The next few years are shaping up to be a period of remarkable economic transformation. The potential for historic productivity gains unleashed by the forces of artificial intelligence (AI) and structural reform in Europe will invariably reverberate across global equity markets. We believe investors should not underestimate the magnitude of these themes and should seek to understand how to optimally position equity allocations during this era of nearly unprecedented disruption.

The promise of AI and European reform is nothing new to investors, as each has contributed to the market rally that has defined most of 2025. The recent succession of record highs, however, has resulted in earnings multiples residing well above average levels. Within this context, any discussion of these themes must incorporate the question of valuations.

For AI, this centers on whether hyperscaler stocks have entered bubble territory. For Europe, one can ask how much of 2025’s impressive gains were attributable to past deep discounts attracting value-oriented investors. While valuations matter, we believe investors should remain cognizant that long-term stock returns are primarily driven by fundamentals – namely, a company’s ability to consistently grow earnings – rather than multiple expansion.

Using this standard, we believe that expectations for AI and European growth are well founded. Each of these themes, in our view, represents the type of sea change that can propel economic growth to a higher trajectory, expand corporate margins, and compound earnings over an extended period.

On the precipice of history

Parallels are often drawn between AI and the advent of the Internet 30 years ago. While the digitization of the global economy has resulted in myriad efficiencies – and entirely new industries – we view AI as even more revolutionary. A more apt comparison, in our view, is the introduction of the steam engine and railroads during the Industrial Revolution. Such periods of sweeping change have the potential to expand the global economy by up to 3.0%, annually. Based on 2024 data, this could be a roughly $2.8 trillion lift.1

Despite the succession of headlines over the past three years, the world economy is only starting to register the value add attributable to AI. This is occurring across sectors, from technology and healthcare to consumer and industrial applications. Importantly, the vast deployment of AI capacity is already resulting in monetization for the hyperscalers that are enabling this change.

