we had hedge fund manager Bill Ackman, who shorted the S&P 500® Index right before the COVID shutdown in March 2020, pocketing a cool $2.7 billion as markets plummeted.

While the thought of pulling off this type of victory might appeal to our thrill-seeking nature, we believe a fascination with the dramatic can lead to suboptimal decision-making and inferior long-term investment outcomes.

Instead, we think investors should opt for an investment approach that is as exciting as watching paint dry – an approach economist Benjamin Graham once described as being “intolerably boring.”

With this approach in mind, we think investors may benefit from adopting three key habits:

1. Obsess over small details, ignore the uncontrollable

In the intensely competitive sport of Formula One (F1) racing – where top finishers are commonly separated by less than one tenth of a second per lap – tiny gains can make all the difference.

An F1 team can invest a lot of money in developing a fast car and hiring a marquee driver, but if they ignore the small things, it can all be for naught. The best teams expend little energy on things they cannot control, like weather and stewards’ actions, while being hyper focused on shaving fractions of a second off their lap times in areas they can control, such as pitstop strategy, tire selection, and car setup. The F1 teams that dominate the thousands of small decisions that transpire over a race weekend will ultimately be the most successful over the long run.

Similarly, we believe sound portfolio management is the culmination of thousands of small decisions that add up to a robust portfolio, irrespective of what happens in the macro environment.

While some world-renowned investors have become famous for one or two big decisions, their investment success was largely founded on a lifetime of small decisions.

On most days in financial markets, there is no big event, no big story, and no heroic play to be made. So, instead of sitting on the sidelines waiting for something big to happen (or worse, hoping for something big to happen), we think investors would do well to implement a strategy that relies on accumulating incremental gains.

2. Seek out positive opportunities, not negative

Investors can adopt one of two mindsets when seeking investment opportunities: investing in something they believe will do well, or “betting” against something they believe will do poorly.

In our view, the first option – investing in positive opportunities – is more straightforward and less risky. Betting against something creates internal conflict (which can be stressful in the long term) because one is ultimately hoping for something to fail to generate a return. We think a better approach is to look to profit from a company or sector’s success, not its failure.

