Late-year volatility in riskier assets and an uncertain macro backdrop are prompting many investors to seek out the relative stability of the fixed income market. But global bonds are facing their own set of complexities. Monetary policy continues to diverge, with many central banks still confronting persistent inflation. Meanwhile, elevated valuations could be tested by a wave of sovereign and corporate issuance. And relatedly, governments’ embrace of fiscal stimulus continues with minimal pushback from erstwhile deficit hawks.

To maximize a bond allocation’s potential to provide ballast to a broader portfolio, we believe investors should consider shorter-duration exposure. This segment of the fixed income universe can offer attractive income, the potential for diversification against riskier assets and, perhaps most importantly, lower exposure to the risks associated with structurally higher inflation in the post-pandemic, fiscal-stimulus era.

The outlook for inflation remains uncertain, partly due to unresolved questions surrounding tariffs and the broader trend toward deglobalization. This path has the potential to increase costs and disrupt supply chains. However, the potential productivity gains from AI adoption adds another layer of complexity to inflation’s possible trajectory. Understanding the tension between these forces will be a key focus for both policymakers and investors throughout 2026 and beyond.

Dealing with their own problems

A divergence of economic trajectories and monetary prescriptions among major regions creates both opportunities and risks for bond investors. Looming large is each region’s outlook for inflation. With policymakers coming to terms with consumer price growth settling in above their preferred targets, some central banks can again prioritize supporting the economy as long as inflation doesn’t accelerate.

While prices can be notoriously unruly, countries like the UK and Norway may be in a position to continue cutting into 2026. Despite softening labor market data in the U.S., the country’s envious growth profile could compel the Federal Reserve (Fed) to pause cuts, a message Chairman Jerome Powell made sure the market heard during his October statement. In contrast to its prolonged era of aggressive stimulus, Japan now stands alone as the only major region likely to raise rates as the country approaches its fourth year of above-target inflation.

Geography, however, may not be the only way to define diverging policy views. These likely also exist within the Fed and may represent an underappreciated risk to bonds in 2026. A market that’s anticipating up to 100 basis points (bps) in cuts over the next 12 months could be caught wrong-footed if a Trump-influenced Fed fails to live up to dovish expectations should inflation continue to inflict pain on U.S. households. Clouding matters is the conundrum of flagging jobs growth despite evidence of economic resilience.

As policy divergence grows, investors may consider avoiding U.S.-centric risks by allocating to regions with more favorable income and duration prospects. A host of factors ranging from tariffs (inflationary) to a slowdown in exports (disinflationary) and domestic economic growth will ultimately determine which central banks stand pat and which are forced to further relax policy. Such moves – especially when they appear inconsistent with consumer price growth – are likely to exert greater volatility on the middle and longer end of yield curves.

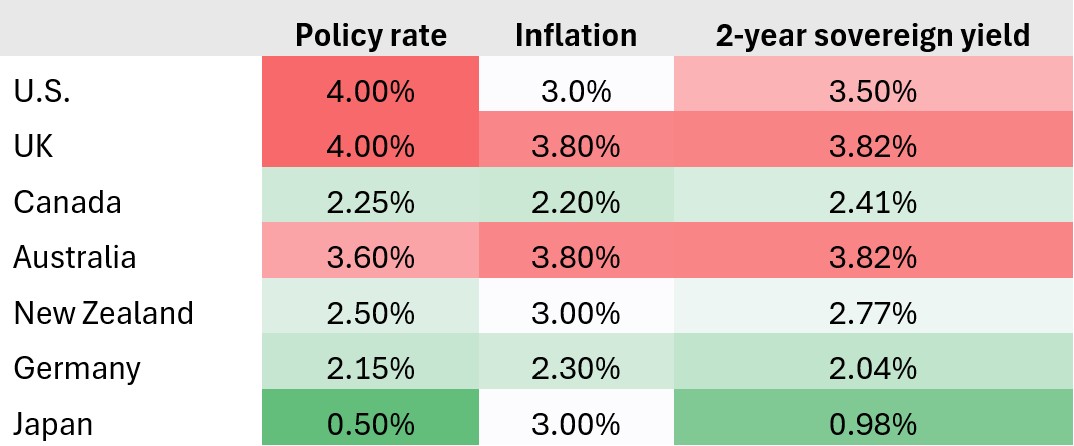

Exhibit 1: Policy and inflation heat map

Policy rates in many jurisdictions are still restrictive relative to headline inflation. But in regions where the difference is small and central banks aren’t fearful of an acceleration in prices, the bias could be toward additional cuts.

