展望2026年,我們對美國大型股保持樂觀。此觀點基於資本投資週期強勁推進、消費需求穩健,以及生產力日益普遍提升,而這些利好因素支持企業盈利增長。

儘管此環境帶來機遇,但要駕馭升幅高度集中與估值偏高的股市,投資者務須採取審慎篩選、靈活應變的策略。我們依然聚焦具備規模優勢、良好資產負債表,以及有能力投資可提升生產力的科技的企業。

資本投資帶動生產力提升

美國經濟正受惠於一場史無前例的資本支出熱潮。AI是主要驅動因素,科技基礎設施開支目前已佔美國實質GDP增長的重大比重。用戶對雲端服務及數據中心運算能力的殷切需求未見減慢跡象。

然而,資本支出的影響不止於科技領域。美國近期容許投資即時折舊的稅務政策,正在為推動市場形成更廣泛的開支週期注入動力。本輪廣泛的資本投資推動了生產力提升,有望為未來經濟增長提供支持。

向更高效率轉型的趨勢日漸明顯。愈來愈多企業以實例證明AI應用帶來的實質生產力提升。過去兩個業績季展現出令人印象深刻的營運槓桿效應,企業在控制開支的同時,又實現了強勁收入增長。這意味著,雖然面臨成本壓力,企業的投資仍開始獲得回報,使到利潤率及盈利有所提高。

