“Leadership in an Age of Uncertainty” was the topic of a recent insightful Janus Henderson event that I was delighted to attend. It included a leading UK senior politician as guest speaker and brought together executives from prestigious investment groups. Part of the enlightening event focused on how the technology sector can exemplify the power of strong leadership in times of flux.

Emerging innovations like artificial intelligence (AI) are drivers of transformation, while at the same time technology as a sector is exposed to the uncertainty of volatile political decisions. While we hear a lot of concern around increasing uncertainty, one thing that our Global Technology Leaders Team has certainty on is the long-term investment potential of the tech industry. Technology has a long legacy of taking share from the wider market; we continue to maintain our belief that artificial intelligence, the next wave of compute, has the potential to support the acceleration of tech company share gains.

Why visionary leadership matters in the tech sector

The technology sector is fortunate to have some exceptionally strong leaders and visionaries to drive the industry forward and help navigate elements of uncertainty, such as deglobalisation and the coming of age of AI. So much so that Jensen Huang (NVIDIA), Tim Cook (Apple), Satya Nadella (Microsoft), Sundar Pichai (Alphabet), and Jeff Bezos (Amazon) are all household names. Collectively, these companies have a total market capitalisation of more than US$20.5 trillion (at the time of writing)1 – greater than the GDP of countries such as Canada, Brazil, and Spain.2 That scale means that these tech leaders, their companies, as well as those leading some of the new disruptive AI companies like Sam Altman’s OpenAI, are increasingly important players in the current geopolitical and economic landscape.

Tech companies’ resilience amid geopolitical uncertainty

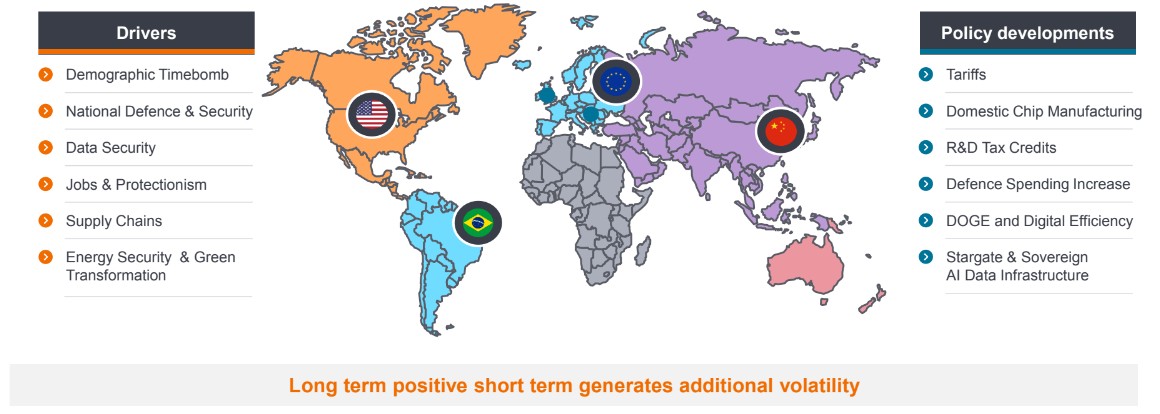

We have seen some major changes in technology ecosystems over the last decade or so, with a move away from global supply chains, to a significant shift towards deglobalisation, which is driving reshoring and onshoring efforts today. This shift was accelerated in the aftermath of COVID19, which revealed the shortcomings of global supply chains. We are seeing many governments push to develop domestic technology infrastructure, be it for AI build out or semiconductor manufacturing. Those investments have driven increased capital spending in areas like AI data centres and semiconductor equipment – tailwinds for the technology sector.

Geopolitics and deglobalisation

Technology is a national priority

Source: Janus Henderson Investors.

However, those deglobalisation efforts have also increased friction between countries. This came to a head with President Trump’s so-called “Liberation Day” in April of this year, with material tariffs being applied on countries trading with the US, which introduced significant uncertainty to financial markets globally. In the technology equities space, experience is a requisite to managing portfolios through periods of elevated volatility. Technology’s rapid changes make it vital to understand both tech ecosystems and end-market exposure, to support capital preservation and to identify opportunities during periods of increased uncertainty.

