Reshaping UK and European credit: the corporate bond unwind

Uneven pressure across sectors

While much focus has been upon central banks propping up government bond markets through quantitative easing, it is often overlooked that they have been influential buyers of corporate bonds – in Europe and the UK since 2016. Purchases were stepped up during the pandemic to shore up growth, with the European Central Bank (ECB) corporate sector purchase programme (CSPP) and the BoE corporate bond purchase scheme (CBPS) accumulating nearly EUR€£350 billion1 and £19.1 billion2 of investment grade (IG) bonds, respectively.

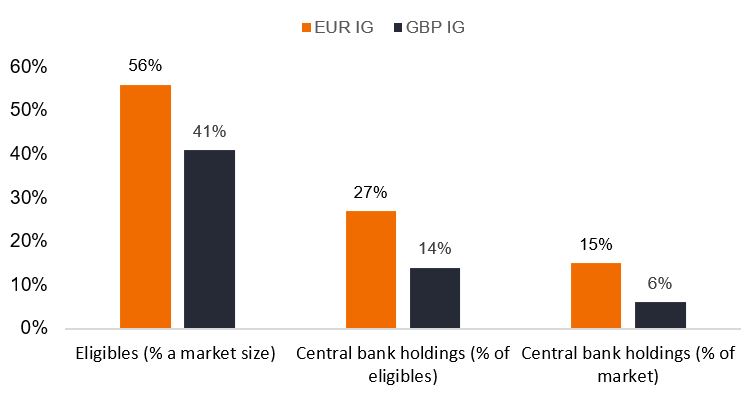

Although the CSPP and CBPS represent 15% and 6% of their respective IG markets (Figure 1), the eligibility criteria for both programmes means that both central banks are even more significant holders of eligible bonds. In fact, the ECB now holds 27% of all bonds eligible for inclusion in the CSPP portfolio, while the BOE holds 14% of CBPS-eligible issues. Non-bank corporate bonds are excluded from the ECB portfolio, as one example. This highlights that the impact of the corporate bond unwind won’t be uniform across sectors.

Figure 1: Stepping back of the central bank buyer

Source: Credit Suisse, Bank of England, 24 August 2022.

BoE first to start selling

Whether quantitative tightening (QT) is initialised as an active tool depends on the necessity to do so. The average maturity of the ECB’s CSPP portfolio is around six years (with around half of the portfolio to naturally mature in five years), versus 14 years for BoE’s CBPS and in perpetuity for the U.S. Federal Reserve’s (Fed’s) Secondary Market Corporate Credit Facility’s3 exchange-traded fund (ETF) holdings, according to HSBC4. This means the ECB is better positioned to achieve balance sheet runoff naturally than the Fed or BoE.

The BoE just kicked off its active sales of an average of £200 million of bonds a week in sector-defined auctions, with the pace to be adjusted to account for prevailing market conditions. The total pool of bonds eligible to be sold is around £17 billion5. This amount could shrink, however, since the BoE also allows issuers to buy back their bonds directly from the bank. The announced sales represent just under a year’s worth of supply6, which would make the BOE a material, but not dominant, seller of bonds over the coming months.

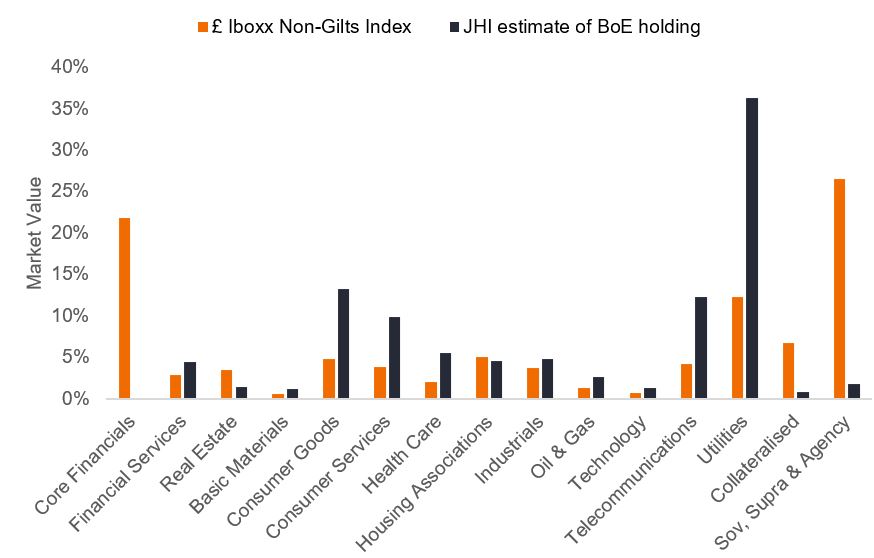

What matters more is the shape of the impact on the sterling IG market given the uneven distribution of holdings across sectors. Our analysis of the current CBPS holdings shows that utilities bonds could shoulder an especially large portion of sales, since they represent 36% of the CBPS portfolio, which is around three times its weight within the sterling IG market (Figure 2). Consumer goods and telecommunications bonds are also set to bear a large portion of the selling pressure, although not to the same extent.

