Eurozone monetary update: false hope from broad money

2 minute read

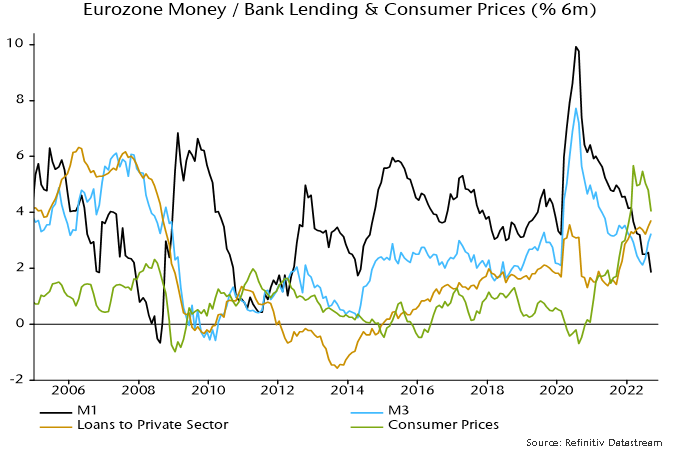

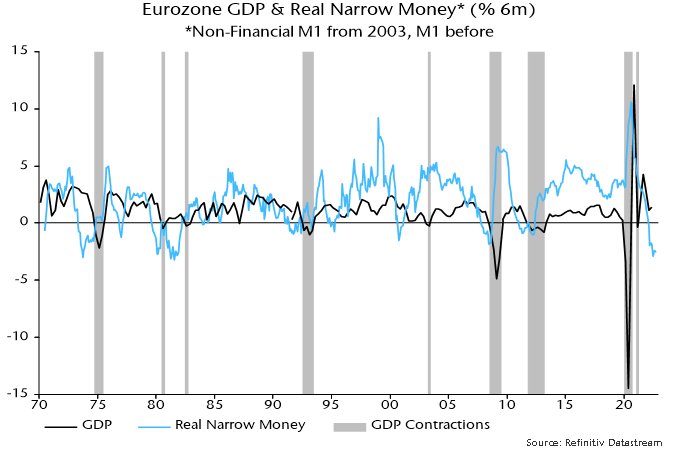

Eurozone money measures are giving mixed signals. Headline broad money M3 rose by a strong 0.7% in September, pushing six-month growth up to 3.3% (6.6% annualised), the highest since December. Narrow money M1, by contrast, contracted on the month, with six-month growth falling further to 1.8% (3.7% annualised) – see chart 1.

Chart 1

Broad money reacceleration, on the face of it, suggests an economic recovery towards mid-2023 after a sharp winter recession. The judgement here, however, is that broad money numbers have been boosted by technical / temporary factors and intensifying narrow money weakness is a better representation of current monetary conditions and economic prospects.

The six-month rate of change of real M3, it should be emphasised, remains negative, with consumer prices (ECB seasonally adjusted series) rising by an annualised 8.2% between March and September.

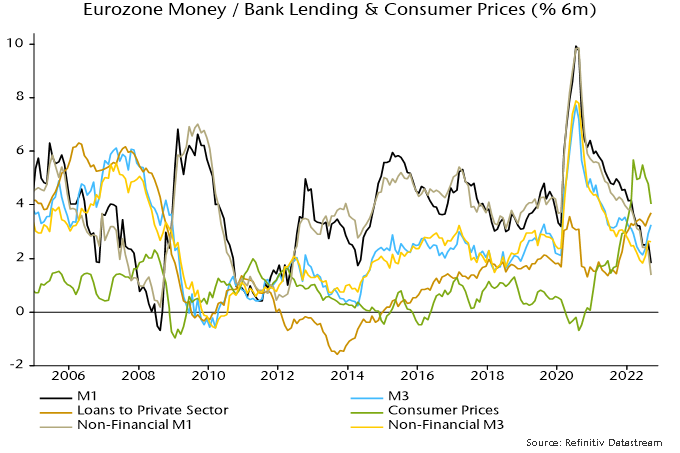

The sectoral breakdown of the headline M3 / M1 numbers, moreover, shows a significant recent contribution from rising money holdings of financial institutions. This probably reflects cash-raising related to weak markets and is not an expansionary / inflationary signal for the economy.

The forecasting approach here focuses on non-financial money measures where available, i.e. encompassing holdings of households and non-financial firms only. Six-month growth of non-financial M3 was 2.6% in September versus 3.3% for M3 and has shown a smaller recent recovery – chart 2.

Chart 2

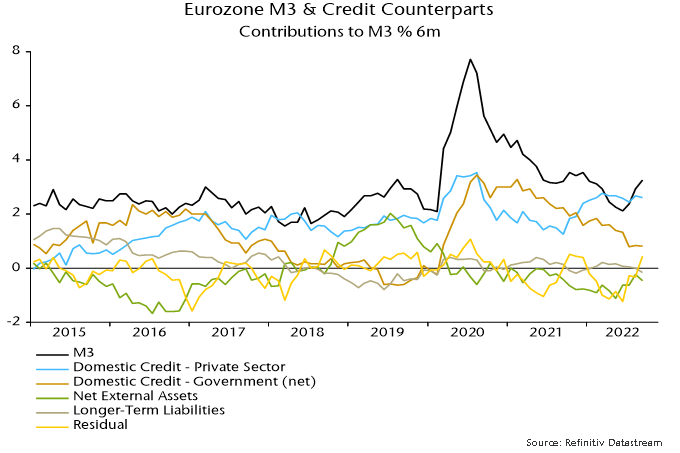

A further reason for playing down the broad money pick-up is that it is not explained by any of the conventional “credit counterparts” – credit to the private sector and government, net external assets and longer-term liabilities. The counterparts analysis shows a positive contribution from unspecified residual items, which behave erratically, suggesting a future reversal – chart 3.

Chart 3

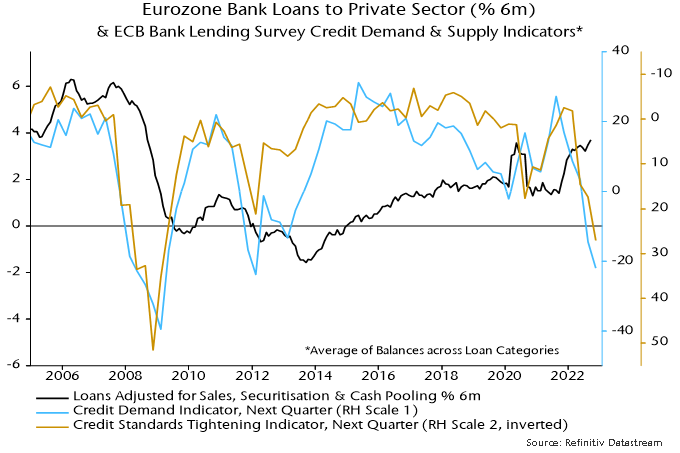

Solid growth of lending to the private sector has been the key driver of recent M3 expansion. The October bank lending survey, however, showed a further plunge in credit demand and supply balances, signalling a future lending slowdown or even contraction – chart 4.

Chart 4

Statistical studies show that real non-financial M1 has the strongest leading indicator properties of the various money and lending measures. Its six-month rate of change remains at the bottom of the historical range, suggesting no economic recovery before H2 2023 – chart 5.

Chart 5

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Comunicazione di Marketing.