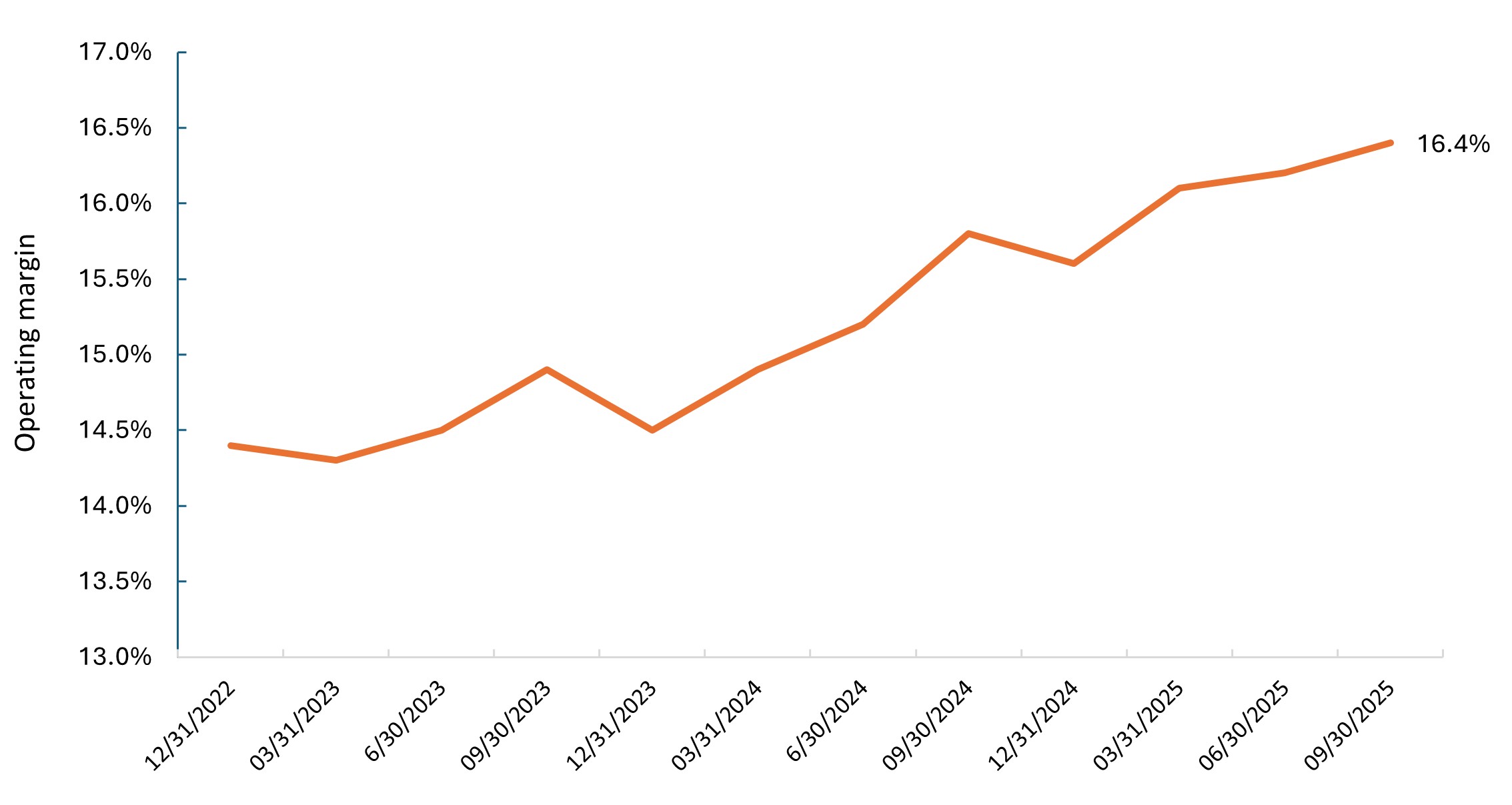

圖1:標普500®指數營運利潤率(能源板塊除外)

剔除波動劇烈的能源板塊,市場受惠於過去兩年來持續的利潤率改善。漲幅主要來自通訊服務、資訊科技及金融等板塊,這些板塊的企業最擅長運用科技來改善營運。

資料來源:彭博行業研究,截至2025年11月14日。

消費開支保持韌性

縱使勞動人口增長有所放緩,我們依然對消費開支持樂觀看法。工資增長率約為4.5%,持續高於疫情前水平,為消費開支提供支持。消費者財務實力強勁,債務償還佔可支配收入的比重處於歷史正常範圍內,信貸拖欠率亦維持低水平。

然而,我們認識到消費開支模式持續轉變,部分經濟領域將會收縮,而其他領域則會擴張。我們分析信用卡數據時發現,整體消費開支強勁,但部分類別表現平平,例如受通脹及就業增長放緩影響較大的行業。現時,消費者傾向偏好體驗式消費而非購物,旅遊需求尤其旺盛。

我們認為,2026年美國消費者開支有望因近期稅制改革而獲得額外動力,預計改革將在報稅季度帶來更高的退稅額。受惠於樓價及股市走高的高收入家庭消費開支最為強勁,而整體形勢仍然向好。

市場集中度反映盈利領先的企業

美國股市集中度處於近年所未見的水平,但當我們審視最大市值企業的盈利增長和可持續性時,此現象毫不令人意外,畢竟它們引領著科技轉型。

考慮到AI基礎設施對經濟的重要性,我們正在密切關注相關企業能否實現合理回報、順利交付積壓訂單,並創造能支持持續投資的收入。倘若AI投資週期進入平穩期,且盈利軌跡發生變化,投資者必須作出調整的準備。

我們認為,儘管AI基礎設施主題股的估值倍數已經擴大,但用戶需求增長持續超出預期,因此盈利增長暫時仍可支持估值倍數。話雖如此,因時制宜是目前合適的策略。投資者須投入大量時間評估企業的資產負債表、現金流量表,及業務可持續性指標,以確保基本因素能合理支撐相關個股的市場權重。

客觀看待估值

我們承認,股市整體估值倍數處於高位,但當考慮到背景因素時,便可更清晰了解這個現象。首先,市場構成已發生徹底轉變。在主要股票指數中,增長最快、投資資本回報率(ROIC)最高的板塊的權重顯著增加。

此外,強勁盈利為現時的估值水平提供了支持。美股第二季盈利平均增長超過12%,預期2026年仍可維持近似水平。有別於2000年科網泡沫時期,當前的估值擴張伴隨著盈利能力溢價的擴大。在長期增長的行業中,我們仍可發現為數眾多的優質企業,其估值處於或低於歷史平均水平。

何處能覓得良機

在AI主題中,我們既關注科技推動者,亦留意科技採用者。科技推動者包括半導體、雲端及軟件公司,以及開發AI和自動化解決方案的企業平台。 科技採用者則涵蓋各行各業中致力應用並大力投資AI這項新科技的公司。

令人鼓舞的是,強勁的盈利增長勢頭已擴展至AI及科技以外領域的企業。商用航空、資本市場、醫療科技,以及旅遊企業均錄得亮眼業績。這種普遍現象表明,企業處於健康經營狀況的現象,較某些市場人士的看法更為廣泛。

金融服務業方面,受惠於併購活動及首次公開招股數量增加,投資銀行業務收入增長逾50%。我們認為資本市場活動將於未來數年保持強勢,因為AI資本支出投資週期持續獲得融資,投資銀行、評級機構及交易所或會因此受惠。此外,隨著消費支出保持強勁勢頭,數碼支付公司的年度盈利增長率保持在15%。

