Views vary on the current state of the global economy and, consequently, the health of the corporate sector. Has inflation been vanquished? Is the cycle extending? Or are the knock-on effects of tariffs yet to be felt, meaning a downturn may be lurking over the horizon? That such a wide range of scenarios seems plausible suggests that the time has passed for investors to ask just one question. In our view, for fixed income investors, a dispersed range of economic outcomes should be taken as a welcome development.

Beginning with the onset of the COVID-19 pandemic and through the wave of generational inflation, many major economies – and thus policy responses – moved in lock step. This synchronization has subsequently broken down. In its place, the status quo of central banks tailoring policy prescriptions to local conditions has returned. This ongoing shift should prove conducive for bond investors as the asset class’s varied duration and credit components can lend value to a portfolio at distinctly different stages of the economic cycle.

Marching to their own tune

With myriad uncertainties hanging over the global economy, we believe investors should prioritize diversification. Rather than simply increasing a portfolio’s fixed income allocation with the aim of protecting against inherently more volatile assets, investors can also seek to optimize diversification within a bond allocation. In contrast to much of the past five years, the current environment is ripe for both a duration and credit sleeve to potentially generate uncorrelated returns, depending on at which stage of the economic and monetary cycle they are deployed.

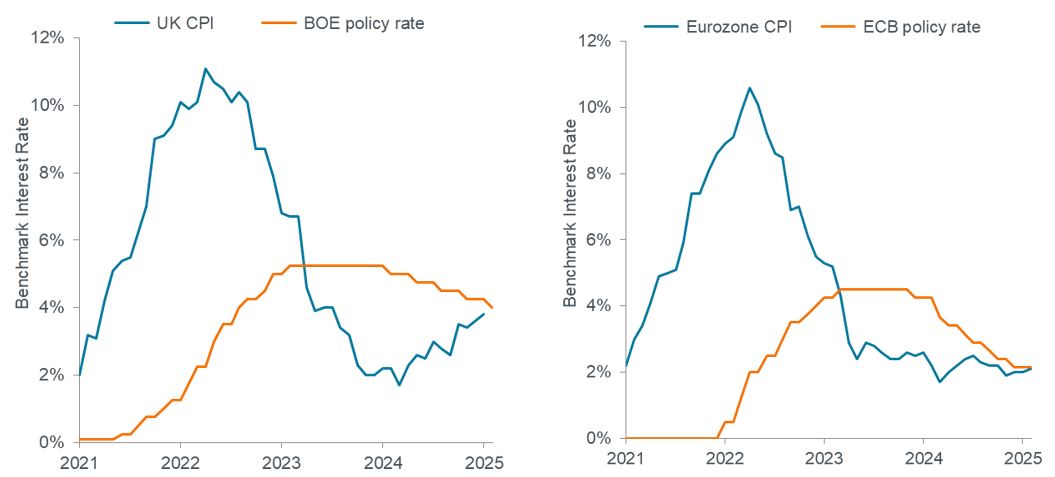

Evidence of this divergence can be found without venturing beyond the shores of Europe. Faced with a cooling economy as pandemic-era stimulus wore off, the European Central Bank (ECB) initiated rate cuts in mid-2024. For investors that increased duration within the eurozone, the subsequent 235 basis point (bps) reduction represented a lucrative level of capital appreciation on short- to mid-dated bonds whose associated returns proved largely uncorrelated to global equities.1

In contrast, facing persistent inflation, which has recently climbed back toward 4.0%, the Bank of England (BOE) was more circumspect in cutting rates. That is slowly changing as it’s now reduced the policy rate by 125 bps, to 4.00%. Its most recent decision was likely not easy: Despite consumer prices remaining well above the BOE’s preferred level, the central bank was probably alarmed by an uncomfortable uptick in unemployment.

Exhibit 1: UK and eurozone inflation and policy rates

Evidence of central banks setting policy in a localized manner is seen in the BOE responding more quickly than the ECB to pandemic-era inflation, while the latter bank was quicker to loosen as prices subsided.

Source: Bloomberg, Janus Henderson Investors, as of 31 August 2025.

With inflation risk hanging over bond prices, investors would rightly approach UK duration exposure with a greater sense of caution. But with yields at the front end of the UK sovereign curve at attractive levels – the 2-year Gilt presently sits just below 4.0% – investors have the potential to earn sufficient carry without shouldering the additional interest rate risk that would come with exposure to longer-dated maturities in a still-inflationary environment.

Appreciating Europe’s management style

The economic torpor that has necessitated rate cuts in the eurozone and a resumption in the UK also represents fertile ground for uncovering corporate credit opportunities. Unlike global equity markets that are dominated by U.S. megacaps, corporate bonds don’t need strong earnings growth and exposure to high-profile secular trends to perform well. Instead, bond investors prioritize the consistent cash flows and judicious use of leverage that beget stable coverage ratios. These are often the calling cards of many conservatively managed European companies.