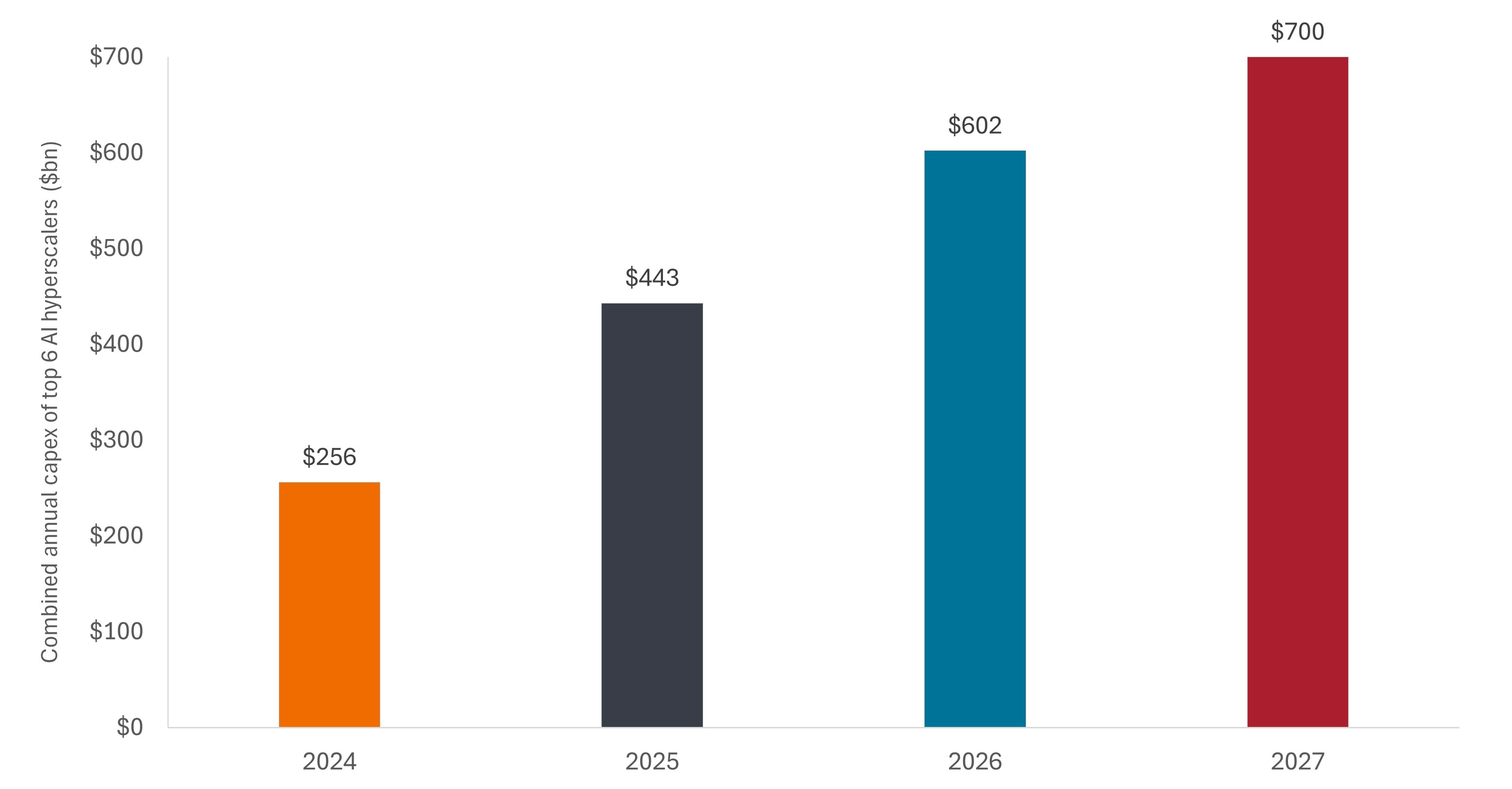

At an estimated $600 billion in 2026 and possibly $700 billion in 2027, the investment tech companies are allocating to AI infrastructure understandably invites scrutiny. Hyperscaler management teams don’t view this expenditure as a choice but rather a matter of survival. While there is likely room for more than one company to claim victory in the race toward artificial general intelligence, laggards could face an existential crisis. The AI data center buildout stands in stark contrast to the problem of excess capacity that plagued broadband providers a generation ago. Industrial users, along with sovereign buyers, are fighting to procure access to AI models, and every graphics processing unit rolling off the assembly line has been met with a long queue of eager customers.

Exhibit 1: Annual AI infrastructure capital expenditure

The leading U.S. hyperscalers are on track to more than double their investments in AI infrastructure by next year, based on 2024 levels. While that pace may eventually slow, demand for computing capacity has often exceeded expectations.

Source: Janus Henderson Investors, company data, as reported in third-quarter earnings calls. 2025-2027 data are estimates. No forecasts can be guaranteed.

The AI rollout is unfolding quickly, and we soon expect a handoff to commence between the enablers that are deploying capacity and the enhancers – often software companies that effectively integrate AI into their product suite – and finally end users. As was the case with the Internet, the latter category could ultimately benefit most from the adoption of this new technology as it disperses throughout the global economy.

The revolution has arrived

Evidence of AI’s ability to expand margins and raise profitability can already be seen in the tech sector, which is not only the vehicle for AI deployment but also its early adopter. The sector’s historically healthier operating margins have widened at a much faster pace than have those of other sectors. As AI’s efficiencies are diffused across the economy, it could accelerate the underappreciated trend of operating margins across U.S. companies expanding by over 400 basis points (bps) since 1991.2

