Cautious optimism amid constructive dialogue

The mood at the October 2025 IMF and WB Annual Meetings was one of cautious optimism for EMs, which are increasingly standing out in a global economy marked by fragmentation, fiscal strains, and policy uncertainty. EMs are showing resilience – underpinned by stronger fundamentals, improved policy frameworks, and a more credible macroeconomic stance. Lifted by excess global liquidity, investors are long emerging market assets, with strong performance over the year to date.

Every six months finance ministers, central bank governors, sovereign debt managers, multilateral institutions, private investors, economists and policy experts convene to Washington DC to engage in both country-specific as well as thematic “big-picture” discussions. Country delegations from EM and frontier markets meet with IMF staff and investors to discuss their macroeconomic outlook, reform progress, and financing needs – highlighting both success stories and areas of concern.

While in Washington DC, Bent and Sorin (pictured) from Janus Henderson’s Emerging Markets Debt Hard Currency team participated in nearly 60 meetings. During our visit, geopolitical tensions appeared to ease. The Gaza ceasefire held, US-China trade tensions de-escalated and discussions around a reappropriation loan for Ukraine using frozen Russian assets gained traction. Argentina’s swap line with the US and signs of a potential regime change in Venezuela added to the sense of progress in Latin America. However, overall risks remain around slower growth, reignited inflation, still elevated geopolitical instability and fiscal deficits. Nevertheless, the shift in tone helped support investor sentiment and reinforced the cautious optimism surrounding EM assets.

