For 30 years, the Balanced strategy has offered a simple and optimal mix of stocks and bonds designed to capture the best opportunities across market cycles.

The advantage of a combination of stocks and bonds

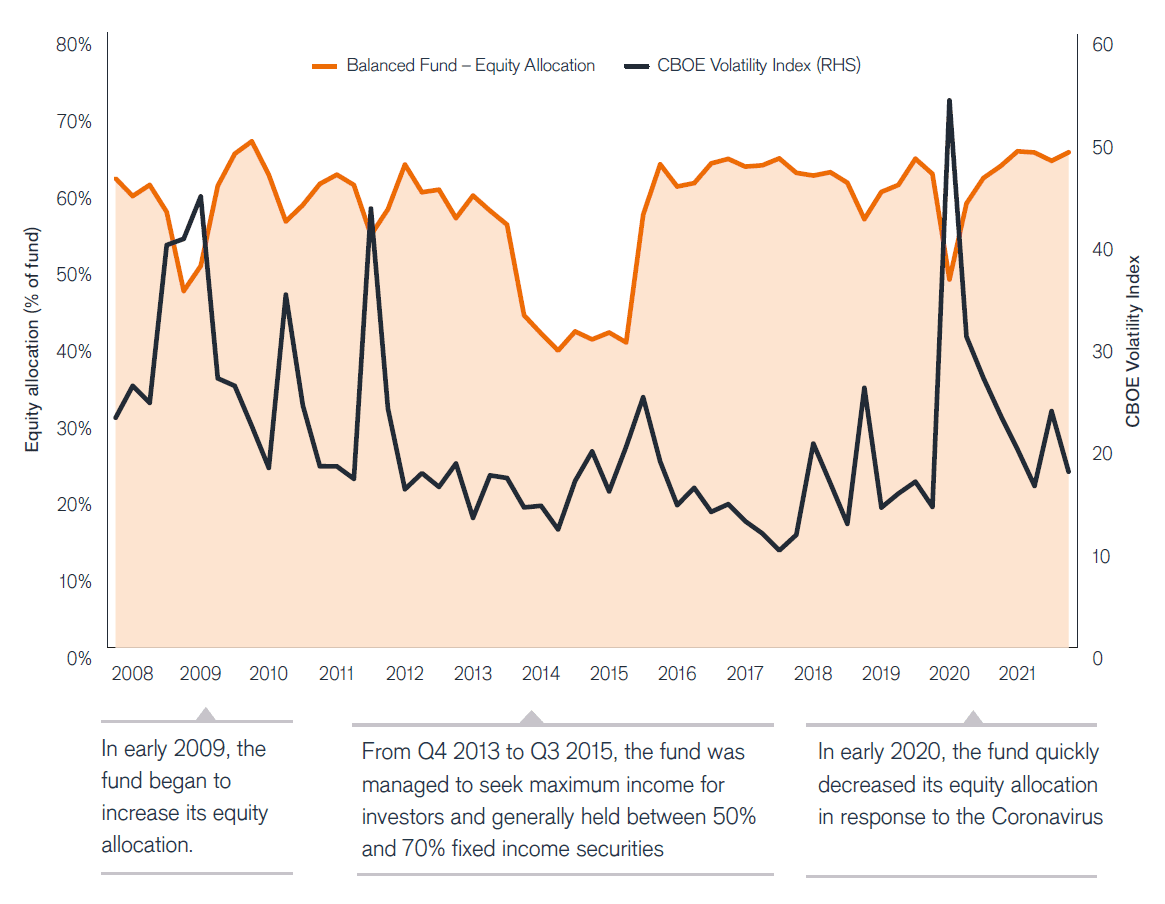

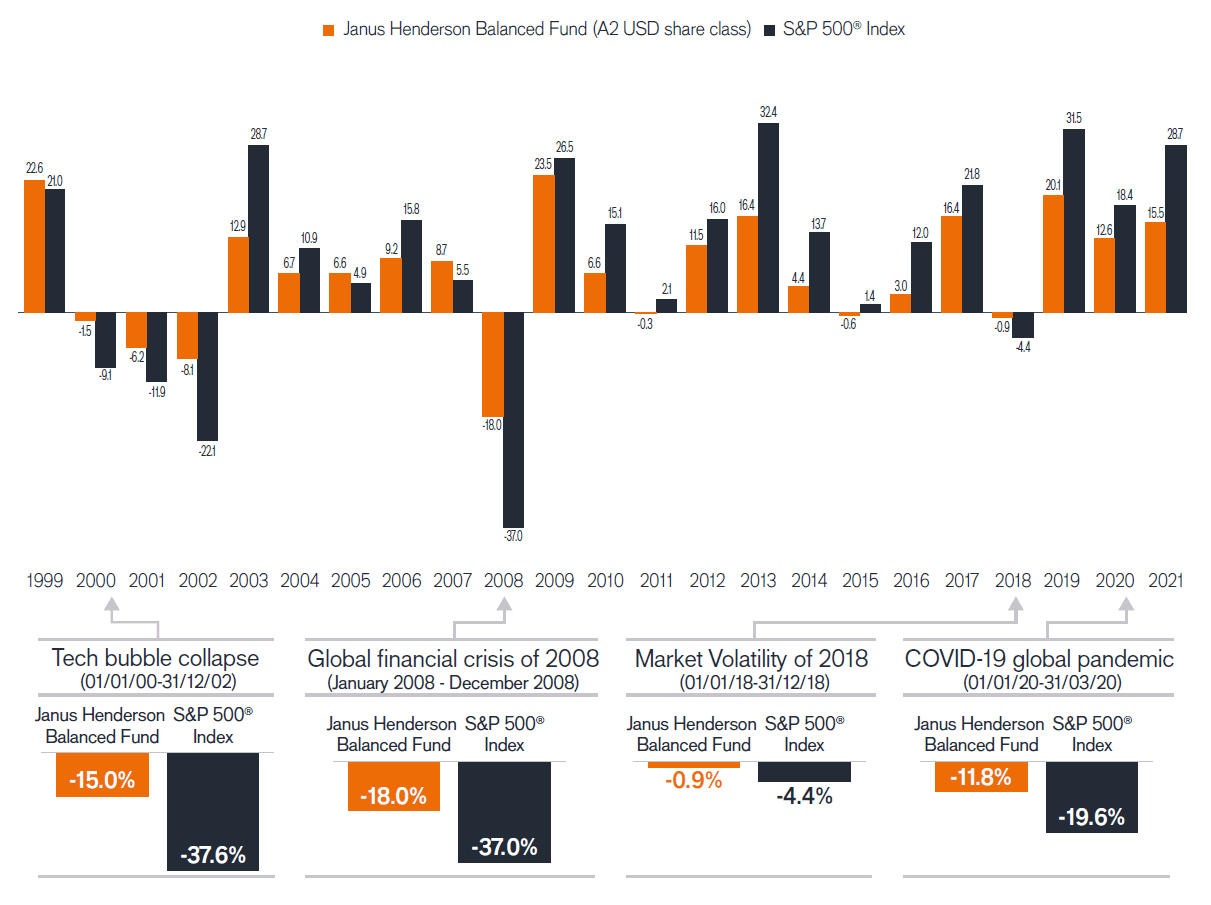

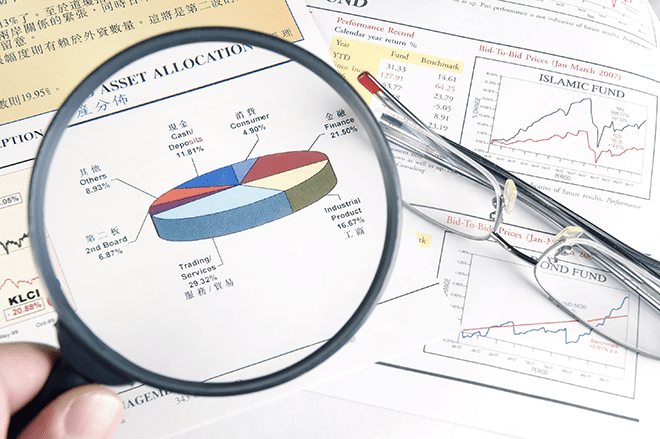

The Balanced Fund’s dynamic asset allocation strategy has the flexibility to defensively position in anticipation of market volatility while seeking strong risk-adjusted returns. Unlike many competitor products where asset allocation is constrained by static targets, the Balanced Fund can actively pivot between an equity weighting of 35% to 65% depending on market conditions.

The fund is designed to:

Offer a dynamic blend of mainly US stocks and bonds

Adapt to all market conditions

Limit volatility relative to the stock market

"We actively position the portfolio based on the most attractive opportunities in the equity and bond worlds, based on evolving economic conditions".

Jeremiah Buckley, CFA,

Co-Manager of the Janus Henderson Balanced Fund

Insights

Insights

Janus Henderson Balanced Fund

Janus Henderson Balanced Fund