The Sydney office market is somewhat bifurcated at the moment: on the one hand tenant demand in the wider market is weak with rising vacancy, and on the other, there are early signs of tightening and strength in the premium segment.

Following our recent trip to Sydney, where we visited the largest office development in the market, we share an update on the sector and explore what the future might hold.

Real estate is meant to be a simple business of supply and demand. Right now, whilst current office supply in Sydney remains elevated, future supply is running below the long-run average due to rising construction costs. At the same time, demand remains anaemic resulting in rental incentives (used to attract or retain tenants eg. fit out contributions, a rent discounts, rent-free periods) currently at eye-wateringly high levels. But this only gives us the headlines. Below the surface we see some green shoots for the best assets in the best locations. Does this signal the beginning of a new cycle for the Sydney office market or a stagnating market with few winners?

Chifley development: A panoramic paradox?

Our visit to Chifley Tower helped answer this question. There, we took in one of the best views from any office building in the world – from Charter Hall’s development at Chifley North Tower. The development will expand the Chifley precinct by adding an additional South Tower and offer combined space of almost 1.2 msqft, most of it office space.

Chifley Tower view west towards Bondi. Image credit: Tim Gibson.

Due to complete in mid-2027, it looks to be one of the most sought-after locations and has already attracted investment banks UBS and Morgan Stanley as anchor tenants. In addition to new office space with amazing views, the Chifley development will offer ‘must have’ facilities such as fitness and wellness offerings, as well as additional ’third spaces‘. This reflects a theme in office markets globally i.e. the flight to quality, which seems to be the new base level as employers seek to get employees back into the office for longer.

Scale model of Chifley development with new South Tower. Image credit: Tim Gibson.

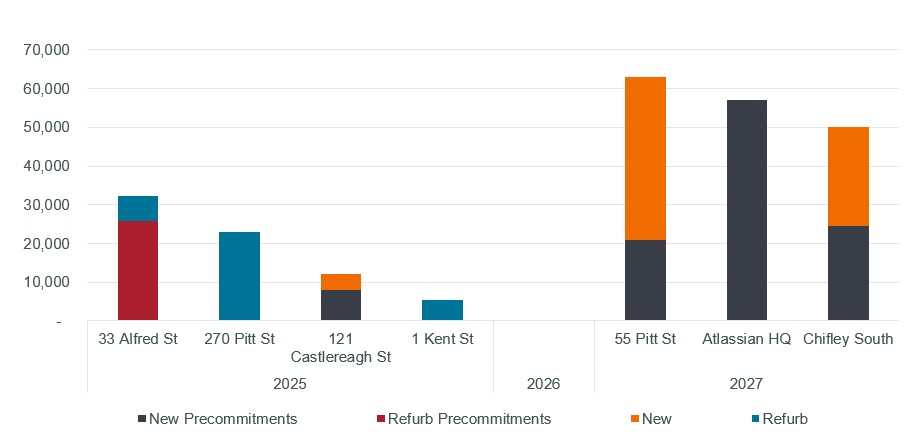

However, dig a little deeper and we find that even for this new super prime asset, incentives remain in line with the market at 30% of the property’s headline gross rental value. While future supply remains muted with no new developments in 2026 and half of the 2027 pipeline already preleased, there is still a current vacancy rate of 14%. Today, Chifley South is 55% pre-leased, but this includes the developer Charter Hall taking 60,000sqft as their headquarters. No doubt this number will improve as completion nears, but for now, tenants have bargaining power.

Figure 1: Sydney central business district (CBD) upcoming major development projects

Total Net Lettable Area (NLA) in sqm

Source: CBRE Research; Sydney CBD; 3Q 2025.

Is Sydney office market weakness due to a lack of sellers rather than a lack of buyers?

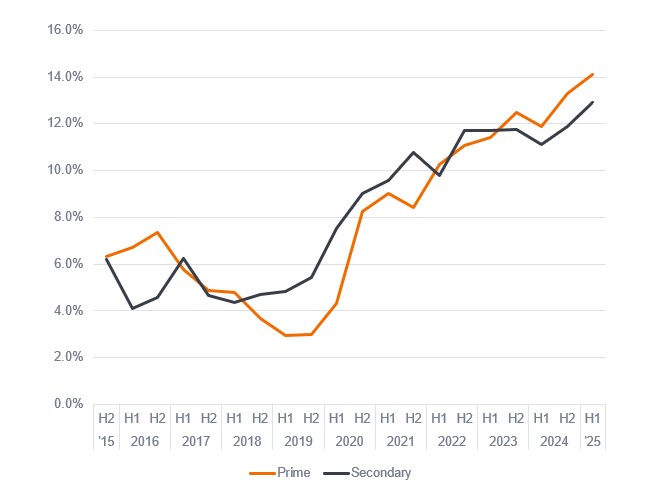

According to CBRE, as of Q3 2025, the Sydney CBD office vacancy rate stands at 13.7%, with previously announced supply hitting the market. Prime vacancy sits at over 14% with secondary at 13%. The good news is that this vacancy level is expected to peak as new supply is more muted, tenant enquiry levels have increased and subleased space is being withdrawn.

Figure 2: Sydney CBD office vacancy rates by grade

Overall vacancy rate

Source: PCA; CBRE Research; Sydney CBD; 3Q 2025.

Incentive levels also look to have peaked having soared during COVID. Currently they average around 31% in the core areas but are up to 44% (!) in the less sought after areas such as the Western Corridor. This means landlords don’t receive any rent, and are in fact cash flow negative due to service charges and other expenses, for almost half the lease!

As for the investment market, 2025 looks set to be one of the worst in terms of volume for a decade. Indeed circa AUD$2 billion of deals will put it on par with the depths of the pandemic in 2020. The big difference over this five-year period is that interest rates have increased, and property valuations have fallen to reflect this. One could argue that perhaps the lack of transactions reflects a lack of sellers rather than a lack of buyers. Indeed, in signs of a potential thawing in the market, in October GPT Group announced it would purchase a 50% interest in Grosvenor Place for $860m at a 7% yield (assuming fully let),1 currently the building is 30% vacant.

However, for older assets and severe laggards on the sustainability front, challenges will persist. Owners must either invest in significant refurbishments or face lingering high vacancy and incentive levels – this is not an enviable decision to have to make.

Conclusion

Sydney’s office market today reflects many of the themes within the office market globally, namely a two-tier market between older, out-of-favour assets, versus newer assets that cater to the needs of today’s tenants. The Chifley development is an example of what aspects tenants desire, namely new modern buildings combining lifestyle and wellness facilities, as well as sustainability credentials.

As the market adapts, the message for property owners is clear – quality is now everything, and the view from the top is as exclusive as ever.

1 Financial Standard; CSC enters partnership with GPT with $860m sale; 24 October 2025.

Cash flow: The net balance of cash that moves in and out of a company. Positive cash flow shows more money is moving in than out, while negative cash flow means more money is moving out than into the company.

Property yield: Annual return on a property investment usually expressed as a percentage of the capital value.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.