Source: Bloomberg, Janus Henderson Investors, 21 November 2025.

Although lingering inflation rightly unsettles bond investors, its persistence – as long as it does not accelerate – has allowed front-end yields to remain at attractive levels. The argument for shorter-duration bonds has been further reinforced by the return of positive carry relative to cash markets in most developed regions. In practical terms, this means investors can again generate returns higher than those available in money markets for only modestly more duration exposure.

More supply than it can handle?

The interplay between inflation and monetary policy has understandably commanded investors’ attention, but it has also obscured the degree to which fiscal policy has been a principal driver of inflation since the onset of the COVID pandemic. And while most of those crisis-era initiatives have lapsed, they are set to be replaced by an onslaught of new spending programs. Foremost among these is Europe’s defense buildup in the wake of Russia’s 2022 invasion of Ukraine. Across the currency union, governments are also seeking ways to spur growth with the aim of quelling voter dissatisfaction. Although bond investors balked at suggestion of fiscal expansion in the UK, within the eurozone, a shifting pendulum is resulting in the sun setting on the era of austerity.

In the U.S., Biden-era big government initiatives have given way to Trump-era fiscal expansion. This is occurring at the same time the Fed seeks to reduce the maturity of its holdings, removing one of this market segment’s marginal buyers. Efforts to stimulate growth through aggressive fiscal policy, especially amid already elevated inflation, have heightened investor concerns about the potential for upward pressure on sovereign yields and curve dynamics. While a material steepening has yet to emerge, the combination of increased supply and shifting demand warrants close monitoring.

On the credit side, underwriting historic technology investment and financing mergers activity would only further increase longer-dated bond supply, likely sending yields upward. Credit spreads already residing well below long-term averages potentially magnify this risk, as some institutional investors are already circumspect about increasing their corporate exposure.

