The severity and duration of crude oil price volatility depend upon how the conflict could impact energy infrastructure and/or shipping in the Strait of Hormuz.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

An early reaction to military strikes in Iran and the implications for investors.

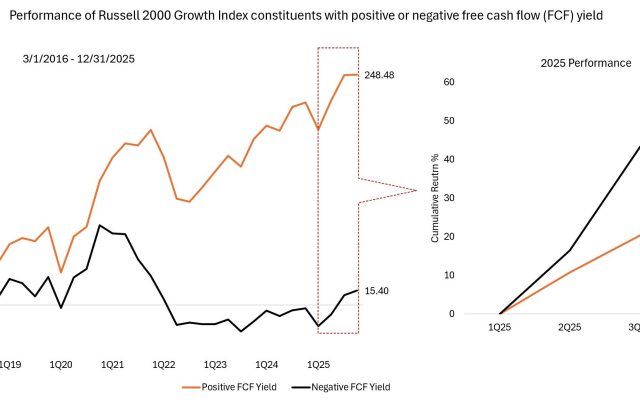

A divergence in performance between positive and negative cash-flow businesses could signal opportunity for investors focused on quality factors.

Key risks and opportunities within asset-backed securities (ABS) for investors seeking to navigate the evolving fixed income landscape.

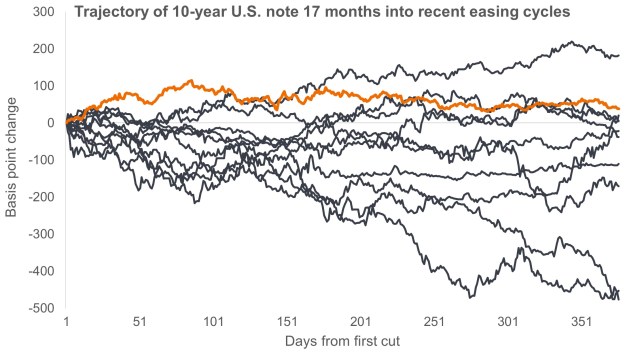

10-year U.S. Treasury yields charting a different course than what we’ve seen in recent easing cycles may indicate that this time could indeed be different.

Private credit has become a core allocation for investors. Hear insights from Janus Henderson and Victory Park Capital on the risk and opportunities in MENA and asset-backed finance.

Kenya’s external position has improved markedly, but beneath the surface emerges a more cautious story on fiscal reform and long term sustainability.

Hong Kong’s residential property market is in a recovery phase driven by supportive macro conditions, stronger household balance sheets, and renewed demand.

Ongoing reforms in Japan and South Korea could turn governance into a durable competitive advantage and catalyst for a re-rating of these markets.

The U.S. Supreme Court’s ruling on President Trump’s tariffs may be welcomed by markets, but investors must now decipher a host of adjacent issues.

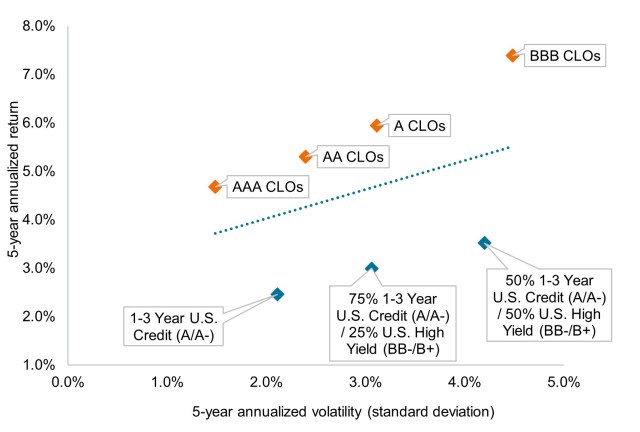

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.