Emerging markets: Ahead on growth and policy credibility

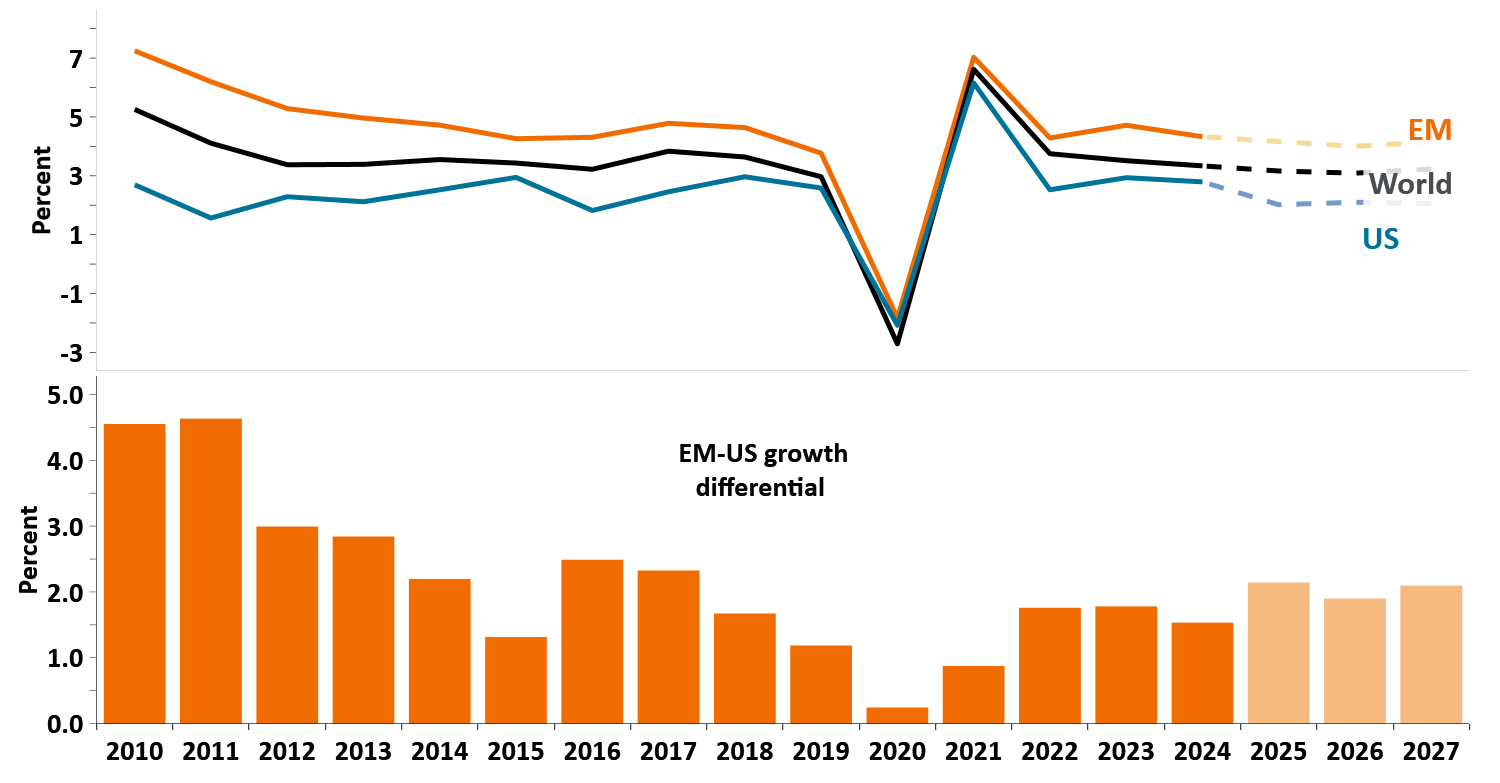

Source: Janus Henderson Investors and Macrobond, as at October 2025. IMF projections shared in the World Economic Outlook, GDP estimates, constant prices. 2025, 2026, 2027 are forecasts. There is no guarantee that past trends will continue, or forecasts will be realised.

The bifurcation between advanced (developed) and emerging economies was frequently cited. One of the most important areas to monitor is the real GDP growth differential between the two: this year and the next advanced economies are expected to grow at 1.6% (with the US overperforming yet again at 2%-2.1%), while EM economies are expected to stay slightly above 4% on average. The EM-US growth differential is a key determinant of the performance of EM hard currency spreads, which should provide a tailwind to EMD performance in the next year.

The IMF upgraded 2025 EM growth forecasts by 27 basis points on an EMBI-weighted level, especially for oil exporters (3.5%)[1]. EM growth has been supported by tariff-related export front-loading, especially to the US, and is benefiting from structural improvements in policy frameworks, digitalisation, and easier financial conditions on the back of a weaker dollar.

Over the past decade, many EMs have transitioned from reactive to proactive macroeconomic management. Central banks have bolstered their independence; macroprudential regulation and inflation targeting have become more widespread; and fiscal policies have become more countercyclical. A panel hosted by JP Morgan discussing the IMF’s World Economic Outlook research on EM resilience mentioned that 20 out of 22 EM central banks now have room to ease, with inflation ex-China and Turkey at its lowest since early 2021.[2]

Resilience to external shocks: A marked improvement

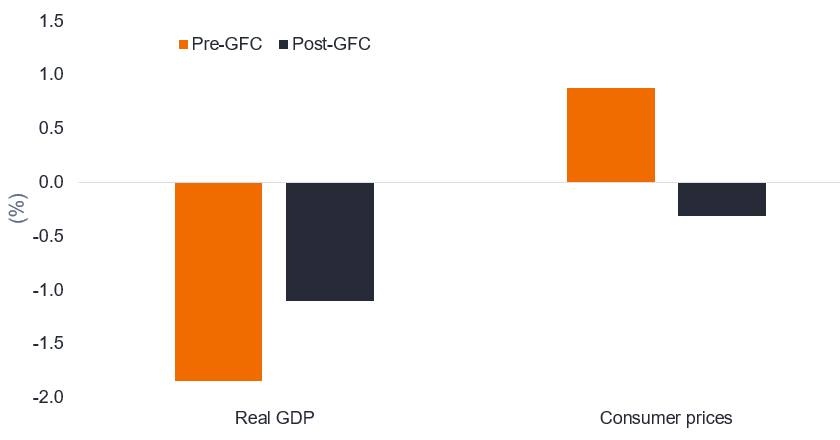

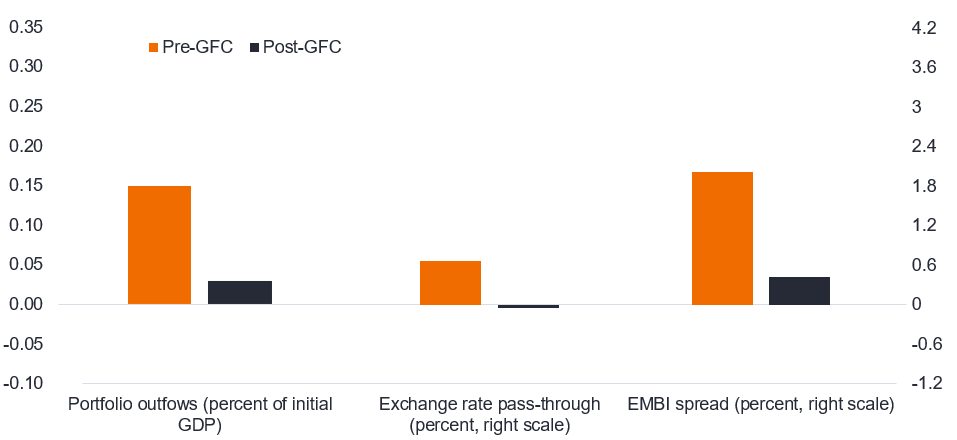

Given improving fundamentals, EMs have become significantly more resilient to external shocks than in previous cycles. Compared to the pre-GFC era, EMs now experience fewer capital outflows, more contained borrowing costs, steadier growth and lower inflation during risk-off episodes, while the increase in sovereign spreads is around one-fifth of pre-GFC moves. Post GFC, six months after a risk-off episode commences, EMs experienced a 1.0 percentage points drop in real GDP growth (compared to 1.8 percentage points pre-crisis), while the pre-crisis 0.9% price increase disappeared after the crisis.[3]