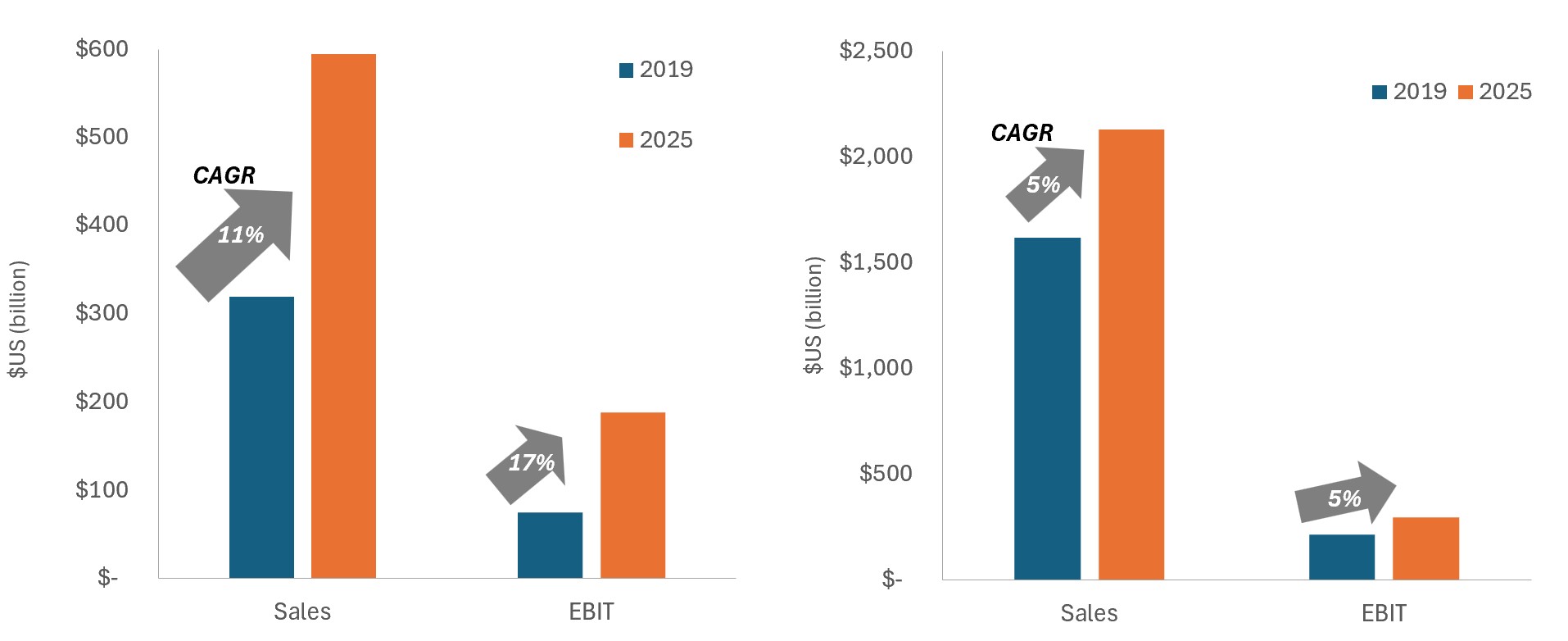

Exhibit 2: U.S. tech and non-tech profitability

While tech sector revenues have far outpaced those of non-tech stocks, operating profits have expanded even more rapidly, with tech margins climbing from 23.4% in 2019 to nearly 28% by the end of 2025.

Source: Bloomberg, Janus Henderson Investors; data as of 31 October 2025. 2025 figures are estimates. Note: EBIT=earnings before interest and taxes. CAGR=compound annual growth rate. No forecasts can be guaranteed.

Putting valuations in perspective

Margin expansion tends to lead to faster earnings growth. We believe the market may actually be underestimating the degree to which earnings can compound once one factors in AI’s impact on revenues. Should higher-than-anticipated growth rates materialize, current earnings multiples would appear more justified. Furthermore, valuations remain an order of magnitude lower than they were at the height of the dot-com frenzy – and this for businesses that are already monetizing their investment and delivering attractive returns on equity.

Europe’s overdue economic renaissance?

