The election outcome therefore does not change already improving economic fundamentals for Costa Rica; rather, it makes the positive credit story more credible.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

What are the implications for risk appetite, emerging markets and geopolitics after Trump’s ousting of Venezuela’s Maduro?

Attractive yield and fundamental diversification makes emerging markets hard currency debt a compelling opportunity for 2026.

Lebanon’s reform hopes hinge on banking overhaul and Hezbollah disarmament. The IMF meetings gave some further perspective on these prospects ahead of the May elections.

China aims to focus on high-quality, innovation-led development to drive economic growth.

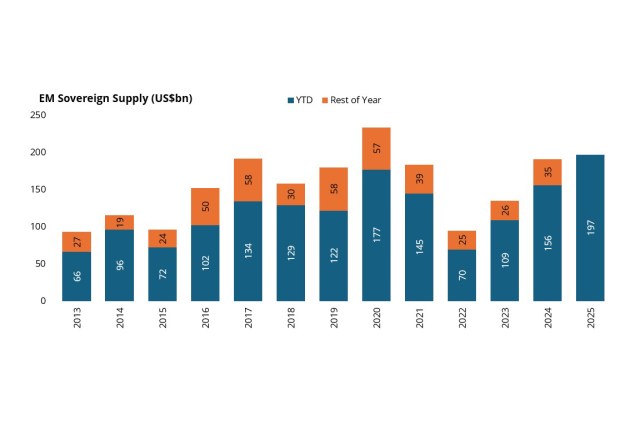

So far in 2025, EM sovereign supply hit record levels with a trend of issuing in non-dollar currencies seen. What are the benefits for issuers and investors?

What does President Javier Milei’s mid-term election victory mean for Argentina's credit trajectory?

How the US commitment to stabilising Argentina's economy signals that policy efforts by President Milei to maintain the country’s fiscal anchor are likely to continue.

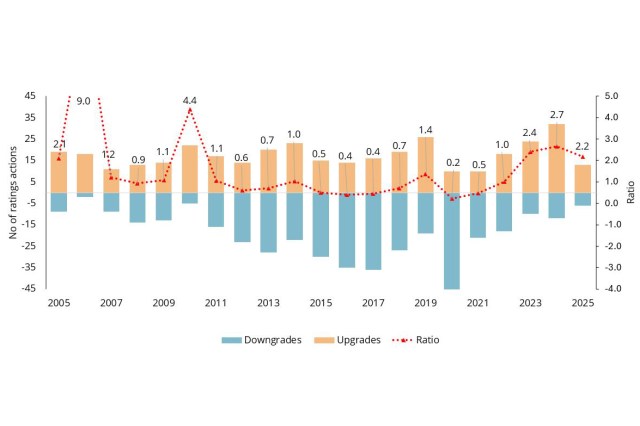

Improving EM fundamentals are driving sovereign credit rating upgrades, which have been more than double the number of downgrades so far in 2025.

How has Emerging Markets Debt (EMD) matured over the decades?

A trip to this year’s Computex trade show in Taipei reinforced our team’s bullish view on AI.