The European exchange traded fund (ETF) industry has entered a new phase of growth, with assets surpassing US$3 trillion in Q3 2025.1 This is driven, in part, by investors prioritising liquidity, transparency, and cost efficiency, while exploring alternative solutions such as tokenised products. Against this backdrop, in 2026 Janus Henderson aims to offer ETF solutions with a differentiated approach that combines innovation with client-centricity.

ETFs have evolved from simple passive index trackers into sophisticated investment tools. While traditional beta (market) exposures remain dominant, the rise of active ETFs and thematic strategies signals a shift toward solutions that deliver incremental alpha without sacrificing cost efficiency. For asset managers, this evolution presents both challenges and opportunities: how can asset managers innovate while maintaining the trust and confidence of investors who value predictability and risk control?

Global ETF adoption and market dynamics

ETF assets under management continue to climb, with active ETFs and thematic strategies gaining momentum. Competitive dynamics remain intense, as issuers seek to differentiate through cost, performance, and innovation. In Europe, demand is shifting from pure passive toward “index-plus” or “active core” strategies, offering the potential for modest outperformance at low incremental fees.

The active ETF market in Europe is still dominated by low tracking error strategies – those that diverge only slightly from the benchmark. These approaches appeal to investors who want incremental alpha without taking on significant risk or paying high fees. While “high-conviction” active ETFs have yet to gain traction, the journey toward more active solutions is underway.

This gradual evolution reflects investor psychology. European allocators face asymmetric incentives: they are rarely rewarded for taking additional risk but are penalised when strategies underperform. As a result, they favour incremental enhancements, such as research-engineered portfolios, that promise modest outperformance while maintaining low volatility.

Investor priorities: Liquidity, transparency, and cost efficiency

European investors typically remain risk averse, favouring strategies with more predictable outcomes. They are willing to pay slightly more for incremental alpha – often just 10 basis points above passive fees – if it can be delivered consistently. This dynamic is shaping demand for research-enhanced and income-enhanced ETFs, which promise modest outperformance while maintaining low volatility.

Beyond traditional ETFs, tokenized products and derivative-based enhancements are emerging as tools for tax efficiency and customisation. These innovations support the broader trend away from “ETF = passive”; they are becoming flexible building blocks for sophisticated portfolios.

Client solutions first: Solving investor challenges

Janus Henderson’s philosophy centres on solving client problems using existing intellectual property. This flexibility includes launching ETFs to order and creating efficient vehicles for complex client needs. Success stories include our tokenised products, providing exposure to US Treasuries and high-quality securitised assets, which have raised US$1.4 billion to date by delivering liquidity and transparency in a digital format.

ETFs are increasingly part of Janus Henderson’s client solutions toolkit. Unlike traditional collective investment vehicles, which offer a fixed shelf of products, ETFs allow for rapid customisation and scalability. This responsiveness is critical in an environment where institutional investors demand tailored solutions across multiple jurisdictions.

Innovation and diversification key to cater for investor needs in 2026

Building on core strengths in Collateralised Loan Obligations (CLOs), Mortgage-Backed Securities (MBS), and short-duration fixed income, Janus Henderson is expanding its ETF toolkit to meet diverse market requirements. We are also adapting high-conviction equity strategies into moderate tracking error ETFs, leveraging proprietary research to deliver incremental alpha while controlling volatility.

For example, Janus Henderson’s approach leverages insights from its high-conviction portfolios to offer ETFs with broader diversification – reducing tracking error while preserving alpha. This evolution reflects a pragmatic response to investor preferences for risk-controlled active exposure.

The concept of “portable alpha” underpins this strategy. By diluting high-conviction exposures into more diversified portfolios, Janus Henderson can distribute alpha across larger AUM while meeting client demand for predictability. This approach also aligns with fee compression trends: investors are unwilling to pay for concentrated bets but will pay modest premiums for incremental enhancements.

The road ahead: ETFs as client solutions

ETFs are increasingly positioned as part of Janus Henderson’s client solutions business. Unlike traditional vehicles, ETFs can be launched to order, enabling bespoke strategies for institutional clients. They also serve as efficient solutions for complex exposures, including derivative-based enhancements for tax optimisation.

This flexibility matters in a global context. European domiciled UCITS ETFs are emerging as the default solution for non-US institutional investors, offering a standardised, liquid, and transparent format across multiple jurisdictions. As Janus Henderson expands its ETF footprint in EMEA, the emphasis will be on customisation, scalability, and integration with multi-asset solutions.

As we help investors position for a brighter future, our goal is to continue to be an industry leader with innovative, client-centric solutions, and a global outlook.