Conversely, the CBPS portfolio has no exposure to core financials (i.e. banks), which could act as a positive technical – supply and demand dynamic – for the sector. From a fundamental perspective, banks’ balance sheets have improved (core tier one ratios7) while regulation more broadly has been a positive for their liquidity and solvency. Coupled with the fact that several large banks have already completed most of their issuance programme for the year, this creates the potential for the sector’s bonds to outperform – particularly given a favourable higher interest rate environment for their profits.

Figure 2: Active sales will have an uneven impact across sectors

Source: Janus Henderson Investors analysis compiled using Bank of England data, 18 August 2022. Markit iBoxx Sterling Non-Gilts Index is representative of the sterling investment grade market.

Bank supply contrasts with the broader market trends, where issuance of sterling non-financial IG bonds has been especially anaemic so far this year, which could set the stage for a ‘double-whammy’ negative technical for corporates that need to come to the market and issue debt during the CBPS sale process. This is expected to be complete by the end of 2023.

‘Green’ tilt could reshape markets

While the BoE already started to tilt its purchases towards companies that would help support the transition to a net zero emissions economy, the ECB will start applying a ‘green tilt’ towards its CSPP bond reinvestments from October this year. The bank will only reinvest maturing CSPP holdings towards issuers deemed to be making enough efforts in curbing current emissions, setting adequate climate goals, and making appropriate climate-related disclosures. Albeit it will be targeted at issuers rather than sectors, this represents challenges for high-emitting sectors, such as oil and gas.

The bank has yet to elaborate on the finer details of how it intends to apply these checks. By one basic measure of reporting scope 1 and 2 emissions, sectors that are lagging behind are technology, transportation, and capital goods, where more than 30% of names are non-reporters, according to Barclays research. While the maturity profile of the CSPP portfolio (as well as its scale) means implementation will be gradual and have little impact, at least initially, this development does raise the prospect that ESG-challenged issuers could be first in line for divestment. (That is, should the ECB decide to unwind the CSPP programme as part of a wider QT policy.) We therefore expect this ‘green tilt’ will lead to ESG analysis playing an even more integral role in investment decisions in euro corporate bonds, not least to identify issuers that could come under selling pressure by failing to meet the ECB’s green criteria.

Opportunities from market dislocations

While it is still early days, the months ahead could create some market dislocations, both at the issuer and sector level. We have been mindful of the influence of central banks stepping back from corporate bond markets. In the UK, significant market volatility after the tax-cutting mini-budget saw gilt yields spike and sterling weaken. Thus the chance of QT plans being amended is increasing. We continue to monitor such developments closely and look to both uncover areas of the market that may come under selling pressure from central banks, but also identify potential value opportunities in issues that become oversold and could bounce back from fundamental strength.

Footnotes

1 Source: European Central Bank, Eurosystem, 31 August 2022. Bonds at amortised costs.

2 Source: Bank of England, 3 August 2022. Figure is initial purchase proceeds.

3 This supported market liquidity by purchasing in the secondary market corporate bonds issued by IG US companies or certain US companies that were IG as of 22 March 2020, as well as US-listed exchange-traded funds whose investment objective is to provide broad exposure to the market for US corporate bonds.

4 Source: HSBC, 22 March 2022.

5 Source: Bank of England, Janus Henderson Investors, Market value as at 18 August 2022.

6 Source: Barclays, 1 September 2022. Net issuance over the last five calendar years 2017 to 2021.

7 The tier one capital ratio compares a bank’s equity capital with its total risk-weighted assets

Quantitative Easing (QE): A government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative tightening (QT) is the reduction of the amount of overall money in the banking system.

Investment-grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

High yield bond: A bond which has a lower credit rating below an investment grade bond. It is sometimes known as a sub-investment grade bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Bond: A debt security issued by a company or a government, used as a way of raising money. The investor buying the bond is effectively lending money to the issuer of the bond. Bonds offer a return to investors in the form of fixed periodic payments, and the eventual return at maturity of the original money invested – the par value. Because of their fixed periodic interest payments, they are also often called fixed income instruments.

Liquidity: The ability to buy or sell a particular security or asset in the market. Assets that can be easily traded in the market (without causing a major price move) are referred to as ‘liquid’.

Solvency: The ability of a company to meet its long-term debts and financial obligations.

Environmental, Social and Governance (ESG) or sustainable investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than, the broader market.

Net zero refers to greenhouse gas production being balanced by removal from the atmosphere.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.