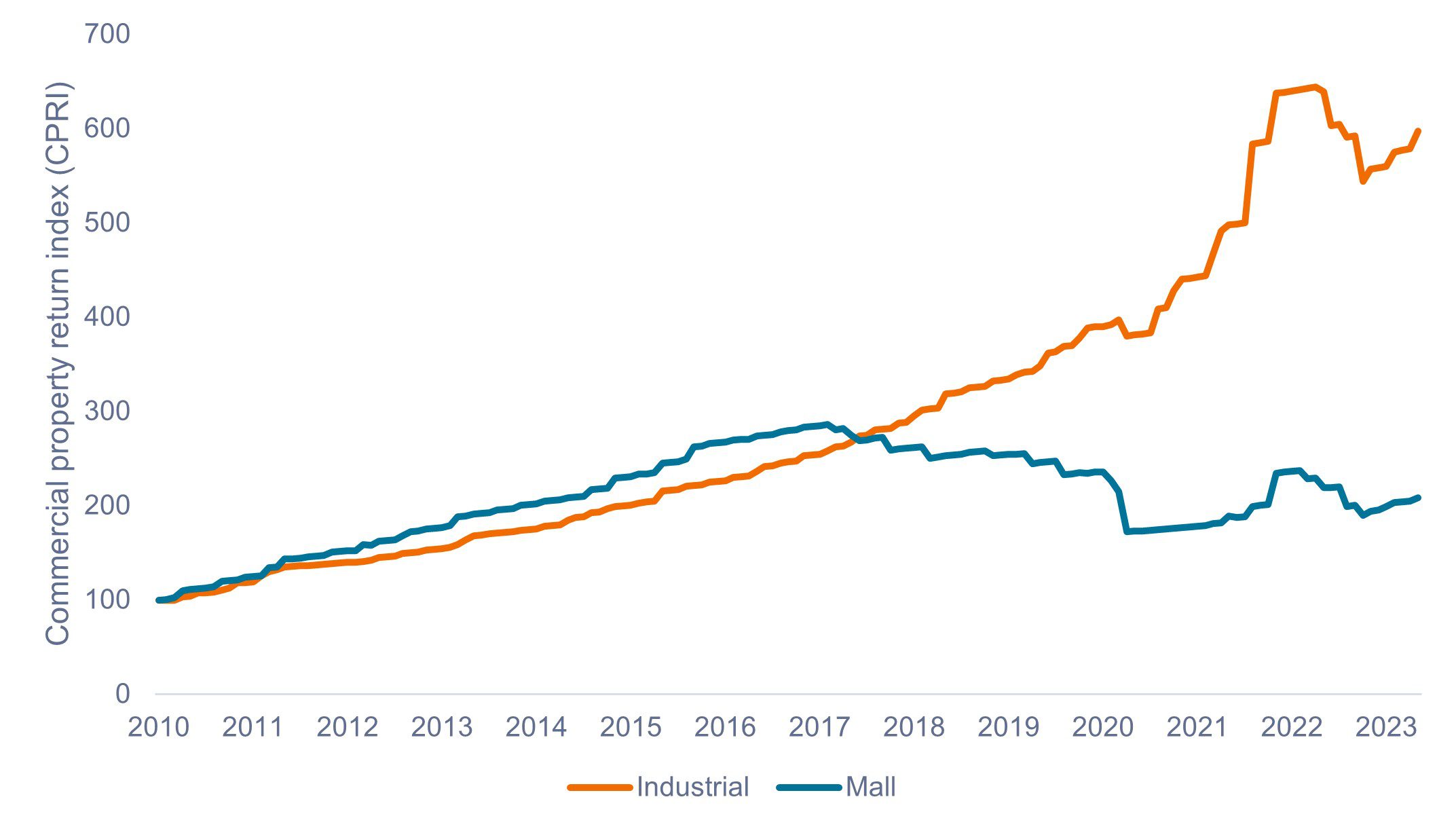

An example of this can be seen in the commercial real estate (CRE) market. For over two decades, there has been a shift away from traditional brick-and-mortar retail to e-commerce. Malls have struggled, while the industrial sector has done relatively well as retailers close stores and move their merchandise to warehouses to be sold online. Yet, while malls have lagged, they haven’t exactly been the anticipated home run for short sellers, as shown in Exhibit 1.

After accounting for carrying costs (expenses incurred as a result of the investment position, such as interest, transaction, and opportunity costs) there have been very few points in the last 13 years where an investor would have profited from a short position in the mall sector. In contrast, an investor would have done much better investing in industrial warehouses, which have continued to thrive as e-commerce has grown.

Exhibit 1: Commercial property return index (CPRI) (2010-2023)

Investing in winners has historically been a better strategy than betting against losers.

Source: Green Street Advisors, as of 1 May 2023. Past performance is no guarantee of future results.

Source: Green Street Advisors, as of 1 May 2023. Past performance is no guarantee of future results.

3. Take what the market is giving you

On any given day, financial markets are offering a range of investment opportunities.

These opportunities differ from one day to the next depending on various macro- and micro-economic factors. While much attention is given to the economic environment in which companies operate, we believe it’s better to focus on what markets are offering in the form of expected risk-adjusted returns. One can get tangled up in making predictions about unknown (and largely unknowable) events and how those events may or may not affect various investments.

