As 2025 beckons, investors may be contemplating how to best allocate their portfolios for the monetary, economic, and geopolitical landscape that the new year may bring. With over $7 trillion sitting in cash and money markets globally, it seems many investors remain in a “wait-and-see” mindset.

In our view, investors should position their portfolios to benefit under the majority of economic outcomes. Below we outline four potential scenarios for the U.S. economy and the prospective outlook for the three major asset classes under each scenario.

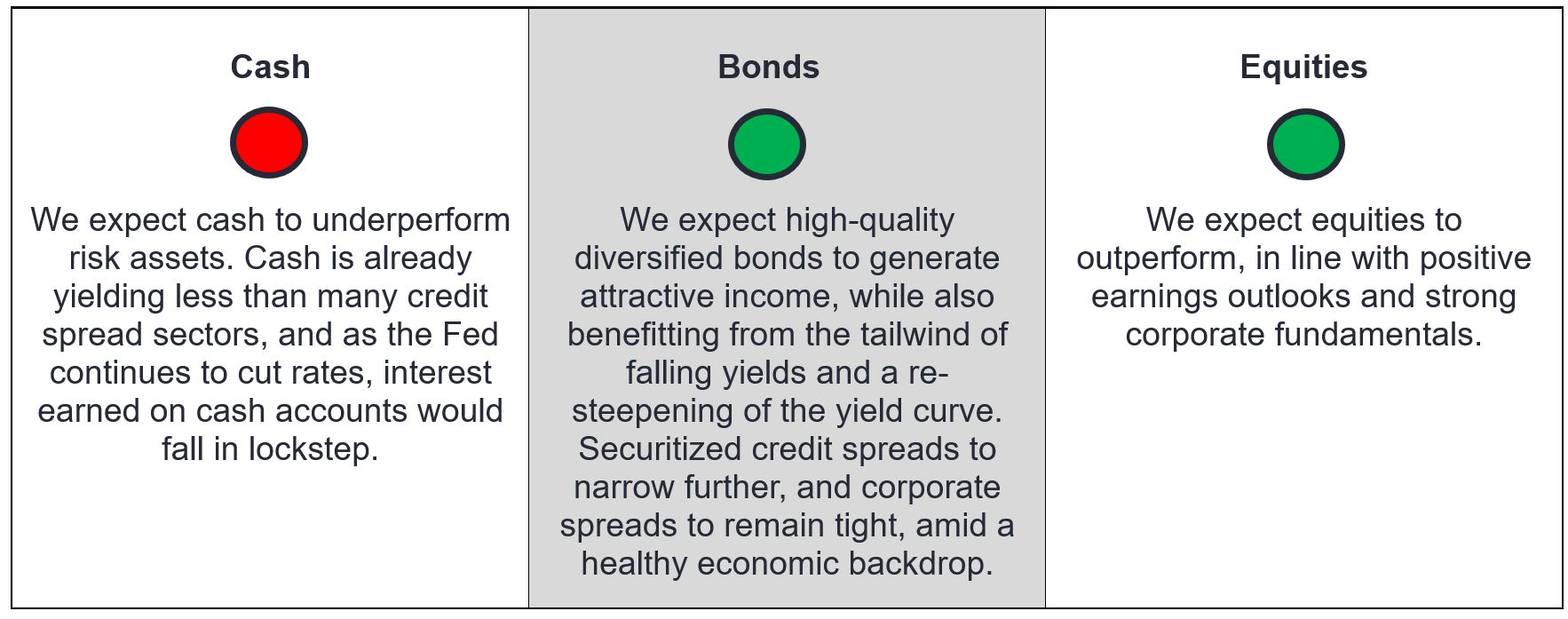

1. Soft-landing scenario

Key characteristics: Inflation continues its downward trend back to the Federal Reserve’s (Fed) 2% target, labor market tightness eases without a dramatic rise in the unemployment rate, and while economic growth begins to taper, the U.S. economy continues its growth trajectory.

