As we look toward 2026, we maintain an optimistic outlook for U.S. large-cap equities. This view is supported by a powerful capital investment cycle, a resilient consumer, and broadening productivity gains that have strengthened corporate earnings.

While this environment presents opportunities, navigating elevated concentration and valuations requires a selective, adaptive approach. Our focus remains on companies with scale, strong balance sheets, and the ability to invest in productivity-enhancing technologies.

Capital investment has driven productivity gains

The U.S. economy is benefiting from a historic capital expenditure boom. AI is a primary driver, with technology infrastructure spending now accounting for a meaningful portion of U.S. real GDP growth. Robust demand for cloud services and data center capacity shows no signs of slowing.

However, the capital expenditure story extends beyond technology. Recent tax policies allowing immediate depreciation of investments are fueling a broader spending cycle across the market. This widespread capital investment drives productivity gains, which could support future economic growth.

The shift toward greater efficiency has become increasingly evident. More companies are providing examples of AI applications delivering tangible productivity gains. The last two earnings seasons showcased impressive operating leverage, with companies posting strong revenue growth while controlling expenses. This suggests businesses are already seeing returns on their investments, boosting margins and earnings despite cost pressures.

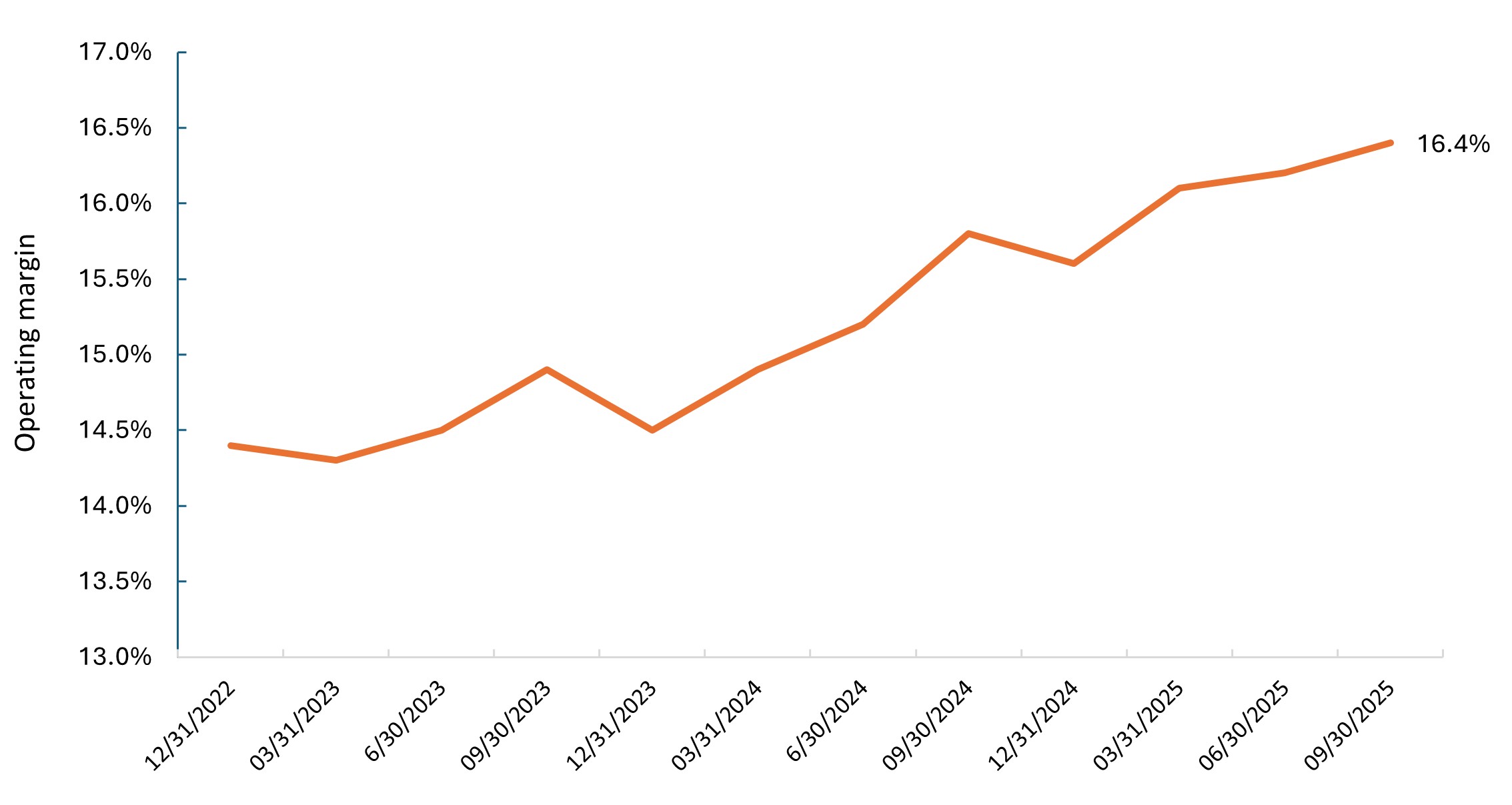

Exhibit 1: S&P 500® Index operating margin (ex-energy)

Outside the volatile Energy sector, the market has benefited from consistent margin improvements over the last two years. Gains have been led by sectors like Communication Services, Information Technology, and Financials where companies can best leverage technology to improve operations.