Effects of Risk-off shocks

Sources: Bloomberg Finance L.P.; Federal Reserve Board; Haver Analytics; J.P. Morgan; and IMF staff calculations, World Economic Outlook, October 2025. Note: The bars denote the change in variables six months after the start of risk-off episodes compared with similar time windows with no risk-off episodes. The specifications control for past real GDP growth, consumer price inflation, and country fixed effects. Risk-off episodes are identified using an extended version of the RORO Index of Chari, Dilts Stedman, and Lundblad (2023). The pre-GFC period is 1997–2009, and the post-GFC period is 2010–24. EMBI = J.P. Morgan Emerging Market Bond Index; GFC = global financial crisis; RORO Index = Risk-On Risk-Off Index.

However, the IMF cautions that this progress on improving EM fundamentals is uneven, and some EMs remain vulnerable due to weaker institutions, policy and limited fiscal buffers. Countries with robust frameworks are better positioned to absorb risk-off shocks, benefiting from easier policy trade-offs and reduced risk of capital outflows. Fiscal consolidation remains prevalent in EM, but with divergent prospects across countries.

Fundamentals matter for sentiment and flows

The management of sovereign debt sustainability in EM has been enhanced, current accounts are more balanced, and local currency bond markets are deeper and more resilient. In fact, the share of local currency debt in major EMs has risen from 79% to 88% over the past decade.[4] Investor flows into EM assets have resumed (~$25bn since May),[5] with EMD HC outperforming other fixed income classes so far this year. 2025 is on track to be a record year for EM gross issuance, many previously distressed credits have rebounded under IMF programmes (e.g.: Ghana, Zambia, Sri Lanka), and several single-B rated countries have been able to tap markets: Kyrgyzstan (with a debut Eurobond), Angola, Kenya, Egypt and Bahrain to name just a few.

Yet, sentiment remains selective, as higher-rated EMs enjoy strong market access. Investors are favouring countries with strong fundamentals and manageable debt profiles, while remaining wary of idiosyncratic risks. The IMF stresses the need for continued reforms, especially in countries where buffers have been eroded and institutional quality remains weak. This uneven progress, as we have discussed, shows the importance of investing selectively in the EMD space.

A window of opportunity

Emerging markets are not immune to global headwinds, but they are better equipped than in previous cycles to navigate them. The IMF meetings revealed a landscape where EMs are increasingly differentiated by the quality of their policy frameworks and the credibility of their institutions. For investors and policymakers alike, this is a window of opportunity – but one that demands vigilance, selectivity, and continued reform.

Romania in the Spotlight: Fallen Angel concerns put on hold

Romania, the highest-yielding EM investment grade (IG)-rated sovereign in our universe, attracted a lot of interest in DC, as investors tried to gauge the likelihood of the country retaining its BBB- rating (currently on negative outlook from all three ratings agencies). The EMD team at Janus Henderson held meetings with delegations from the country’s Ministry of Finance, Debt Management Office, National Bank, as well as the IMF’s Mission Chief and representatives from all three ratings agencies. The key insights were largely positive, as evidenced by the new World Economic Outlook projections which reflected the swift implementation of this year’s fiscal consolidation, with a massive revision of the 2026 fiscal deficit (5.8% of GDP vs 7.6% under the prior IMF projection).

Despite this significant fiscal drag, growth is expected to accelerate in 2026 as significant disbursements are expected from the EU’s Recovery and Resilience Facility (RRF), as well as pre-financing under the new SAFE (Security Action for Europe) programme which has a dual-use component that allows funding for major infrastructure projects like the highway connections with neighbouring Moldova and Ukraine.

Although the fiscal situation has stabilised, there are ongoing concerns regarding the stability and longevity of the current coalition, as well as the possibility of reform fatigue. Fortunately for Romania, the requirement to meet the RRF milestones before any payments are made serves as a catalyst for addressing longstanding structural issues. This, in turn, has the potential to yield fiscal savings beyond 2026 by driving public sector reform, enhancing state-owned enterprise (SOE) governance, and improving tax administration – reforms that might have been delayed otherwise. This should offer rating agencies sufficient justification to maintain their IG rating and potentially stabilise the outlook next year as implementation progresses.

Summary takeaways

- Cautious optimism prevails: Investor sentiment was broadly constructive, with optimism around EM assets despite tight valuations.

