Convertible bonds: opportunities in the aftermath

The primary market for convertible bonds came to a halt in the first half of 2022. Portfolio Manager Natasha Sibley asks if it is time for them to get back on the road.

6 minute read

Key takeaways:

- Falling equity prices, rising rates, and widening credit spreads have all caused pain in the convertible bond market in 2022

- Against this backdrop, corporate convertible bond issuance has been the weakest on record

- What comes next could potentially be a big opportunity for investors

Convertible bonds were an attractive instrument in the aftermath of the initial COVID crisis, as companies looked to recapitalise. But against a backdrop of monetary policy uncertainty and geopolitical tension, the convexity that is so sought after has evaporated. How has the opportunity-set shifted against a reshaped backdrop?

Convertibles – the basics

Convertibles are a useful tool for companies with lower credit ratings, or growing businesses that are not yet profitable, offering a cheaper way to borrow money to fund expansion, without necessarily diluting existing shareholders’ holdings. For investors, a smaller coupon is offset by the potential prize of making a profit via the conversion option. But convertibles proved to be an attractive instrument for a much broader range of firms in 2020 and into 2021, given the high level of market volatility – a key driver of the value of options (and therefore convertibles).

At that time, we saw a wave of convertible issuance, significantly increasing the size of the global market, as companies took advantage of accommodative financing conditions to strengthen their balance sheets in the wake of COVID-era restrictions. Market exuberance meant deal terms became stretched, and conversion prices in new issues moved further and further out of the money (OTM)1, making the option component less and less valuable.

Much of this issuance came from technology2, with companies in the sector leveraging their popularity with investors to issue minimal or zero-coupon convertibles. Peloton, a darling of the COVID-era tech boom, was one such, raising US$1 billion via a zero-coupon convertible bond with a strike price of US$239.23, which was just over 60 per cent higher than the stock was priced at the time.3

