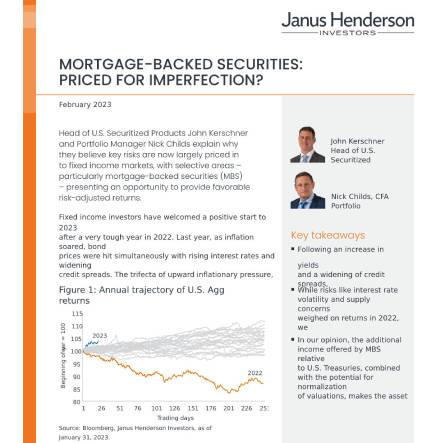

Fixed income investors have welcomed a positive start to 2023 after a very tough year in 2022. Last year, as inflation soared, bond prices were hit simultaneously with rising interest rates and widening credit spreads culminating in the Bloomberg U.S. Aggregate Bond Index (Agg) registering its worst year since 1999. As painful as this sharp drawdown was for investors’ portfolios, in our view, a lot of bad news is now priced in. While there is potential for more volatility, we believe there are opportunities in selective areas of fixed income.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.