Very few are forecasting recession in Europe, and some praise is likely owed to the ECB for being ahead of the curve when it initiated its rate-cutting cycle last year. Despite its sinister reputation, some inflation can be good for corporate finances. It tends to align with economic growth and can allow companies to modestly raise prices, which, in turn, fortifies coverage ratios. Inflation in the eurozone has been holding fairly steady, coming in at 2.1% in August, and expectations appear anchored at similar levels. And while inflation’s recent uptick in the UK merits close attention, the BOE is undoubtedly also watching the data, and future releases will invariably help determine how many additional cuts the central bank implements over the back half of the year.

A surprisingly global local credit market

A steadying economic backdrop for European issuance is only part of the story, however. Despite accounting for only a third of the global corporate bond index, the continent – and the UK – exemplify how globalized bond markets have become. Positive, if unspectacular, growth has limited the threat of falling sales and margin compression putting European issuers at risk of ratings downgrades. And with issuance emanating from a range of sectors, including industrials, financials and consumer, investors can fortify diversification by seeking quality issuance exposed to different segments of the region’s economy.

Yet the European credit market is more than a collection of European issuers. Reflecting the global nature of the asset class, companies from around the world issue bonds on the continent and in the UK. The reasons are myriad: Companies like to increase liquidity by diversifying their investors base, they recognize that many bond investors exhibit home bias and seek securities listed in local markets, and often companies seek to match their debt obligations to the regions and currencies where they generate revenue.

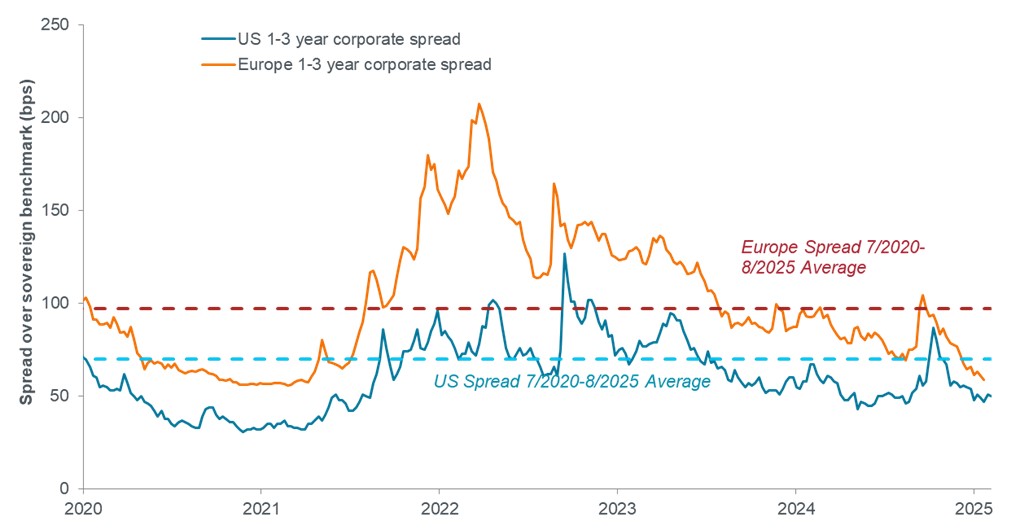

Exhibit 2: Shorter-dated European and U.S. corporate spreads

Investment-grade European corporates tend to trade at a premium to U.S. counterparts, potentially resulting in attractive relative value opportunities for either similar credit quality or specific issuers.

Source: Janus Henderson, as of 31 August, 2025. Note: U.S.-based on Bloomberg 1-3-Year Corporate Index and Europe on Bloomberg Pan-European Aggregate Corporate 1-3-Year Index.

Issuing debt across jurisdictions can lead to pricing variations for a particular company’s securities – or credit rating – and thus create relative value opportunities for fixed income investors. For example, American companies such as McDonald’s often issue bonds in European markets given their sizeable operations in the region. In many instances, the Eurobond may be priced at a discount to a similar security listed in the U.S.

A credit issued by a European company in an overseas market may also exhibit different pricing. In another example, given Australian investors’ focus on environmental, social, and governance (ESG) – along with the aforementioned home bias – bonds issued in that country by Germany’s Volkswagen can trade at a discount to those with similar characteristics issued in Europe.

The right kind of risk in a diversified allocation

As evidenced by what was likely the BOE’s difficult decision to cut rates, many economies are not fully out of the woods. Diverging growth trajectories allow investors to source credit or duration risk where conditions merit, while at the same time being mindful of the diversification that’s likely needed in a still-uncertain economy.

With inflation, growth, and policy varying across borders, European bond markets provide a unique opportunity to construct portfolios with precision. Active management across global rates and credit exposures should enable investors to pursue consistent returns while managing risk in a targeted, thoughtful way.

1Correlation based on daily price changes over the past year between the MSCI World Index and the Bloomberg Pan-European Aggregate 1-3 Year Total Return Index.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Carry is the excess income earned from holding a higher yielding security relative to another.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Premium/Discount indicates whether a security is currently trading above (at a premium to) or below (at a discount to) its net asset value. Sharpe Ratio measures risk-adjusted performance using excess returns versus the “risk-free” rate and the volatility of those returns. A higher ratio means better return per unit of risk.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

Volatility measures risk using the dispersion of returns for a given investment. A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.