Another potential tailwind for global equities in 2026 is a European reform agenda that prioritizes growth. Among the confluence of forces that has heightened the sense of urgency are domestic developments – namely, demographics and local political pressures – and geopolitics causing policymakers to prioritize defense spending. The combination of structural reform and fiscal stimulus has the potential to unlock up to 20% of gross domestic product in idle capital that could then flow to the most productive uses.3

Freeing capital

Economists have long highlighted the European Union’s (EU’s) regulatory regime as a contributor to the region’s flagging growth. Faced with demographic challenges and the risk of falling behind more dynamic economies, perspectives are evolving, as delineated in Mario Draghi’s 2024 report on the subject.

A key potential reform is the Savings and Investment Union. This initiative seeks to more effectively channel the EU’s ample household savings toward the most attractive investments. One component of this is fortifying the region’s capital markets, thus lowering its dependence on traditional bank financing (roughly 75% of lending activity). These changes could benefit savers and small businesses, improve economic competitiveness, and provide liquidity and depth to capital markets. Another initiative seeks to reinvigorate the EU’s securitization market, expanding options for both borrowers and investors.

Putting the era of austerity to bed

One catalyst in officials’ newfound openness to increase fiscal stimulus is the war in Ukraine. Given the amount of materiel already consumed and steady rhetoric from Washington, Europe’s NATO members are coalescing around the goal of increasing defense spending to 5% of GDP. Revamping the continent’s defense industry, in our view, could lead to a defense dividend that could potentially reach adjacent industries. Security concerns would also require improving the resilience of critical infrastructure, including cybersecurity, energy, and the transportation network.

