The financial press has not been short of alarming headlines on leveraged loans in recent months. Elissa Johnson, Portfolio Manager within Janus Henderson’s specialist loans team headed by David Milward, clarifies some of the negativity in the messages from a European perspective…

The press commentary on leveraged loan markets in Europe and the US over the past few months has been notable. Given repeated warnings of complacency and risks that loans will cause the next financial crisis, one could be forgiven for thinking that the market was out of control.

However, we do not believe that this is the case. Reasonable risk-adjusted returns can still be found in the loan market for ‘credit selective’ investors, and the structure of the European loan market itself suggests that the historical lower realised volatility of the market, relative to other comparable asset classes, should continue through any cycle.

European leveraged loans are an ‘institutional only’ market and as such c.75% of the market participants enjoy either locked-up capital — the average legal maturity date for collateralised loan obligations (CLOs) is over ten years compared with an average loan maturity of seven years — or non-mark-to-market investments (banks do not need to mark-to-market performing loans). This provides lower levels of volatility in the market than those with daily traded funds as investors do not necessarily need to react to short-term corporate news flow (eg, 5-year average volatility in the European loans market is 2.0% and in the US 2.75%, while that of the European high yield market is 4.25%).

Recent reports have focused on the prevalence of cov-lite loans, excessive leverage and loose loan documentation in the European loan market. We discuss each in turn below.

Covenant lite (cov-lite) loans

Cov-lite is not in itself a problem for loan investing in our view. In 2006-07 all deals that came to the market had covenants — but that did not prevent significant price falls and defaults. Covenants do not turn a bad company into a good company; there have been many examples of borrowers with financial covenants, which have ultimately recovered very little for investors.

However, it does mean that credit selection is more important given that there is no support for investors if the company’s performance falls short of expectations set at the time of the deal.

For credits that default through the next cycle, we expect recovery to be lower than historical averages for the asset class given the absence of covenants. In practice, this means defaults will likely occur later in the company’s ‘period of weaker performance’, as there are less triggers for the event in the deal structure.

Standard & Poor’s (S&P) rating agency has suggested recovery prospects for European first lien loans1 are 58%, versus an historical average of 73% — ie, the actual recovery from defaulted loans was on average 73 pence for every pound invested by the lenders. Additionally, loan recovery prospects remain significantly above those for high yield bonds, at 58% for Europe and 64% in the US, reflecting the seniority of loans in the capital structure and their secured status.

Excessive leverage

Reports have focused on the prevalence of EBITDA2 adjustments to suggest real leverage in the market is significantly higher than reported leverage and hence the market is an accident waiting to happen.

EBITDA adjustments have always been a feature of the loan market. For example, if a company buys another company part way through the year, adding last year’s EBITDA of the acquired business to its own plus some diligent cost savings, to create a pro forma EBITDA figure, would seem reasonable. Our investment process has always involved the construction of our own base and stress case models to ensure we are looking at the real leverage and cash generation of the underlying business, rather than a heavily ‘pro forma’d’ (ie, expected or potential) number.

We assess both last twelve months (LTM) EBITDA and presented adjustments; cutting any that we feel are not justified or will take too long to be realised, after liaising with management to fully understand the impact of any cost reduction programmes. Clearly, if we believe leverage is too high based on our own assessment of EBITDA then we would not invest.

We also note that the mix of leveraged loans being underwritten is changing, with borrowers increasingly positioned in capex-lite sectors; meaning free cash flow conversion from earnings is typically higher and as such higher burdens of debt are affordable. For example, capex-lite business models such as technology businesses have grown from 1.1% to 11.3% of the European loan market, and services from 8.3% to 11.6%, over the past decade.

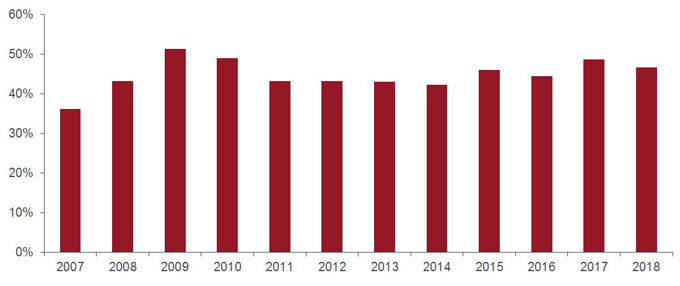

In addition, equity contributions for deals remain elevated at close to 50% suggesting a continued substantial cushion3 is available for first lien lenders, as shown in the chart, offering downside protection.

Chart: Average equity contributions for leveraged buyouts (LBOs)

[caption id=”attachment_75715″ align=”alignnone” width=”680″] Source: Citigroup Global Markets Limited, as at 31 December 2018 Note: Data on a 3-month rolling basis[/caption]

Source: Citigroup Global Markets Limited, as at 31 December 2018 Note: Data on a 3-month rolling basis[/caption]

Loose loan documentation

Our investment process also considers the loan documentation, which is bespoke to each deal. We have frequently not participated in deals where the documentation is too weak to provide adequate protection over the company’s cash flows and assets — in the last year we have requested material documentation changes on 24 deals and only participated in half of those that did amend their loan documentations. The overall participation rate for deals meeting our investment criteria over the past year has been 39%.

Conclusion

It is easy to write headlines, but as ever, the devil is in the detail. The loan market has seen strong demand, with investors being drawn to the attractive yields, low duration and downside protection offered by their senior secured position in the capital structure.

We continue to believe good risk-adjusted returns can be found in the European loan market. The changing mix of the European loans universe, the long-term nature of the investor base and bespoke investment analysis, mitigate the negative headlines we see. In our opinion, European loans look well placed to deliver sterling-hedged returns of c.5% and euro-hedged returns of c.4% in 2019.

Glossary:

First lien loan – a loan where the lender is the first to be paid when the borrower defaults, where property or assets were used as collateral for the debt

EBITDA – earnings before interest, taxes, depreciation and amortisation; in simple terms, a measure of a company’s profitability

Cushion behind senior debt – the average amount of equity contributed by private equity owners in a deal, which acts as a cushion behind debt in the capital structure and which gives investors some comfort as to how much value in the business could be lost before the loan debt is impaired

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.