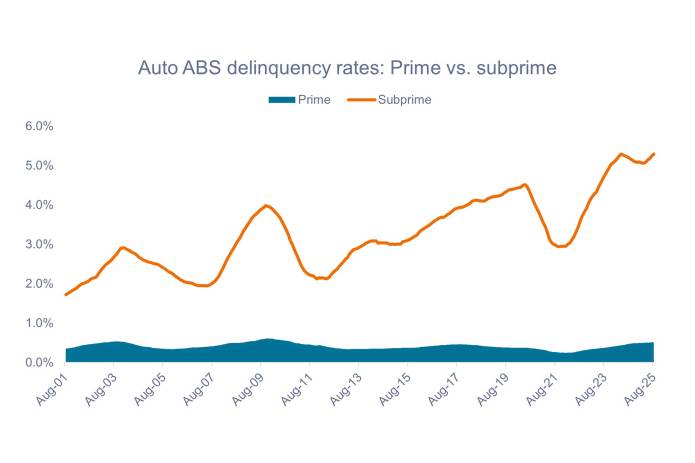

Source: Intex, Goldman Sachs Investment Research, as of 31 August 2025. Chart shows trailing 12-month moving average of share of balances 60 days or more past due. Borrower credit scores: Subprime <620, prime >660.

Back in 2022 and 2023, we witnessed spread widening within commercial mortgage-backed securities (CMBS) due to high-profile turmoil in pockets of the office subsector. In addition to steering clear of troubled office buildings, we took advantage of fear-based selling within the broader market to buy CMBS assets we liked – such as data centers – at discounted prices.

Today, we see a similar opportunity in ABS: While we prefer to avoid subprime exposure at present, the bankruptcies of First Brands and Tricolor have resulted in indiscriminate selling of numerous higher-quality assets, providing an opportunity to acquire prime auto ABS at historically attractive prices. We cannot overemphasize the potential value of active management within securitized markets.

Idiosyncratic risks are factors that are specific to a particular company and have little or no correlation with market risk.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Tranche: In securitized products like CLOs, a tranche is one of a number of related securities offered as part of the same transaction, with each representing a different degree of risk and carrying a commensurate credit rating.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.