Change in direction

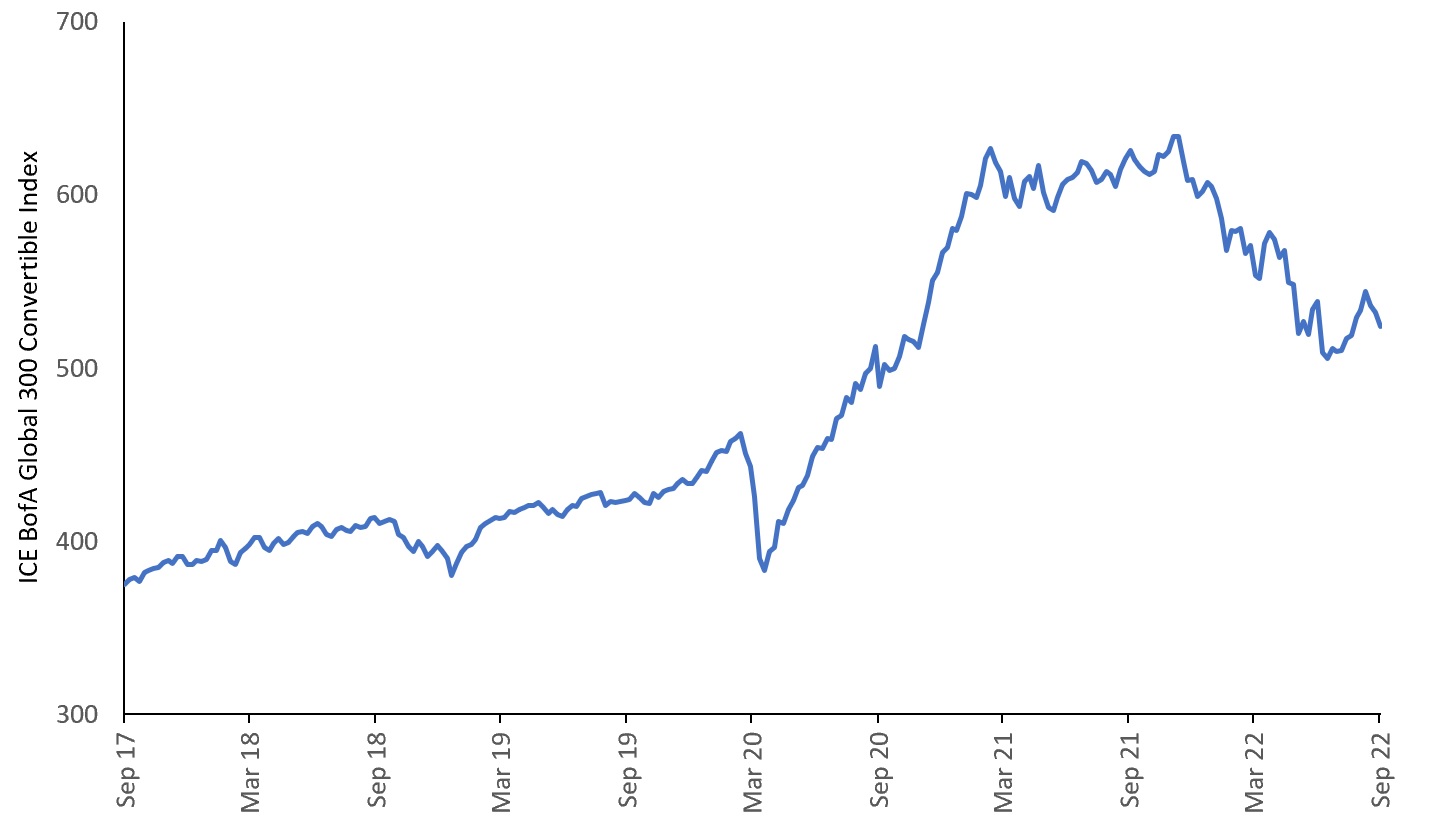

All this changed in 2022. The threat of rising inflationary pressures and higher interest rates saw high-growth technology stocks hit by sharp selling pressure, a move exacerbated by Russia’s invasion of Ukraine. Stock prices tumbled, and unusually, this coincided with falling bond prices, meaning the typically negative stock-bond correlation, the diversification factor that had been dampening convertible bond risk for decades, could no longer cushion the pain. With credit spreads increasing, the resulting loss in value was bad news for convertible bonds, which experienced one of the worst starts to a year on record, during the first half of 2022 (Exhibit 1).

Exhibit 1: Convertibles H1 headwinds

Source: Bloomberg, ICE BofA Global 300 Convertible Total Return Index4, 5 September 2017 to 5 September 2022. Past performance does not predict future returns.