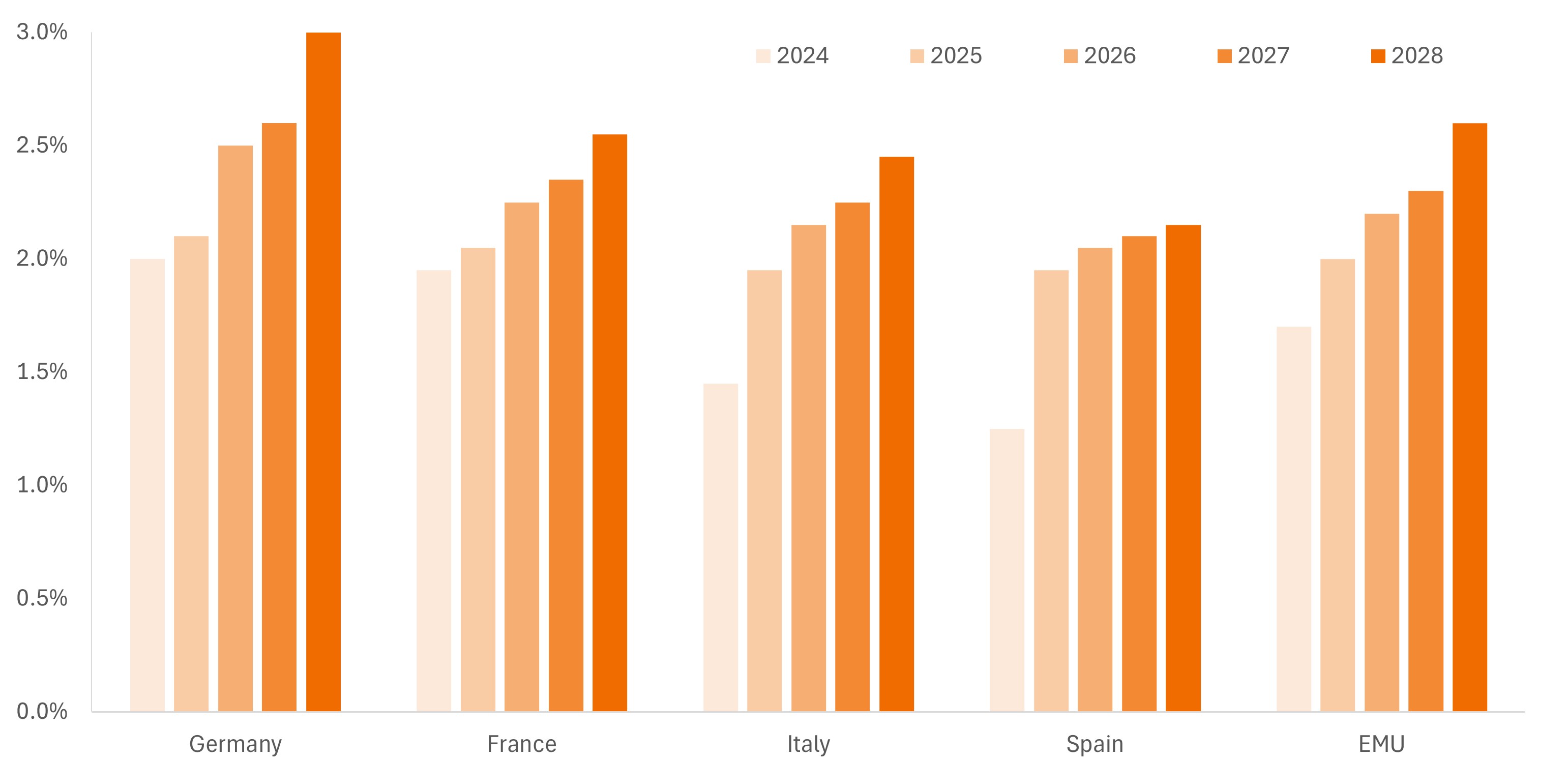

Exhibit 3: Projected European Defense expenditure as a percentage of GDP

Geopolitical pressures are compelling European NATO members to raise their defense commitments, potentially reaching 5% of GDP by 2035.

Source: Goldman Sachs, as of 17 November 2025.

Perhaps the best example of this strategic shift is Germany contemplating loosening its restrictive debt brake – an artifice from the region’s debt crisis over 15 years ago. Such reform could allow Europe’s industrial powerhouse to nearly double defense-related expenditure.

AI: Not just a U.S. story

Although a reform agenda would seek to improve the EU’s competitiveness in sectors in which the bloc has lagged – namely technology – investors should not overlook that many of the region’s leading companies already have exposure to the AI theme. Among these are world-beating semiconductor capital equipment makers, electrical component manufacturers, and the grid operators that will help power the AI revolution.

As AI models advance, thus allowing end users to participate in value creation, innovative European companies across sectors could be poised to generate wider margins and higher earnings. The degree to which these companies already participate in AI and other secular-growth themes is a reminder that Europe is home to many world-class, innovative enterprises.

Maintaining a long-term view

A strong 2025 rally reveals that these themes are no secret. But with respect to AI, with every new advancement in technology, the market tends to overestimate near-term earnings growth but vastly underestimate earnings over a 10-year horizon. We would argue the same logic stands for the structural shifts that may unfold in Europe. Furthermore, tech valuations lie well beneath their dot-com peaks and – importantly – AI-related margin improvement and monetization are already occurring.