Anticipated Fed response: We would expect the Fed to cut interest rates gradually as the economy and inflation continue to cool and the labor market comes back into balance. Expect the federal funds rate would be close to the Fed’s terminal – or neutral – rate within 18-24 months. (The terminal rate is a subjective rate the Fed considers to be neither restrictive nor accommodative for the economy, currently estimated to be around, or slightly above, 3%.)

Likelihood: We consider the soft landing our base case for the U.S. economy over the next twelve months.

Exhibit 1: Soft landing – Potential outlook for major asset classes

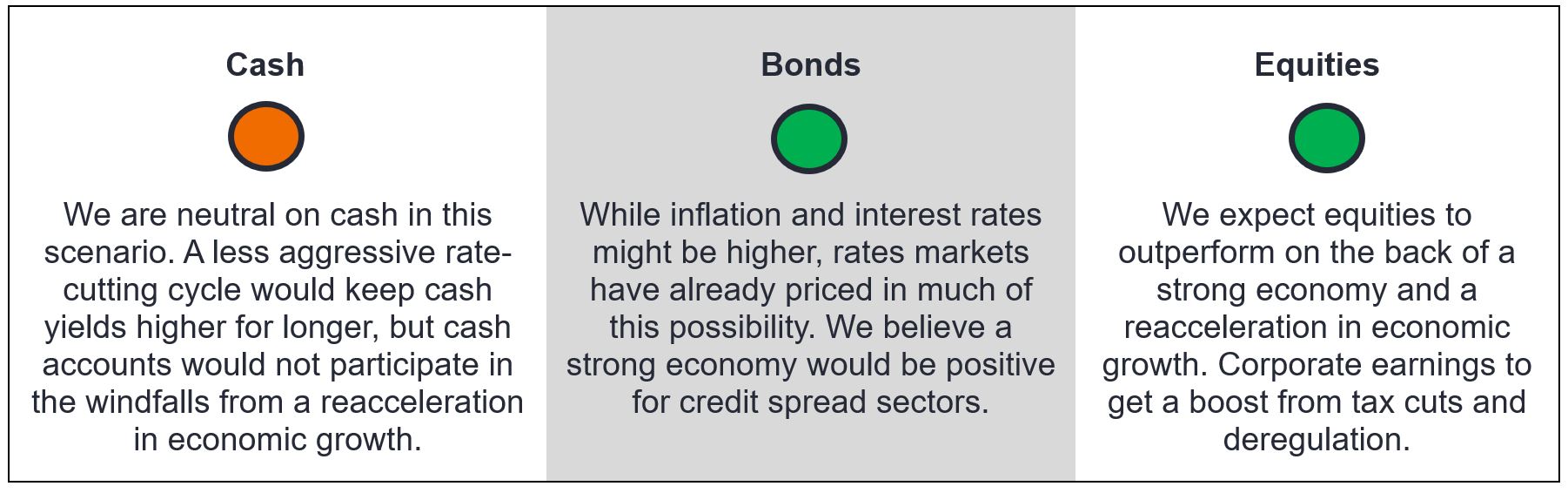

2. No-landing scenario

Key characteristics: The U.S. experiences no deceleration in economic growth, and the labor market stays tight. Inflation remains sticky above the Fed’s target and possibly begins to rise again.

Anticipated Fed response: Higher growth coupled with potentially higher inflation would hamstring the Fed from cutting rates as much as currently projected, thereby precipitating a higher-for-longer interest rate environment.

Likelihood: The incoming administration’s stated policies of lower taxes, deregulation, and tariffs on imported goods may lead to higher growth but also higher inflation. As a result, the likelihood of a no-landing scenario has increased.