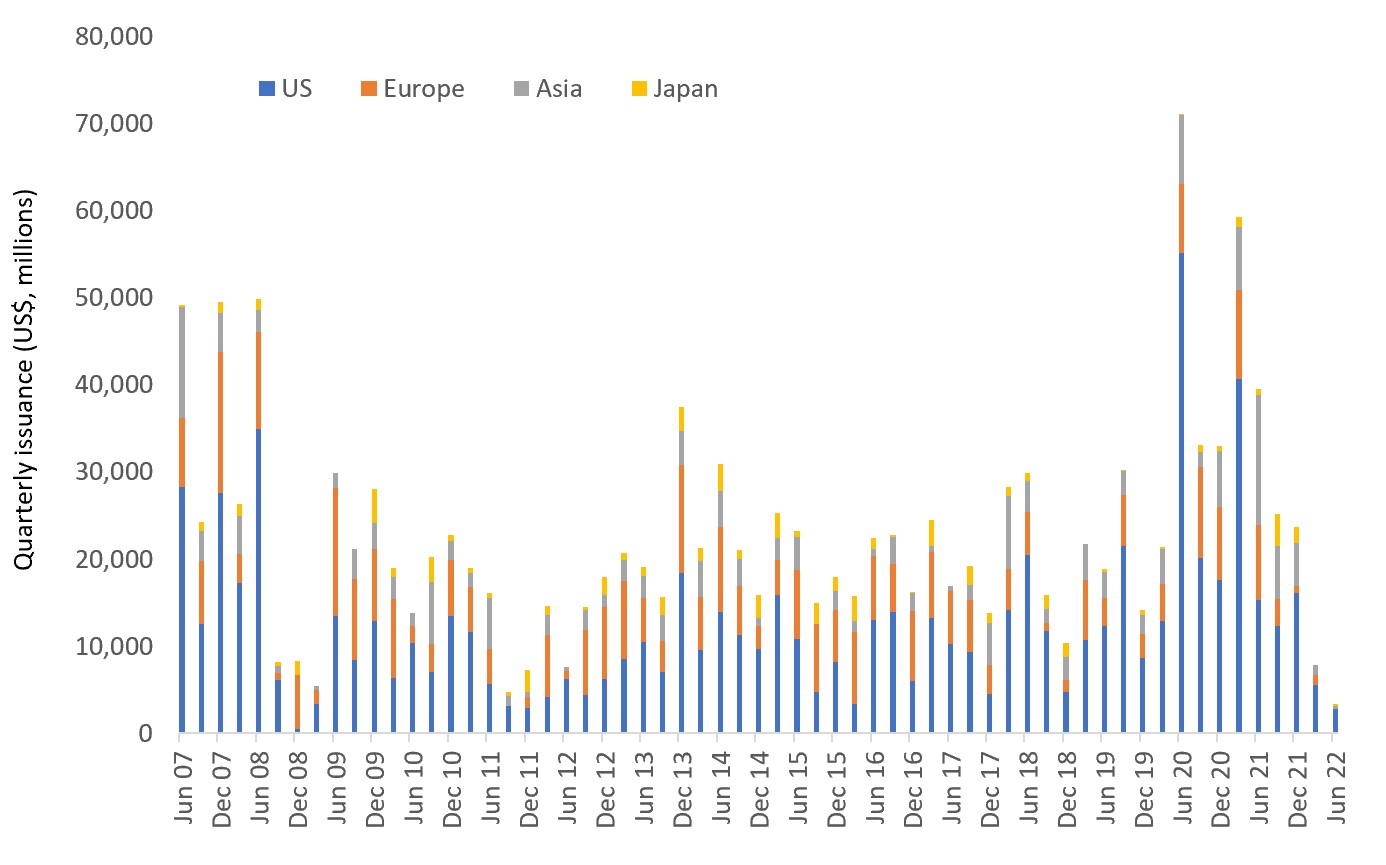

Against this backdrop of monetary policy uncertainty and geopolitical tension, the primary market effectively shut down. Only US$11 billion in convertibles were issued globally in the first half of 2022, as issuance collapsed (Exhibit 2), with the smaller coupon and out of the money options offering little appeal for investors seeking to offset inflation.

Exhibit 2: Issuance dries up

Source: BofA Global Research, 30 June 2007 to 30 June 2022. Chart shows quarterly issuance by region, in US dollar terms. Past performance does not predict future performance.

Evaporated convexity

So far, the pace of outflows from convertible bond funds have not been materially greater than the redemption profile of the convertible universe. With barely any new issuance, this has meant we have not yet seen a rush for the exit, and while convertible bond valuations have fallen, in our view, this has mostly been driven by moves in the credit and equity markets, rather than a large dislocation in the convertible market itself. However, while there are always opportunities to find value, for much of the large component of issuance that followed the emergence of COVID, the conversion price is so far away from current stock levels that the embedded options are close to worthless. The convexity that is so sought after has evaporated.

Where next?

From here, all options are on the table, whether that is a stabilisation of markets, a rebound in risk sentiment, or for things to turn even uglier. If we see the former, and markets settle down, the long drought of new issuance places the convertible market well to receive new bonds. Both in terms of the number of companies needing to refinance as their existing convertibles reach maturity, and in terms of the demand for new paper from convertible investors, which should keep the primary market buoyant.

If it is the latter (things turn even uglier), and we start to see significant outflows from funds in this space, then we may enter a period similar to that which followed the 2008 global financial crisis, where we saw some convertible bonds trading at yields close to or just below their straight peers. This would be a huge opportunity for investors with sufficient liquidity to hand to take advantage; a rare prospect of buying options for pennies, potentially even for free. Even if the far OTM price for the convertibles mean that these options are not worth much, if a portfolio of diversified names can be bought for well below this value, then future volatile markets could potentially make this a canny bet.

—–

[1] Out of the money (OTM): this refers to an option that has no intrinsic value, ie, it is worthless at a specific point in time using an objective calculation of the option. An option can still contain extrinsic value related to time (potential for prices to change and make the option valuable) and investors’ appetite for the asset.

[2] Source: https://www.ft.com/content/2b8d6fa1-cae8-4e29-9953-834a43a0fd29

[3] Source : Bloomberg, PTON 0% 02/15/26, bond issued on 9 February 2021.

[4] The ICE BofA Global 300 Convertible Total Return Index is a global convertible index composed of companies that are representative of the market structure of countries in North America, Europe and the Asia/Pacific region. It is composed of securities denominated in their respective local currencies.

Please note:

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Volatility measures risk using the dispersion of returns for a given investment.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.