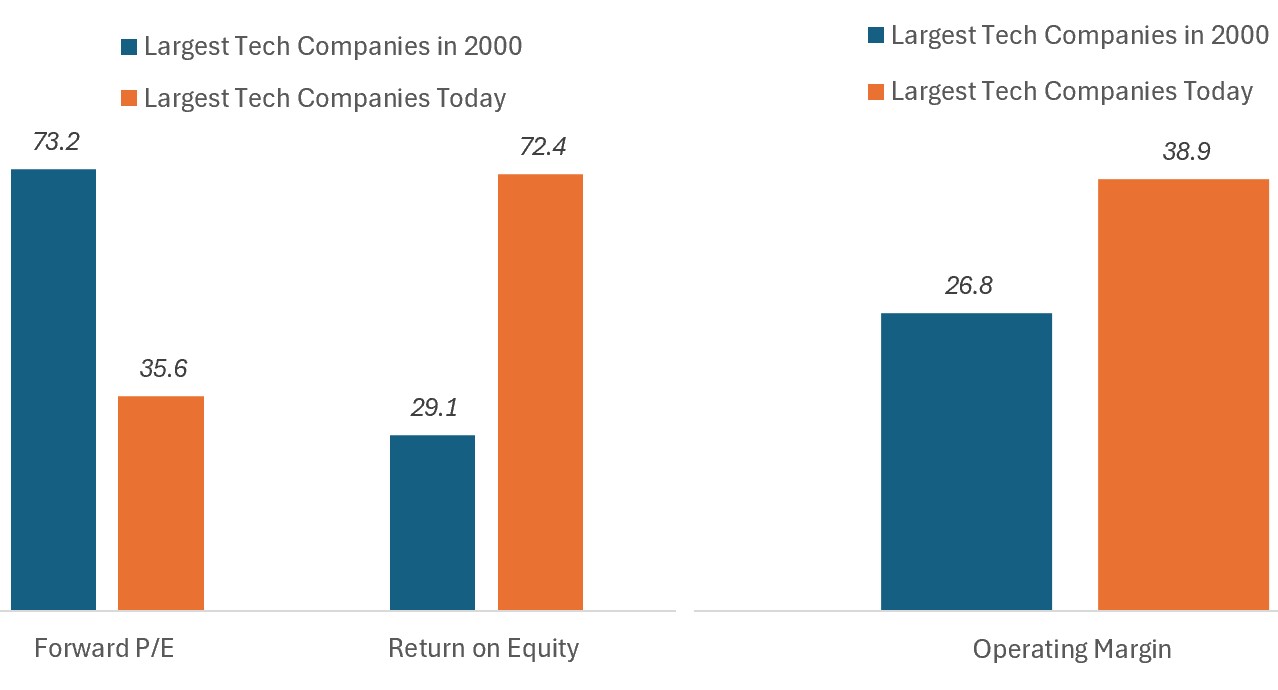

Exhibit 4: How current tech leaders compare to the dot-com era

In stark contrast to the dot-com era, today’s leading tech companies are both more profitable and trade at much more modest valuations.

Source: FactSet, Janus Henderson Investors, as of 24 October 2025. Largest tech companies = 10 largest tech and internet firms in the U.S.

As for Europe, an early-year expansion of earnings multiples hinted at growing investor enthusiasm. We believe the next leg of a European rally will be more substantive, as the earnings growth that ultimately determines stock performance could reset set to a higher trajectory than investors have come to expect.

