Why active management, fundamental research, and selectivity across sectors are key to identifying opportunities while managing volatility in fixed income.

Insights

While options markets indicate a relatively sanguine 2026 for equities, investors should take note of a potentially worrisome absence of systemic risk.

BBB CLOs combine income, structural resilience and diversification benefits, offering an alternative way to reshape credit exposure for a late‑cycle environment of tight credit spreads.

Victory Park Capital discuss the opportunities and risks in this dynamic area of private credit.

Investors need a new playbook for a period of potentially significant geopolitical and economic change

Jonathan Coleman explores key drivers that could support U.S. small-cap performance in 2026, including reshoring trends, M&A activity, and AI productivity gains.

In their 2026 outlook, Lucas Klein and Marc Pinto discuss how AI and structural reforms, especially in Europe, present opportunities for selective investors.

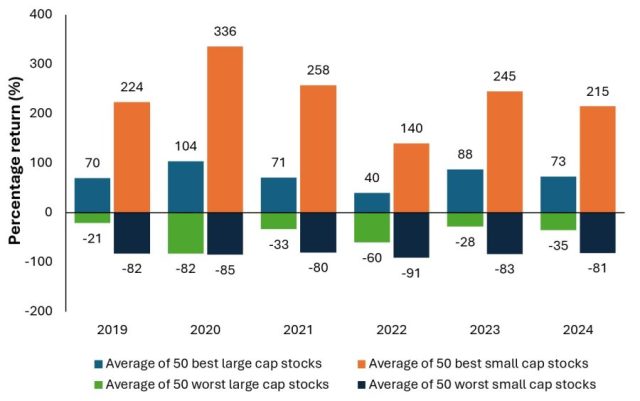

From underdogs to potential frontrunners: are small caps ready for a resurgence in 2026?

Alex Veroude explains why the credit cycle in fixed income still has further to run in 2026, but investors should build some resilience into their portfolios.

Private credit is expanding rapidly – and asset-backed finance (ABF) is leading its next phase. In 2026, we believe the winners will be defined by transparency, data precision, and disciplined execution.

While big tech is making headlines in the US, small caps benefit from much high pricing dispersion and market inefficiencies. Is this the area where active managers can shine?