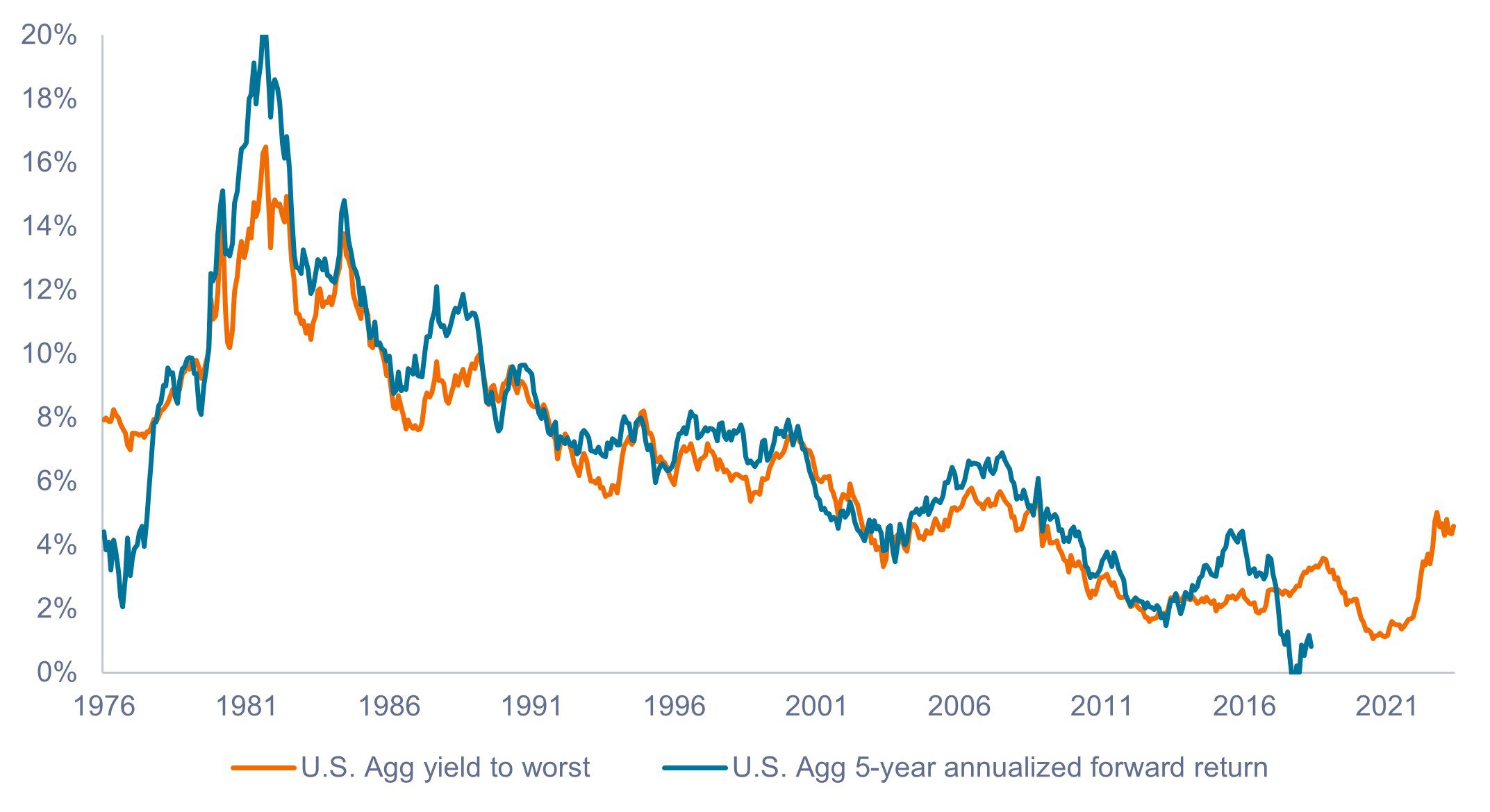

An example of this is in the U.S. fixed income market. With the sharp increase in interest rates in 2022 and 2023, the starting yield to worst (YTW) on the Bloomberg U.S. Aggregate Bond Index (U.S. Agg) is now higher than at any point since 2008. While past performance is no guarantee of future returns, starting YTW has historically been a reliable indicator of forward annualized 5-year returns on the U.S. Agg.

As such, investors may find it a more productive exercise to pay attention to current YTW than to try to predict the path of future inflation or interest rates.

Exhibit 2: U.S. Agg YTW and 5-year annualized forward returns (1976-2023)

Source: Bloomberg, as of 1 May 2023. U.S. Agg yield to worst period from 31 January 1976 to 31 May 2023. U.S. Agg 5-year annualized forward returns period from 31 January 1976 to May 31, 2018. Past performance is no guarantee of future results.

Source: Bloomberg, as of 1 May 2023. U.S. Agg yield to worst period from 31 January 1976 to 31 May 2023. U.S. Agg 5-year annualized forward returns period from 31 January 1976 to May 31, 2018. Past performance is no guarantee of future results.

In summary

So far in 2023, economic events have dominated headlines, from inflation and interest rates to the debt ceiling debacle and turmoil in the regional banking sector.

While there may be value in being informed about events taking place in the economy, we think investors should not allow the potential outcomes of these events to drive their investment decisions.

Rather, we believe that a strategy that focuses on building a robust portfolio through evaluating individual investment opportunities based on their expected risk-adjusted return is the better long-term approach.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (i.e., the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Short sales are speculative transactions with potentially unlimited losses, and the use of leverage can magnify the effect of losses.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.