Resilient returns

Widespread market volatility following the introduction of US “Liberation Day” tariffs saw noticeable spread widening across all fixed income sectors. CLOs, as credit products, displayed a similar initial reaction to overarching negative market sentiment.

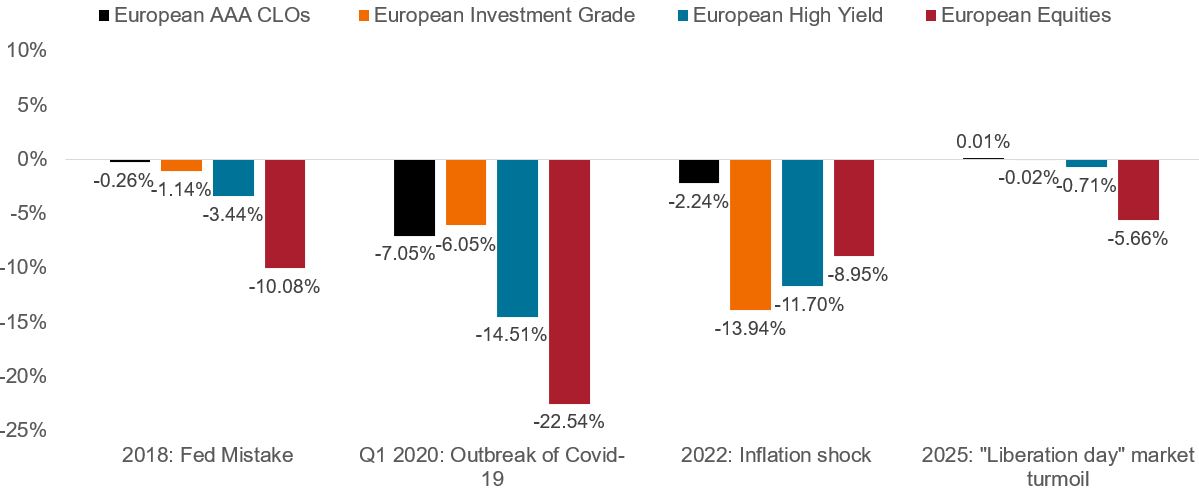

During challenging market environments, as seen in Figure 1, the drawdowns in European AAA CLOs have been shallower when compared to corporate credit and equities. This same trend has been evidenced during this latest period of volatility with European AAA CLOs delivering a flat total return of 0 basis points (bps), versus other European fixed income asset classes that saw drawdowns through April 2025 (from end of February).

Figure 1: Resilience in total returns delivered by European AAA CLOs

Source: Janus Henderson Investors, JP Morgan, Bloomberg. EUR returns. European AAA CLOs: JP Morgan European AAA CLO Index. European IG: ICE BofA Euro Corporate Bond Index. European High Yield: ICE BofA European Currency Non-Financial High Yield 2% Constrained Ind. European Equities: MSCI Europe.

Note: 2018 and 2022 periods correspond to calendar year returns. 2025 period refers to end of February to end of April performance. For illustrative purposes only. Past performance does not predict future returns.

