I&I therapies hit new milestones for patients and investors

Portfolio Managers Andy Acker and Agustin Mohedas explain why shares of companies delivering next-generation therapies for inflammation and immunology (I&I) disorders could have plenty of room to run.

5 minute read

Key takeaways:

- In 2023, stocks of companies developing treatments for inflammation and immunology disorders have outperformed, beating other large categories such as oncology.

- The therapeutic area’s success can be attributed to several factors, including important medical advances, a large and growing patient population, and favorable reimbursement.

- These dynamics look set to continue in the near term, attracting investment, including in the form of multibillion-dollar mergers and acquisitions.

Cancer, obesity, Alzheimer’s. In recent years, these therapeutic areas have often captured the spotlight given their sizable patient populations and significant medical advances. But inflammation and immunology (I&I) is another field with similar scientific progress and size – and this year as a category has outperformed the other big three by a longshot.

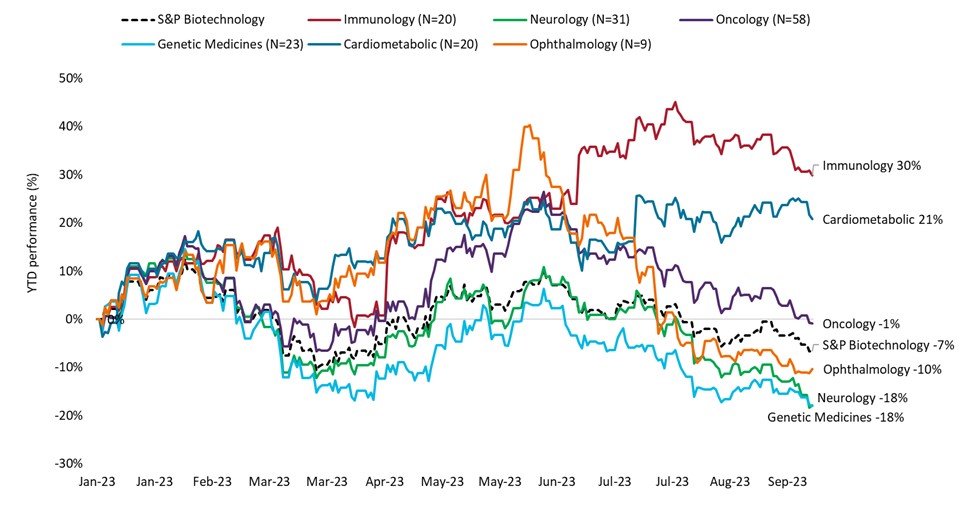

As shown in Figure 1, this year I&I stocks have returned an average of 30%, trouncing oncology’s slide of -1% and neurology’s loss of -18% and outperforming cardiometabolic’s rise of 21% (though certain obesity-focused companies within this group have seen far bigger returns thanks to the growing potential of new GLP-1 agonists1 for weight loss).

Next-gen treatments arrive – and drive growth

What explains the success? One reason has to do with science. At a broad level, I&I encompasses autoimmune and inflammation conditions such as inflammatory bowel disease (e.g., Crohn’s disease), rheumatoid arthritis, psoriasis, Type 1 diabetes, and multiple sclerosis. While the field has benefited from scientific progress for many years – resulting in the launch of several blockbuster products2 – researchers have continued to identify new biomarker targets or mechanisms of action with the potential to further improve the standard of care for patients.

Tumor necrosis factor-like cytokine 1A (TL1A), for example, is a protein that helps regulate inflammation and fibrosis (tissue scarring) and has been found to be abnormally expressed in several autoimmune diseases, including rheumatoid arthritis, inflammatory bowel disease, psoriasis, and primary biliary cholangitis. Researchers have identified this biomarker as a new potential therapeutic target that could be effective for the high percentage of patients who don’t respond to existing treatments.

The results so far have been promising. In one study, a company developing an anti-TL1A drug for moderate-to-severe ulcerative colitis reported that more than a quarter of patients who had failed conventional therapy achieved remission, a meaningful clinical milestone. The company’s stock nearly tripled in a day.

Figure 1: I&I leads – stock performance by therapeutic area

Source: Jefferies, as of 19 September 2023. The S&P® Biotechnology Select IndustryTM Index comprises stocks in the S&P® Total Market Index that are classified in the GICS Biotechnology sub-industry. N = number of stocks.

Source: Jefferies, as of 19 September 2023. The S&P® Biotechnology Select IndustryTM Index comprises stocks in the S&P® Total Market Index that are classified in the GICS Biotechnology sub-industry. N = number of stocks.

Past performance is no guarantee of future results. Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

As for mechanism of action, today’s pipeline of I&I drug candidates consists of many new ones, including blocking tyrosine kinase 2 (TYK2), an enzyme that mediates immune signaling and inflammatory signaling pathways. (Mechanism of action refers to the biochemical process a drug uses to produce its effect.) TYK2 is a type of Janus kinase (JAK), a family of proteins implicated in a wide range of inflammatory diseases.

