Discussion on value opportunities in credit, collateralised loan obligations and mortgages, and why really understanding each credit will be pivotal in 2026.

Insights

As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

Amid global uncertainty and shifting credit conditions, we explore how innovation, attractive valuations, and deep research make small caps a compelling choice.

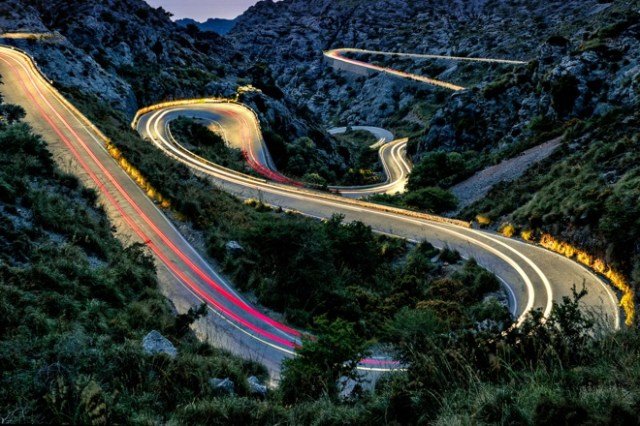

At JHI's recent Madrid Investment Summit, Ali spoke with Jeremiah Buckley and Luke Newman about where they are finding the most compelling opportunities within equities.

Conversations with clients on fixed income at JHI's Madrid Investment Summit.

At the Janus Henderson London Investment Conference, experts discussed the implementation of 2025’s new political environment on portfolios and highlighted strategies to help position for a brighter investment future.

Janus Henderson’s ‘Partnerships for a Brighter Future’ event in New York discussed AI and bionic enhancements that can support human resilience.

Ali Dibadj, CEO, speaks with Janus Henderson’s experts about shifting market dynamics and the growing demand for active management.

An update on the three macro drivers we believe will shape markets in the second half of 2025.

The material costs of frittering away the U.S. dollar’s reserve currency status must be considered in any trade rebalancing.