我們還在專注自動化及電氣化的工業股中物色具吸引力的機遇。此外,數據中心對電力及冷卻技術的需求,也帶來良機。

創新與規模支撐市場領先地位

我們相信,當前環境突顯美國大型企業所具備的規模、創新能力,以及融資渠道優勢。AI驅動的轉型成本高昂,需要強勁的資產負債表和企業的市場領導地位,以為必要投資提供資金,並利用數據開發有效應用程式。我們認為,缺乏規模或投資能力的企業唯恐面臨落後他人和市佔率流失的風險。

總括而言,我們認為踏入2026年,美國大型股的環境依然理想。創新科技的領導地位及創業文化跳出科技行業,擴展至醫療器械、診斷以及生物科技等重要領域。美國還擁有靈活應變的勞工,當部分崗位被AI取代,他們可通過接受再培訓轉向更具生產力的職位,並積極把握新機遇。資本投資、生產力提升、保持韌性的消費者,以及盈利增長現象持續擴展至更多行業,共同為美國大型股穩守市場領導地位構築穩固的基礎。

倘若英文版本與中文版出現歧異,概以英文版為準。

重要資料

主動型管理的投資組合或無法產生預期的結果。沒有任何投資策略可確保實現利潤或消除虧損的風險。

專注於人工智能(「AI」)的公司可能面臨產品迅速過時、激烈的競爭和更嚴格的監管審查,當中某些開發或使用AI。這些公司往往高度倚賴知識產權,在研發方面投入巨額資金,並依賴維持和拓展消費者需求。相比提供更成熟技術的公司,這些公司的證券或會更加波動,且可能因為在業務營運中使用AI而受到相關風險的影響,包括法律責任或聲譽損害。

倘若英文版本與中文版出現歧異,概以英文版為準。

股票證券面對市場風險等各類風險。回報將視乎發行人、政治和經濟形勢而波動。

金融產業可能受到廣泛政府監管的重大影響,而隨著不同服務類別的界線日益模糊,未來或會出現相對較快的改變,亦可能受到資本資金供應和成本、利率變動、企業及消費者債務違約的比率,以及價格競爭的重大影響。

增長股承受較大的虧損風險和價格波幅,亦未必達到期望的增長潛力。

健康護理產業受制於政府監管和報銷率以及當局對產品和服務的審批,這些因素可能對價格和供應造成重大影響,亦可能受到迅速過時和專利到期的重大影響。

市盈率(P/E)用於衡量投資組合內一隻或多隻股票的股價與每股盈利之比率。

投資資本回報率(ROIC)衡量企業運用投入營運中資金的效率。

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

波幅 / 波動性是指投資組合、證券或指數價格升跌的速度和幅度。倘若價格大幅上下擺動,表明其波動性高。倘若價格變動更為緩慢且幅度更小,表明其波動性較低。波動性較高意味著投資風險較高。

重要資料

請參閱以下與文章相關之基金的重要資料

主要投資風險:

- 本基金投資於股票,須承受證券價值波動的股本證券風險 。

- 本基金投資於債券及資產╱按揭抵押證券╱商業票據,須承受較高利率、信貸╱對手方,波動性、流動性、降級、估值及信貸評級風險,或會具較高波動性。

- 投資本基金涉及一般投資、人民幣貨幣及兌換、貨幣、對沖、經濟、政治、政策、外匯、流動性、稅務、法律、監管及證券融資交易相關風險。在極端的市場環境下,閣下可能會損失全部投資。

- 本基金可使用金融衍生工具作投資及有效管理投資組合目的,並涉及對手方、流動性、槓桿、波動性、估值、場外交易、信貸、貨幣、指數、交收違約及利率風險,本基金可能蒙受全部或重大損失。

- 本基金的投資集中於美國公司╱債券,或會具較高波動性。

- 本基金可酌情決定(i)從本基金的資本中支付股息,及╱或 (ii)從收益總額中支付股息,同時從本基金的資本中扣除所有或部份費用及開支,導致可供本基金支付股息的可分派收益增加,故本基金實際上可從資本中支付股息。此可能導致本基金的每股資產淨值即時減少,並相等於從投資者的原本投資或該原本投資應佔的任何資本增益中退回或提取部份款項。

- 投資者不應只根據此文件而作出投資決定,並應細閱有關基金銷售文件,了解風險因素資料。