- EM growth prospects revised up: The IMF upgraded 2025 growth forecasts on the back of fewer tariff-related headwinds. EMs are expected to grow at double the rate of the US in 2025/2026.

- Fundamentals Have Improved: EMs have strengthened their macroeconomic frameworks. Central banks are more independent, inflation targeting is more widespread, and fiscal policies are more responsive to debt sustainability concerns.

- Varied progress across EMs: While some EMs have rebuilt buffers and credibility, others remain vulnerable. Some frontier markets show mixed progress in developing policy frameworks and managing their debt load.

- EM debt stabilisation Is uneven: Although EM debt levels are expected to flatten, over half of EM sovereigns are set to see debt rise in 20256. EM central banks are urged to maintain independence to anchor inflation expectations and avoid excessive FX interventions.

- Geopolitical and trade risks persist: While geopolitical tensions dissipated in some areas, EMs continue to navigate a fragmented global landscape marked by tariff-linked trade shifts, supply chain disruptions, and geopolitical uncertainty. These risks are shaping investor sentiment and policy priorities.

- Investor flows are returning – but selectively: EM dedicated bond inflows have resumed, marking a turnaround from prior outflows. However, investors remain selective, favouring countries with strong fundamentals and credible reform paths.

Footnotes

[1] Source: IMF forecasts as reported by Morgan Stanley, 22 October 2025.

[2] Source: JP Morgan on IMF panel on “Emerging Market Risk and Resilience”, 6 October 2025.

[3] Source: IMF World Economic Outlook, ~”Emerging Market Resilience: Good Luck or Good Policies?”, October 2025.

[4] Source: IMF panel on “Emerging Market Risk and Resilience”, National authorities, Bloomberg and IMF staff calculations, 6 October 2025. 2010 compared to 2024.

[5] Source: JP Morgan, “EM takeaways from the 2025 IMF/ World Bank Annual Meetings,”, 22 October.

The J.P. Morgan Emerging Markets Bond Index (EMBI) is a family of benchmark indices that tracks the performance of debt instruments issued by emerging market countries. It measures the total return of external debt instruments, which are typically dollar-denominated bonds issued by governments and corporations in developing countries.

The Risk-on Risk-off (RORO) index is a multifaceted measure designed to capture the realized variation in global investor risk appetite.

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Volatility measures risk using the dispersion of returns for a given investment.

Countercyclical refers to economic policies or measures that move in the opposite direction to the current state of the economy. These policies are designed to stabilize the economy by reducing fluctuations in economic growth.

Current account is a component of a country’s balance of payments that measures the flow of goods, services, and investments into and out of the country.

Excess global liquidity refers to a situation where there is an abundance of available financial capital in the global economy.

Eurobond is a type of international bond that is issued in a currency not native to the country where it is issued.

Financial conditions refer to the overall state of a financial system, encompassing aspects such as interest rates, credit availability, exchange rates, and market volatility.

Fiscal policy: Describes government policy relating to setting tax rates and spending levels. Fiscal policy is separate from monetary policy, which is typically set by a central bank. Fiscal drag refers to the process by which inflation and earnings growth cause taxpayers to move into higher income tax brackets. Fiscal buffers refer to the extra financial resources that governments set aside during periods of economic growth to be used in times of economic downturn or financial crisis. A fiscal deficit occurs when a government’s total expenditures exceed the revenue it generates, excluding money from borrowings. Fiscal deficits are funded through borrowing, which can lead to accumulation of public debt. Fiscal consolidation refers to the policies and strategies implemented by governments to reduce their budget deficits and accumulated debt. This process typically involves either increasing revenue through taxation and other means, or reducing government spending, or a combination of both.

FX intervention, or foreign exchange intervention, is a monetary policy tool used by central banks to influence the value of their national currency.

Global fragmentation refers to the process where international integration and cooperation are reduced, leading to a more divided and isolated world. This can occur in various domains such as economics, politics, and technology.

Gross issuance refers to the total amount of new securities issued by a government, corporation, or other entity within a specific period,

Idiosyncratic risks are factors that are specific to a particular company and have little or no correlation with market risk.

Inflation is the rate at which the prices of goods and services are rising in an economy. The consumer price index (CPI) and retail price index (RPI) are two common measures; the opposite of deflation.

Long position is when a security that is bought with the intention of holding over a long period in the expectation that it will rise in value.

Real GDP, or Real Gross Domestic Product, measures the total economic output of a country, adjusted for inflation.

Sovereign fundamentals refer to the key economic indicators and policy frameworks that determine the financial health and stability of a nation.

Swap line: In finance, a “swap line” refers to an arrangement between two central banks to exchange currencies, enabling a central bank to obtain foreign currency liquidity from the other central bank. This is typically done to provide financial stability and to ensure liquidity in foreign exchange markets.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.