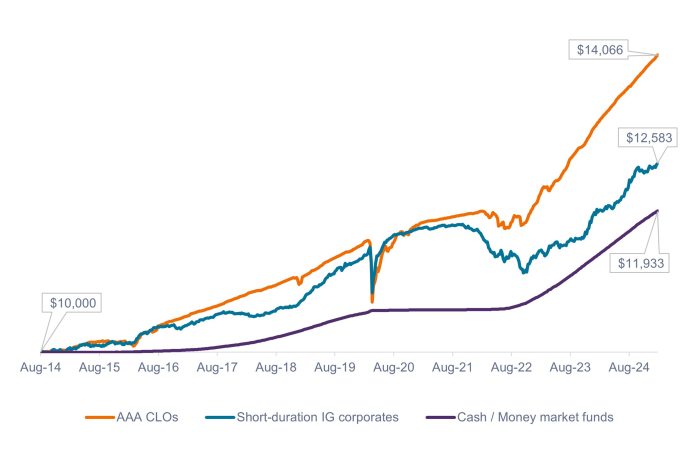

Source: Bloomberg, J.P. Morgan, as of 24 January 2025. Indices used to represent asset classes: AAA CLOs = J.P. Morgan AAA CLO Index, Short-duration IG corporates = Bloomberg U.S. Corporate 1-3 Year Index, Cash / Money market funds = Bloomberg U.S. 1-3 Month Treasury Bills Index. Past performance does not predict future returns.

Some investors who are hesitant to put their short-term cash reserves at risk may feel uneasy with any volatility in their short-duration holdings. We believe this approach may be overly cautious, as many investors could handle an incremental amount of volatility in exchange for potentially higher returns. Historically, despite occasional drawdowns, AAA CLOs and short-duration IG corporates have ended up comfortably ahead of cash over the long term.

– John Kerschner, Head of U.S. Securitized Products

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.