Source: Bloomberg Intelligence, as of 14 November 2025.

Consumer spending remains resilient

We continue to be optimistic about consumer spending even as labor force growth has softened. Wage growth of around 4.5% continues to outpace pre-pandemic levels, supporting spending. Consumer balance sheets are strong, with the ratio of debt service to disposable income within normal historical range and credit delinquencies remaining low.

However, we recognize consumer spending is always shifting and there will be segments of the economy that contract while others expand. When analyzing credit card data, overall spending is strong, but some segments are flat, such as those more impacted by inflation and moderating job growth. Today, we see that consumers tend to favor experiences over goods, and that there is strong demand for travel.

We see the potential for an additional boost in consumer spending in 2026 from recent tax reforms, which should lead to better refunds during tax season. While spending is strongest among upper-income households benefiting from housing and market gains, the overall picture remains positive.

Market concentration reflects earnings leadership

Market concentration in the U.S. is at a level we haven’t seen in recent history. But when we look at the earnings growth and sustainability of the companies with the largest market capitalization, it’s not surprising because they are leading the technology transformation.

Given AI infrastructure’s importance to the economy, we’re monitoring whether companies achieve appropriate returns, execute on their backlogs, and generate revenue that supports continued investment. Should the AI investment cycle plateau and earnings trajectories change, investors must be prepared to adjust.

While multiples have expanded in the AI infrastructure theme, demand has continued to surprise to the upside, so earnings growth supports the multiples for now, in our view. That said, being adaptive is the right positioning today. Considerable time must be spent assessing balance sheets, cash flow statements, and business sustainability metrics to ensure fundamentals justify market weights.

Putting valuations in context

We acknowledge that the market’s overall multiple is elevated. However, context is helpful. First, the market’s composition has fundamentally shifted. The fastest-growing, highest return on invested capital (ROIC) sectors within the major indices have significantly increased in weight.

Furthermore, strong earnings support current multiple levels. The market delivered more than 12% earnings growth in the second quarter, with similar expectations through 2026. Unlike the 2000 tech bubble, today’s valuation expansion has been matched by a widening profitability premium. We can still find plenty examples of high-quality companies in secular growth industries trading at or below historical multiples.

Where we see opportunity

Within the AI theme, our focus is on both enablers and adopters. Enablers include semiconductor, cloud, and software companies, as well as enterprise platforms developing AI and automation solutions. Adopters are companies across all sectors that have committed to this new technology and are investing aggressively.

Encouragingly, earnings strength has extended beyond AI and technology. Commercial aerospace, capital markets, medical technology, and travel have delivered impressive results. This breadth suggests corporate health is more widespread than some narratives suggest.

Within financial services, investment banking revenues have grown more than 50% based on increased mergers and acquisitions activity and initial public offerings. We think capital markets activity will be strong for the next couple of years as funding continues for the AI capital expenditure investment cycle, potentially benefiting investment banks, ratings agencies, and exchanges. Also, digital payment companies have continued to grow earnings at a 15% annual clip as consumer spending remains strong.

We’re also finding attractive opportunities in industrials focused on automation and electrification. In addition, the need for power and cooling technology for data centers presents compelling opportunities.

Innovation and scale support market leadership

We believe the current environment underscores the advantages of scale, innovation, and access to capital that define leading U.S. large-cap companies. Transformation driven by AI is expensive, requiring strong balance sheets and market leadership to fund the necessary investments and harness the data for effective applications. We believe companies lacking scale or investment capabilities risk falling behind and losing market share.

Overall, we believe environment for U.S. large-cap equities remains positive heading into 2026. Innovation leadership and entrepreneurial culture extend beyond technology into important areas like healthcare devices and diagnostics as well as biotechnology. The U.S. also has a flexible labor force that can be retrained for more productive roles and opportunities as some jobs are replaced by AI. The combination of capital investment, productivity gains, a resilient consumer, and broadening earnings growth provides a durable foundation for continued market leadership.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Return On Invested Capital (ROIC) is a measure of how effectively a company used the money invested in its operations.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility is the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.