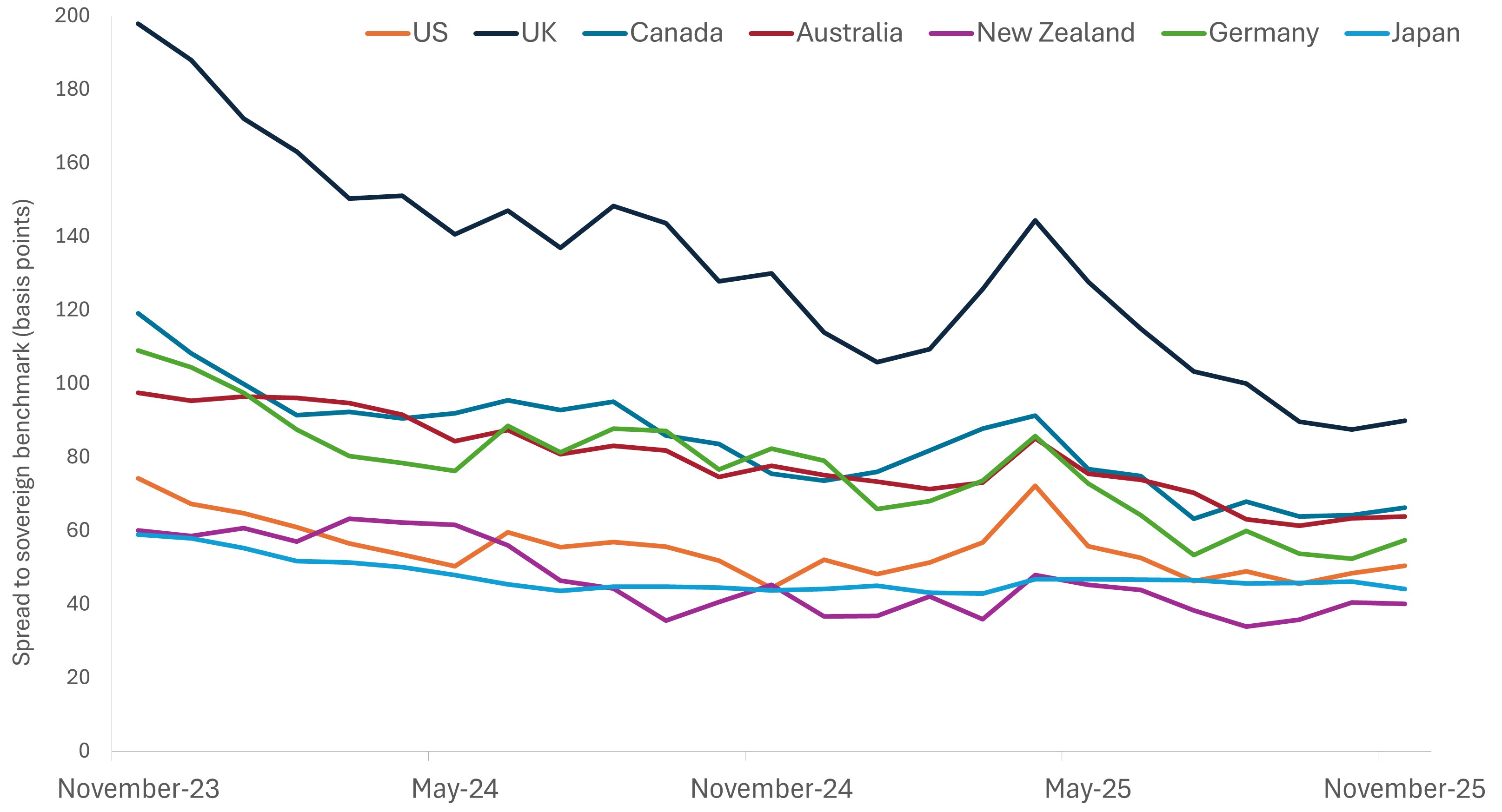

Exhibit 2: Difference between shorter-dated corporate yields and sovereign benchmarks

In most instances, shorter-dated corporate issuance continues to offer steady yields relative to sovereign benchmarks without the additional exposure to rate volatility present in longer-dated bonds.

Source: Bloomberg, Janus Henderson Investors, 21 November 2025. Note: Indices compared to sovereign benchmarks are: Bloomberg US Corporate 1-3 Yr Index, Bloomberg UK Corporate BBB 1-5 Years Index, Bloomberg Canada Aggregate – Corporate 1-5 Years index, Bloomberg AusBond Credit 1-3 Yr Index, Bloomberg NZBond Credit 0-5 Yr Index, Bloomberg Euro Corporate 1-5Yr ex BBB Total Return Index, and Japan Aggregate Corporate & Non-Japanese Government Related 1-7 Years Index.

Balancing the risks

In today’s environment, front-end strategies have the potential to provide reliable income, capital preservation, and – thanks to the market’s global element – flexibility and diversification. Consequently, we believe these characteristics make shorter-dated bonds an attractive ingredient for allocations that seek stability and excess returns over cash.

With economic growth tepid across most developed markets and the Fed vexed by weak payrolls counteracting otherwise resilient U.S data, we believe the balance of risks favors the front end of the curve. With the exception of the eurozone and Japan, reducing rates – even after a pause – is likely the next policy move in most jurisdictions. The combination of policy error, a fiscal impulse, and a wave of issuance has the potential to catch overly sanguine and duration-hungry investors off guard.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Carry is the excess income earned from holding a higher yielding security relative to another.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Volatility measures risk using the dispersion of returns for a given investment.

The yield curve is a graph that plots the yields of U.S. government bonds with different maturities at a single point in time. It is used to visualize the relationship between the interest rates (yields) and the time until the bonds mature, providing insights into economic expectations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.