Price declines through the volatility

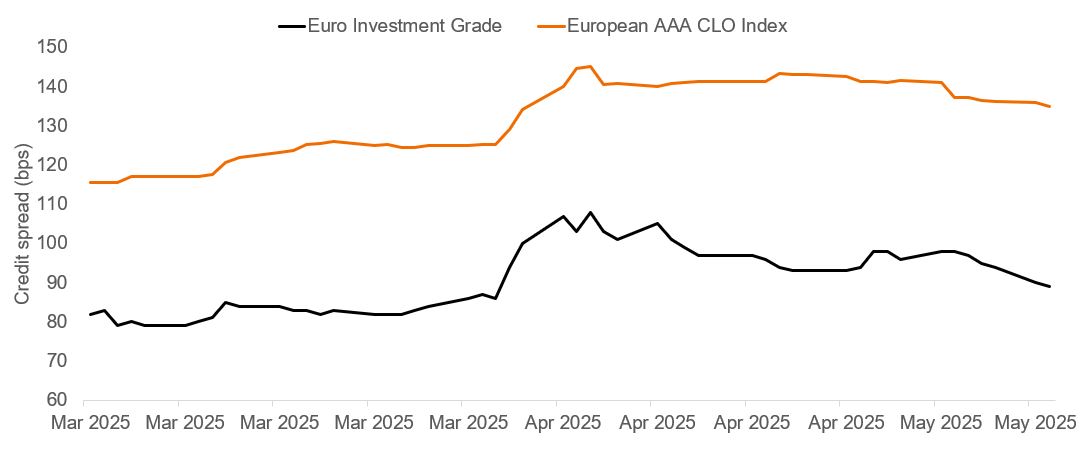

Prices weakened across markets during the volatility seen through April. The spread level on the JP Morgan Euro AAA CLO Index widened from 125bps at the start of April to a peak wide level of 145bps on April 9th and finished the month still wider at 141bps. Since April, spreads have tightened further over the month to date, which benefited performance in May[1]. AAA-rated CLOs have continued to show resilience, primarily buoyed by robust income levels, which helped mitigate the effects of price volatility during the market dislocation. High attractive income is essential for clients who are seeking fixed income portfolios that will perform well in both normal and challenging market conditions.

Figure 2 shows spread levels for the Euro AAA CLO Index and comparable corporate credit, evidencing the slightly smoother return profile of AAA CLOs during this period.

Figure 2: European AAA CLO spreads versus Euro Investment Grade spreads

Source: JP Morgan, ICE, Bloomberg, Janus Henderson. Spread levels from 3 March 2025 to 13 May 2025. Euro IG: ICE BofA Euro Corporate index. European AAA CLO: JP Morgan European Collateralised Loan Obligation AAA Index.

Less sensitivity to the spread moves

Amortising structures and the short-dated nature of AAA CLOs naturally lowers spread duration or the sensitivity of a bond to the movement in credit spreads. This contributed to relatively smaller price declines compared to other fixed income asset classes, as credit spreads widened. The absence of interest rate duration in CLOs helped stabilise returns, as sovereign bond markets have faced significant volatility since the beginning of the year. Factors such as lower income, longer spread duration, and increased spread volatility contributed to sharper drawdowns in the corporate bond markets.

Capturing relative value

Following the increases, spreads in European CLOs moved into the mid-percentile range (50th percentile) on a historical basis [2], with CLOs well positioned to offer attractive returns compared to broader fixed income markets. For investors, capturing attractive relative value becomes increasingly important in a falling interest rate environment, as credit spreads become an increasing component within the overall yield, supporting returns.

More attractive relative value emerging in AAA CLOs can also help prices to normalise following a period of volatility, as investors step in to purchase what remain as high-quality investments. After reaching the peak in April, AAA CLO spreads began to normalise. The Euro AAA CLO Index fell to 141 basis points by the end of April and further to 135 basis points by mid-May, retracing some of the weakness. During volatile periods, CLOs have typically retraced the downside within six to 12 months. Investors can benefit from such a price recovery and the high-quality floating rate income offered by European AAA CLOs, which aids fixed income portfolio diversification.

Active management can also help support performance, as price dispersion can clearly emerge during severe market instability between different AAA CLO deals. Credit selection, focusing on higher quality and more conservative CLO managers and deals, is a valuable approach to seek outperformance in the broader CLO market through difficult markets. This requires specialist expertise, and a thorough understanding of the underlying collateral, to identify relative value opportunities that can capture superior return potential while managing downside risk.

Footnotes

[1] Source: Janus Henderson Investors, JP Morgan, Bloomberg. EUR returns. European AAA CLOs: JP Morgan European AAA CLO Index, as at 13 May 2025.

[2] Source: Bloomberg, Janus Henderson Investors, as at 12 May 2025.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.