With innovation on the rise and interest rate hikes likely over, investors may want to pay closer attention to emerging market stocks.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Higher-for-longer rates creates opportunity and risk within European loans with quality names expected to outperform highly leveraged credits.

With M&A activity showing signs of a potentially significant revival in 2024, David Elms, Head of Diversified Alternatives, and Julius Bird, Client Portfolio Manager, discuss what this could mean for investors allocating to alternatives.

In the latest of our European Espresso series, Portfolio Manager Robert Schramm-Fuchs shares his insights on the current performance of the semiconductor sector.

Conflicting signals from cycle and monetary influences on the economy and asset prices suggest increased uncertainty for equity markets, explains Simon Ward, Economic Adviser.

Notes from a visit to a high-end cable manufacturer – a company that is vital for the transmission of clean energy from production to consumption points.

Can thematic investing continue to drive European stocks higher, despite sticky inflation and uncertainty over interest rates?

Why assessing macroeconomic drivers such as government debt, national savings, and monetary policy are key to investing in the EM space.

The conditions that have buoyed credit markets in recent months look set to continue.

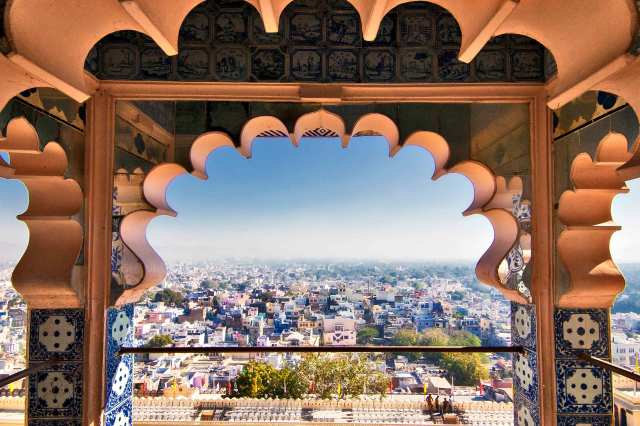

Saudi Arabia has embarked on an ambitious economic transformation programme aimed at propelling the kingdom into a bright, post-oil future.

While stickier-than-expected inflation undoubtedly alters the timing of rate cuts, it likely does not affect the Fed’s goal of eventually easing restrictive policy.