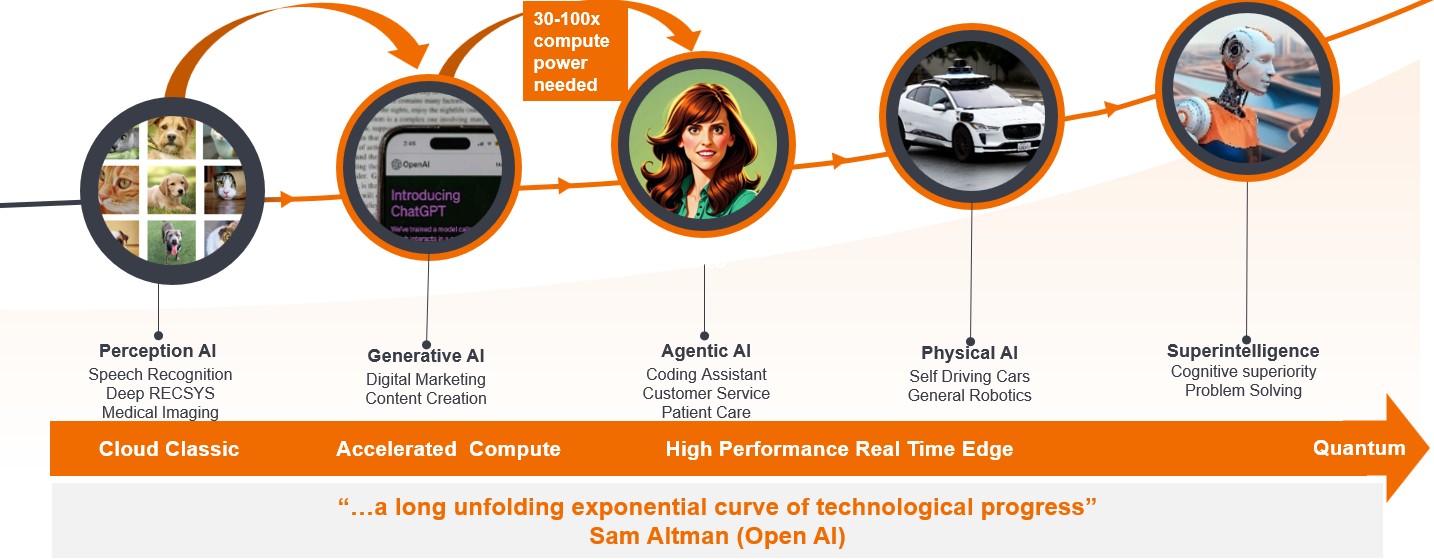

From platforms to applications: the evolution of AI

AI has been central to much of the political friction we see today. This is centred around how important it will be in terms of improving efficiency and productivity, how disruptive it will prove, and who will win the AI race. Whatever the case may be, as a team we believe AI is a key catalyst to drive further tech sector share gains versus broader equities, underpinning unappreciated long-term growth for the sector.

AI evolution expands use cases

Source: Janus Henderson Investors.

The emergence of AI has increased uncertainty in the software space and in particular, application software. Despite enabling the acceleration of software coding, AI is seen as a threat to application software with some commentators suggesting that AI agents will be able to replace or replicate software applications. We believe that this is unlikely to be the case as mission critical software applications hold vital business data and business process models, which are difficult to replicate using agents or ‘vibe-coded’ software. The fact that a casual user can vibe code the classic arcade game Asteroids in minutes doesn’t mean that complex Enterprise Resource Planning (ERP) software from companies like SAP and Oracle can be replicated or replaced easily.

The widespread acknowledgement of the importance of AI has led to the technology’s building blocks, such as NVIDIA’s GPUs, becoming potential political pawns. Fortunately, as mentioned above, the leading technology providers and platforms have exceptional, visionary leaders with the significant scale of their combined market capitalisations behind them. This brings seats at the negotiating tables around the world and does not seem to have impacted the pace of development of this vitally important next wave of technology. We are also seeing the emergence of some native AI leaders with sizeable valuations including the likes of OpenAI and Anthropic; OpenAI is already valued at circa US$0.5 trillion, and potentially double that when it considers a public listing in 2026.3

How to navigate the AI hype: Look at the fundamentals

The pace of development, the amount of investment, and the sustainability of funding have led investors to increasingly question the level of hype around AI. Through our experience of investing through the dotcom tech bubble we can reflect and contrast between then and now; in our view there are key differences between what’s happening in current markets. One significant difference is that today’s AI boom is supported by more disciplined valuations and robust private funding among financially strong, large technology companies.

In an environment shaped by geopolitical shifts and rapid AI adoption, technology’s resilience depends on disciplined, visionary leadership. These leaders are steering through deglobalisation while leveraging AI as a structural growth driver, supported by robust fundamentals and strong balance sheets. For experienced investors, this underscores why leadership quality remains a critical determinant of long-term value creation in the tech sector.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable.

1 Euronews; “Magnificent Seven surpass EU GDP”; 4 October 2025. CNBC Markets Data as at 18 November 2025.

2 IMF, Investopedia; Top 25 countries by nominal GDP as of 2025.

3 Reuters; “OpenAI lays groundwork for juggernaut IPO at up to $1 trillion valuation”; 30 October 2025.

Balance sheet: A financial statement that summarises a company’s assets, liabilities, and shareholders’ equity at a particular point in time. A company with a strong balance sheet indicates that it is in good financial health.

Fundamentals/fundamental analysis: The analysis of information that contributes to the valuation of a security, such as a company’s earnings or the evaluation of its management team, as well as wider economic factors.

GPU: A graphics processing unit performs complex mathematical and geometric calculations that are necessary for graphics rendering and are also used in gaming, content creation and machine learning.

Valuation: The process of determining the fair value of an asset, investment, or firm. Among others, future earnings and other company attributes are used to arrive at a valuation.

Vibe-coding: An emerging software development practice that uses artificial intelligence (AI) to generate functional code from natural language prompts, accelerating development, and making app building more accessible, especially for those with limited programming experience.

Volatility: The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility, the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.