Not too long, not too short – the argument for absolute return

Market inefficiencies will always exist due to imperfect information and unpredictable investor behaviour. Investors can misjudge the prospects for a company; markets can over-react to negative news. This can create opportunities for those investment strategies capable of generating positive returns, whatever the prevailing market conditions.

5 minute read

Key takeaways:

- Valuations on both equities and bonds have been strained, inviting questions as to what alternative strategies investors can use to manage risk across their portfolios.

- Highly accommodative government and central bank policies have pushed the relationship between bonds and equities into uncertain territory.

- The Janus Henderson Absolute Return Fund has been approved for classification as an Article 8 product, reflecting efforts to embed environmental and social considerations into the investment process.

Equity long/short ‘absolute return’ strategies focus on exploiting market inefficiencies to generate absolute returns (ie. a return greater than zero) in various market environments.

The long and short of it

Classic ‘long’ investing involves putting your money into assets (whether that be stocks, bonds or property) in the hopes/expectation that they can rise in value over time. ‘Short’ investing is a form of investment that can profit if the underlying asset falls in value. The most common technique is to borrow an asset (for a fee), and then sell it, with the intention of buying it back for less than you sold it for and returning it to the original owner by the agreed date. If correct, the strategy can make money from assets that are depreciating. But they can lose money if the underlying asset increases in value.

More flexible strategies are also able to actively adjust the proportion of long or short investments held, which can improve their adaptability. Holding a relatively large proportion of long investments can make a strategy more sensitive to prevailing market conditions, indicating optimism about the prospects for stock markets, whereas being net short (holding a greater proportion of shorts than longs), can indicate the expectation that markets might struggle, or that share prices are too high. Net exposure can be adjusted at an overall portfolio level, by sector, region, or even at a stock level, allowing investors to target their exposure in line with their views.

But… why absolute return?

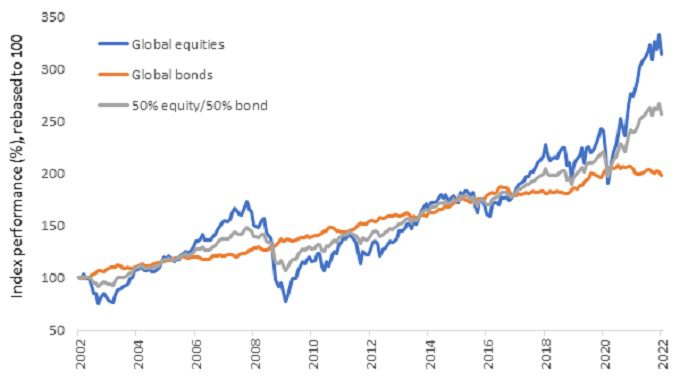

Traditional asset allocation strategies built around equities and bonds have been a useful tool for investors over the past two decades (Exhibit 1) – and this has continued throughout most of the pandemic era. Allocations to bonds helped to mitigate the worst of the market falls seen during that initial period of shock and uncertainty in March 2020. Meanwhile, stock markets rebounded sharply in response to large-scale intervention from central banks and governments to support economies and protect jobs.

Source: Refinitiv Datastream, 31 December 2002 to 31 January 2022. Rebased to 100 at start date. Past performance does not predict future returns.

Note: ‘Global equities’ is the MSCI World Total Return Index (in US dollars). ‘Global bonds’ is the JPM GBI Global All Traded Index. ‘50% equity/50% bond’ represents a simple 50/50 strategy equally allocated to equities and government bonds.

November 2020 was a significant moment, with markets responding positively to news of Pfizer’s vaccine breakthrough, optimism that continued throughout most of 2021, despite the uncertainty created by emergent strains with different transmissibility and potency. This has left both equities and bonds currently looking arguably expensive. This, in turn, is leading investors to seek alternative strategies investors that can help them better manage risk across their portfolios.

Could traditional diversification strategies fail to protect clients in the next downturn?

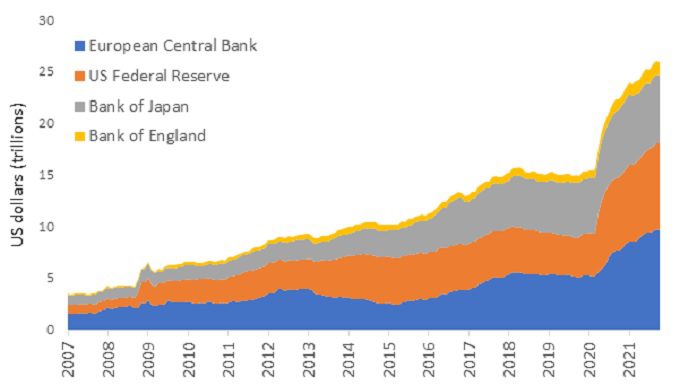

History shows us that diversification is not something that should be taken for granted. Governments and central banks have pursued highly accommodative policies, which has pushed the relationship between bonds and equities into uncertain territory. For the world’s major central banks, the purchase of massive quantities of government bonds (and other assets), aimed at increasing economic activity, has led to significant increases in the size of their balance sheets (Exhibit 2).

While this largesse helped to finance governments during the pandemic, it has also helped to inflate asset prices. Central banks now face the high-stakes task of finding some way to unwind their stimulus measures (‘tapering’), without precipitating a new crisis. The US Federal Reserve has been the first major central bank to act, dialling back its bond purchases from $120 billion per month in November 2021, with the intention of ending them by March 2022. Elsewhere, in late 2021 the Bank of England surprised markets by increasing interest rates for the first time since 2018. Markets have reacted negatively to this surprisingly hawkish stance, with both equities and bonds[1] losing ground in January 2022.

Products that meet the needs for modern investors

Demand continues to grow for long/short equity strategies as the correlation between stocks continues to fall from the peak we saw during the early days of the pandemic. The past few months has also seen a rotation from growth to value, supported by rising interest rates and higher-than-expected inflationary pressures. This is likely to be a more favourable environment for absolute return strategies where stock selection is based on company fundamentals, as is the case with our Janus Henderson Absolute Return Fund.

Finally, we are also celebrating confirmation that the Janus Henderson Absolute Return Fund has been approved for classification as an Article 8 fund, effective from 25th February 2022. This was positive recognition of our efforts to embed environmental and social considerations in our investment process. In accordance with the Sustainable Finance Disclosure Regulation (SFDR), Article 8 labelled portfolios promote, among other characteristics, environmental and social characteristics.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.