Exhibit 2: No landing – Potential outlook for major asset classes

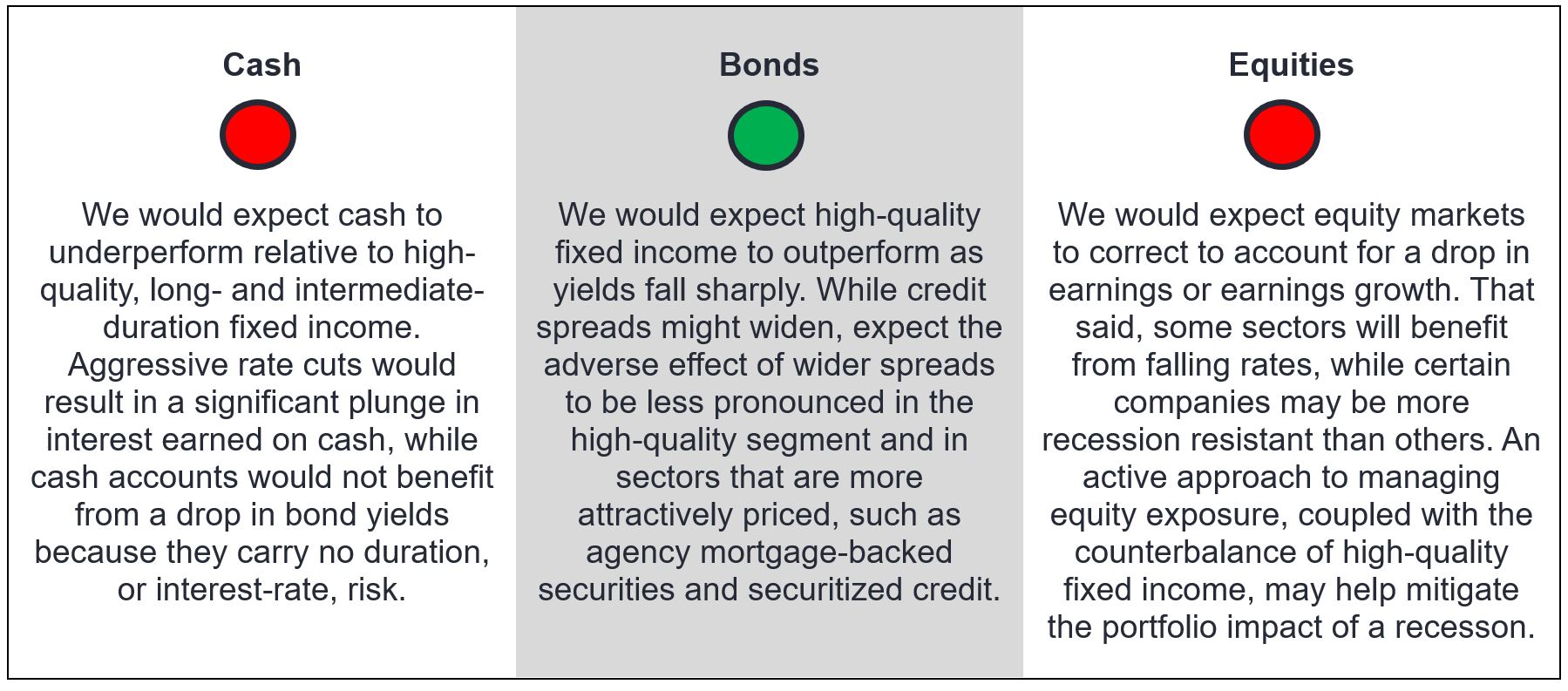

3. Hard-landing/recession scenario

Key characteristics: Economic growth and consumer spending slow dramatically. Corporates are forced to cut jobs, leading to a rise in unemployment and an exacerbation of the recessionary cycle.

Anticipated Fed response: Inflation is already close to the Fed’s target, and if the U.S. does enter a recession, we would expect inflation to fall further. Consequently, the central bank has the flexibility to focus on the full employment side of its dual mandate. Expect the Fed to cut rates aggressively to boost economic growth and employment.

Likelihood: In our view, a hard landing is unlikely. By most measures, U.S. corporates and households are in good shape. We do not see anything in the present data that suggest a recession is a highly probable outcome in 2025.

Exhibit 3: Hard landing – Potential outlook for major asset classes

4. Stagflation scenario: Rising inflation coupled with stalled economic growth

Key characteristics: Immigration reform squeezes labor supply and the labor market tightens up again, with a resultant increase in wage inflation. Rising prices and the lagged effects of higher interest rates slow consumer spending, while trade wars, tariffs, and geopolitical tensions further increase inflationary pressures. Economic growth stalls while inflation accelerates.