Drugmakers initially developed therapies blocking all JAKs, but the broad approach resulted in troubling side effects, including increased risk of cancer and cardiovascular events. But last year, the U.S. Food and Drug Administration approved Sotyktu, the first drug to focus on TYK2 specifically, a more targeted pathway that has resulted in greatly reduced safety events. Now, other TYK2 inhibitors are being developed with a focus on improving efficacy even further while keeping side effects to a minimum.

A growing addressable market

Innovation invites competition. So does market opportunity, and here I&I has significant scope. A population-based study of 22 million people published earlier this year found that one in 10 individuals suffers from at least one immune disorder. Furthermore, the number of sufferers may be rising due to factors such as improved hygiene (the hygiene hypothesis3) and environmental triggers.4 While the study looked at 19 of the most common autoimmune diseases, scientists have identified more than 80 types of I&I disorders, suggesting drugmakers have a large addressable market to explore. Indeed, I&I is the second largest therapy area by value, according to analysis by IQVIA, with sales expected to total US$156 billion globally by the end of 2023.5

While these figures are impressive, many existing therapies that helped the category to reach such lofty heights – including the world’s best-selling drug, Humira – face loss of exclusivity and increasing competition from generics and biosimilars. As such, revenue growth is projected to decelerate to an average of 4%-6% annually from 2022-2027, down from 15% the previous five years.

But these pressures are also helping drive investment in innovations such as TKY2 inhibitors, as well as the development of orally bioavailable small molecules against validated targets to improve patient accessibility (i.e., pills and topical treatments vs. injections and infusions). And the average does not reflect expectations for novel therapies that address high, unmet medical needs, which are forecast to expand at double-digit rates.

Reimbursement is another motivator. Many patients with autoimmune conditions are children or of working age and therefore stay on therapies for long periods of time. In addition, in the U.S., these patients typically fall under commercial insurance plans, which are not subject to the drug price negotiation now allowed in Medicare, the government insurance plan for the elderly.

Biopharma investment

For biopharma’s part, the industry seems to be betting that I&I’s innovation, market size, and favorable reimbursement trends will pay off over the long term.

This year, several multibillion-dollar mergers and acquisitions have been announced, including Merck’s $11 billion bid for Prometheus Biosciences, which has a TL1A drug candidate, and Takeda’s $4 billion acquisition of Nimbus Therapeutics, which is developing a TYK2 inhibitor for psoriasis.

These deals, all made at significant premiums to the acquired firms’ pre-announced stock price, reflect the confidence that large-cap pharma has in I&I’s growth potential – and, in our view, could make investors confident, too.

1 GLP-1 agonists mimic the action of a hormone called glucagon-like peptide 1. The drugs help curb hunger and slow the movement of food from the stomach into the small intestine, making patients feel full faster and longer.

2 A blockbuster drug is defined as having sales of US$1 billion or more annually.

3 According to the hygiene hypothesis, the decreasing incidence of infections in western countries and more recently in developing countries is at the origin of the increasing incidence of both autoimmune and allergic diseases.

4 “Incidence, prevalence, and co-occurrence of autoimmune disorders over time and by age, sex, and socioeconomic status: a population-based cohort study of 22 million individuals in the UK” by Nathalie Conrad et al. The Lancet, 5 May 2023.

5 “Changing of the guard: Immunology at an inflection point” by Markus Gores, IQVIA, 3 August 2023.

IMPORTANT INFORMATION

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Comunicazione di Marketing.

Important information

Please read the following important information regarding funds related to this article.

- Le Azioni/Quote possono perdere valore rapidamente e normalmente implicano rischi più elevati rispetto alle obbligazioni o agli strumenti del mercato monetario. Di conseguenza il valore del proprio investimento potrebbe diminuire.

- Le azioni di società a piccola e media capitalizzazione possono presentare una maggiore volatilità rispetto a quelle di società più ampie e talvolta può essere difficile valutare o vendere tali azioni al momento e al prezzo desiderati, il che aumenta il rischio di perdite.

- Un Fondo che presenta un’esposizione elevata a un determinato paese o regione geografica comporta un livello maggiore di rischio rispetto a un Fondo più diversificato.

- Il Fondo si concentra su determinati settori o temi d’investimento e potrebbe risentire pesantemente di fattori quali eventuali variazioni ai regolamenti governativi, una maggiore competizione nei prezzi, progressi tecnologici ed altri eventi negativi.

- Il Fondo potrebbe usare derivati al fine di conseguire il suo obiettivo d'investimento. Ciò potrebbe determinare una "leva", che potrebbe amplificare i risultati dell'investimento, e le perdite o i guadagni per il Fondo potrebbero superare il costo del derivato. I derivati comportano rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Il Fondo può sostenere un livello di costi di operazione più elevato per effetto dell’investimento su mercati caratterizzati da una minore attività di contrattazione o meno sviluppati rispetto a un fondo che investa su mercati più attivi/sviluppati.

- Il Fondo potrebbe perdere denaro se una controparte con la quale il Fondo effettua scambi non fosse più intenzionata ad adempiere ai propri obblighi, o a causa di un errore o di un ritardo nei processi operativi o di una negligenza di un fornitore terzo.