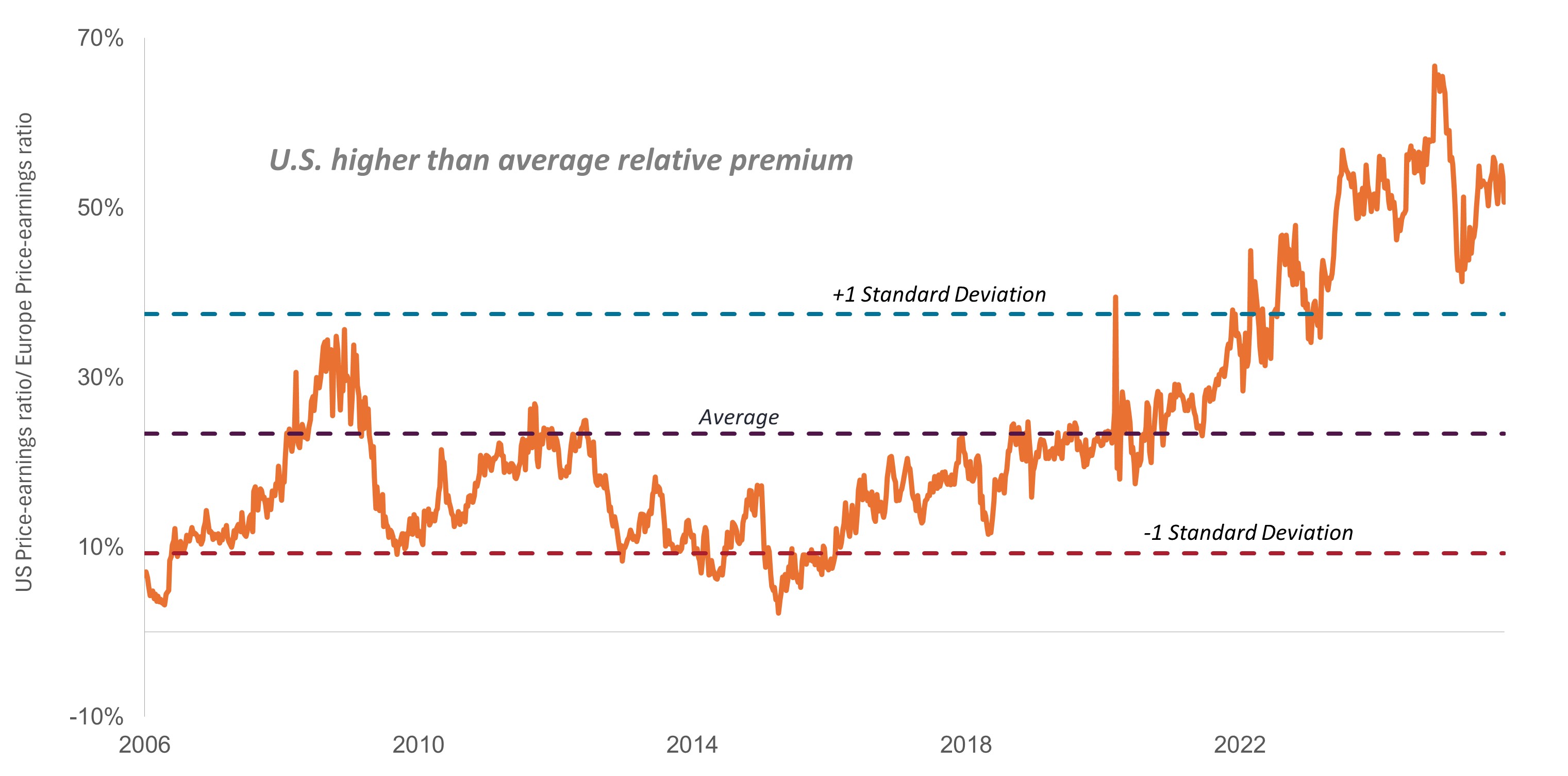

Exhibit 5: U.S. and Europe relative price-earnings ratios

Source: Bloomberg, Janus Henderson Investors, as of 14 November 2025; data based on 12-month forward price-earnings ratios of S&P 500® Index and STOXX Europe 600 Index.

Disruption invites differentiated views

Despite their fundamental underpinnings, each of these themes carries risk, with valuations being just one of them. We believe, however, that any technical pullback could represent a buying opportunity in high-quality companies whose valuations may currently be stretched. The rally has also led to the indiscriminate participation of stocks only remotely associated with AI or defense spending. We believe avoiding these names requires active management, which could dampen drawdowns during any market correction.

Lastly, with technological and policy disruption, there will invariably be both winners and losers. Determining which AI enablers, enhancers, and end users stand to benefit will take rigorous research, as will identifying those European companies positioned to gain from a more productive economy and robust defense.

Again, it’s our view that over the long haul, investors that can proactively position portfolios to concentrate exposure to the winners while avoiding the losers have the greatest opportunity to maximize returns.

IMPORTANT INFORMATION

Aerospace and defense industries can be significantly affected by changes in the economy, fuel prices, labor relations, and government regulation and spending.

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

1 Source: McKinsey, PwC, International Data Corporation. Note: Estimates vary with consensus centering on 1.0% to over 3.0% annually.

2 Source: Bloomberg.

3 Source: European Central Bank, European Commission, Janus Henderson Investors.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Return on Equity (ROE) is the measure of a company’s annual return (net income) divided by the value of its total shareholders’ equity, expressed as a percentage. The number represents the total return on equity capital i.e., the profits made for each dollar from shareholders’ equity.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

STOXX® Europe 600 Index represents large, mid and small caplitalization companies across 17 countries in the European region.

Volatility is the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.