Anticipated Fed response: This scenario would be the trickiest situation for the Fed. The central bank would have to choose whether to tolerate higher unemployment or higher inflation. Expect the Fed to tiptoe through the political and monetary minefield, trying to strike a balance on rates.

Likelihood: Low. The U.S. economy is showing few signs of stress, and it is unlikely that the incoming administration’s policies would be implemented in a manner – or to the extent – that they result in stagflation. Markets and the Fed would conceivably look through a one-time upward price adjustment due to tariffs, while the scope and pace of implementation of new immigration policy would probably be lower than was touted on the campaign trail.

Exhibit 4: Stagflation – Potential outlook for major asset classes

結語

In our view, in the three scenarios we consider most likely for the U.S. economy (soft landing, hard landing, no landing) an actively managed portfolio of high-quality diversified fixed income and equities would outperform cash.

While a cash allocation might be beneficial in the unlikely scenario of stagflation, we think the diversification benefit of an allocation to high-quality fixed income outweighs any potential benefits of cash. In our view, investors should remain invested and implement a strategy that is poised to outperform in the majority of outcomes.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

存續期衡量債券價格對利率變動的敏感度。債券存續期越長,其對利率變動的敏感度就越高,反之亦然。

貨幣政策指央行旨在影響經濟體系通脹和增長水平的政策,當中包括控制利率和貨幣供應。

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

波動性是使用投資回報的離散度來衡量風險。

重要資料

Actively managed investment portfolios are subject to the risk that the investment strategies and research process employed may fail to produce the intended results. Accordingly, a portfolio may underperform its benchmark index or other investment products with similar investment objectives.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

固定收益證券受到利率、通脹、信貸和違約風險的影響。債券市場表現波動。隨著利率上升,債券價格通常會下跌,反之亦然。不保證可退還本金,如發行人未能及時還款或其信貸實力減弱,價格可能下跌。

多元化投資既不保證利潤,亦不會消除冒受投資虧損的風險。

Mortgage-backed security (MBS): A security which is secured (or ‘backed’) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages, similar to the coupon on bonds. Mortgage-backed securities may be more sensitive to interest rate changes. They are subject to ‘extension risk’, where borrowers extend the duration of their mortgages as interest rates rise, and ‘prepayment risk’, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

按揭及資產抵押證券等證券化產品對利率變化較為敏感,牽涉續期及提前還款風險,信貸、估值及流動性風險高於其他固定收益證券。

重要資料

請參閱以下與文章相關之基金的重要資料

主要投資風險:

- 本基金投資於股票,須承受證券價值波動的股本證券風險 。

- 本基金投資於債券及資產╱按揭抵押證券╱商業票據,須承受較高利率、信貸╱對手方,波動性、流動性、降級、估值及信貸評級風險,或會具較高波動性。

- 投資本基金涉及一般投資、人民幣貨幣及兌換、貨幣、對沖、經濟、政治、政策、外匯、流動性、稅務、法律、監管及證券融資交易相關風險。在極端的市場環境下,閣下可能會損失全部投資。

- 本基金可使用金融衍生工具作投資及有效管理投資組合目的,並涉及對手方、流動性、槓桿、波動性、估值、場外交易、信貸、貨幣、指數、交收違約及利率風險,本基金可能蒙受全部或重大損失。

- 本基金的投資集中於美國公司╱債券,或會具較高波動性。

- 本基金可酌情決定(i)從本基金的資本中支付股息,及╱或 (ii)從收益總額中支付股息,同時從本基金的資本中扣除所有或部份費用及開支,導致可供本基金支付股息的可分派收益增加,故本基金實際上可從資本中支付股息。此可能導致本基金的每股資產淨值即時減少,並相等於從投資者的原本投資或該原本投資應佔的任何資本增益中退回或提取部份款項。

- 投資者不應只根據此文件而作出投資決定,並應細閱有關基金銷售文件,了解風險因素資料。