A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

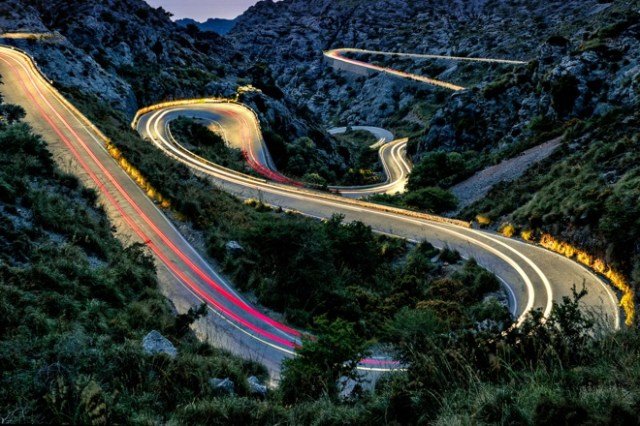

At JHI's recent Madrid Investment Summit, Ali spoke with Jeremiah Buckley and Luke Newman about where they are finding the most compelling opportunities within equities.

An update on the three macro drivers we believe will shape markets in the second half of 2025.

What do current market dynamics mean for asset allocation? The Market GPS Multi-Asset Quarterly highlights key drivers and positioning.

With Trump's tariffs reshaping global trade, our portfolio managers share insights on the longer-term implications for financial markets.

Why the U.S. economy has a chance at avoiding recession. Plus, the opportunity we’re seeing in secular growth businesses.

The material costs of frittering away the U.S. dollar’s reserve currency status must be considered in any trade rebalancing.

Can diversification help investors to ride out the uncertainty as US tariffs reshape global trade dynamics?