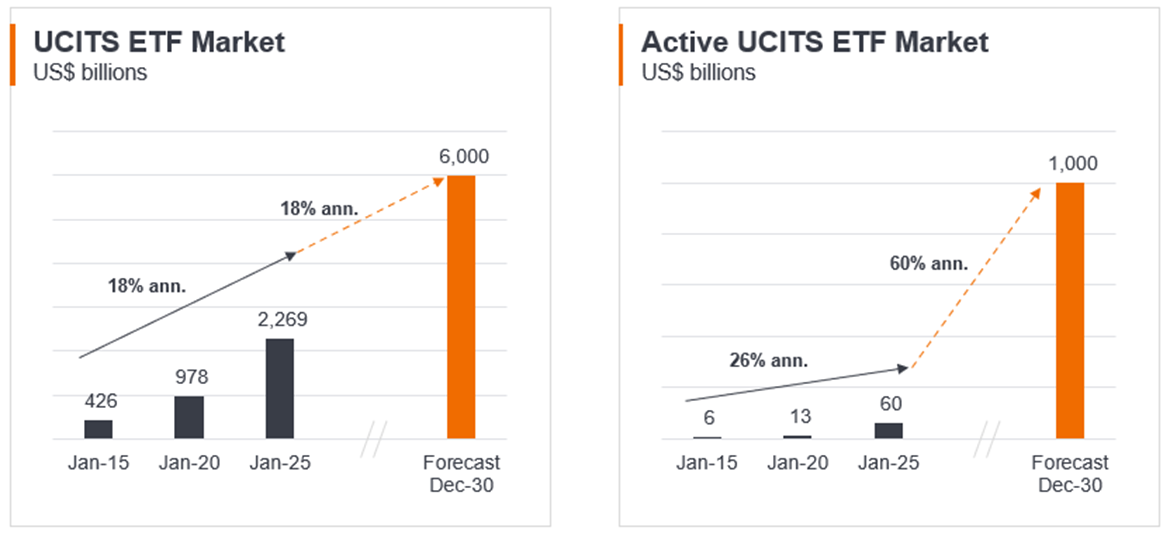

Exhibit 1: Impact of the rise of active ETFs

Source: ETF Book and Janus Henderson as at 30 September 2025

Note: Forecast is based on internal estimates and may vary. There is no guarantee the forecast will be achieved.

1Source: ETFGI ‘ETFGI research reports Europe’s ETF industry surpassed US$3 trillion milestone for the first time at end of September’, 10 October 2025.

Active investing: An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis, and the investment choices they make. The opposite of passive investing.

Alpha: Alpha is the difference between a portfolio’s return and its benchmark index after adjusting for the level of risk taken. This measure is used to help determine whether an actively-managed portfolio has added value relative to a benchmark index, taking into account the risk taken. A positive alpha indicates that a manager has added value.

Basis point (bp): One basis point equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Beta: This is the measure of the relationship that a portfolio or security has with the overall market. The beta of a market is always 1. A portfolio with a beta of 1 means that if the market rises 10%, so should the portfolio. A portfolio with a beta of more than 1 means it will likely move more than the market average (i.e., more volatility). A beta of less than 1 means that a security is theoretically less volatile than the market.

Bid offer spread: The difference between the bid price (a figure that represents the maximum price a buyer is willing to pay) and the offer price (the minimum price a seller would be willing to accept for a security).

Collateralised Loan Obligation (CLO): A bundle of generally lower-quality leveraged loans to companies that are grouped together into a single security which generates income (debt payments) from underlying loans. The regulated nature of bonds that CLOs hold means that in the event of default, the investor is near the front of the queue to claim on a borrower’s assets.

Exchange traded fund (ETF): A security that tracks an index, sector, commodity, or pool of assets (such as an index fund). ETFs trade like an equity on a stock exchange and experience price changes as the underlying assets move up and down in price. ETFs typically have higher daily liquidity and lower fees than actively-managed funds.

Index: A statistical measure of a group or basket of securities or other financial instruments. For example, the S&P 500 Index indicates the performance of the largest 500 US companies’ stocks. Each index has its own calculation method, usually expressed as a change from a base value.

Liquidity/Liquid assets: Liquidity is a measure of how easily an asset can be bought or sold in the market. Assets that can be easily traded in the market in high volumes (without causing a major price move) are referred to as ‘liquid’.

Mortgage-backed security (MBS): A security which is secured (or ‘backed’) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages (similar to the coupon on bonds), like an asset-backed security. Mortgage-backed securities may be more sensitive to interest-rate changes. They are subject to ‘extension risk,’ where borrowers extend the duration of their mortgages as interest rates rise, and ‘prepayment risk,’ where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Passive investing: An investment approach that involves tracking a particular market or index. It is called passive because it seeks to mirror an index, either fully or partially replicating it, rather than actively picking or choosing stocks to hold. The primary benefit of passive investing is exposure to a particular market with generally lower fees than you might find on an actively-managed fund, the opposite of active investing.

Tracking error: This measures how far a portfolio’s actual performance differs from its benchmark index. The lower the number, the more closely it resembles the index.

Volatility: The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility, the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.