Manage market vertigo with balanced strategies

The Portfolio Construction and Strategy Team explain how a successful allocation to a balanced fund may help encourage investors to stay the course through volatility and avoid the temptation of market timing.

3 minute read

This article is part of the latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

A successful allocation to a balanced fund may help investors manoeuvre these difficult markets by encouraging them to stay the course and avoid the temptation of market timing.

YTD Recap

- During the first half of the year, equities entered into bear market territory as a result of rising global inflation, geopolitical conflict and central banks embarking on a regime of quantitative tightening (QT).

- Unfortunately, this strong shift to QT sent bond returns sharply negative alongside equities, resulting in underwhelming performance for the classic “60/40” equity/bond portfolio.

- In fact, the 60/40 has seen its worst six-month drop since 1988 and its second-worst year (so far) in total returns since the Global Financial Crisis in (-16.1% in the first half of 2022 vs. -22.1% in 2008).

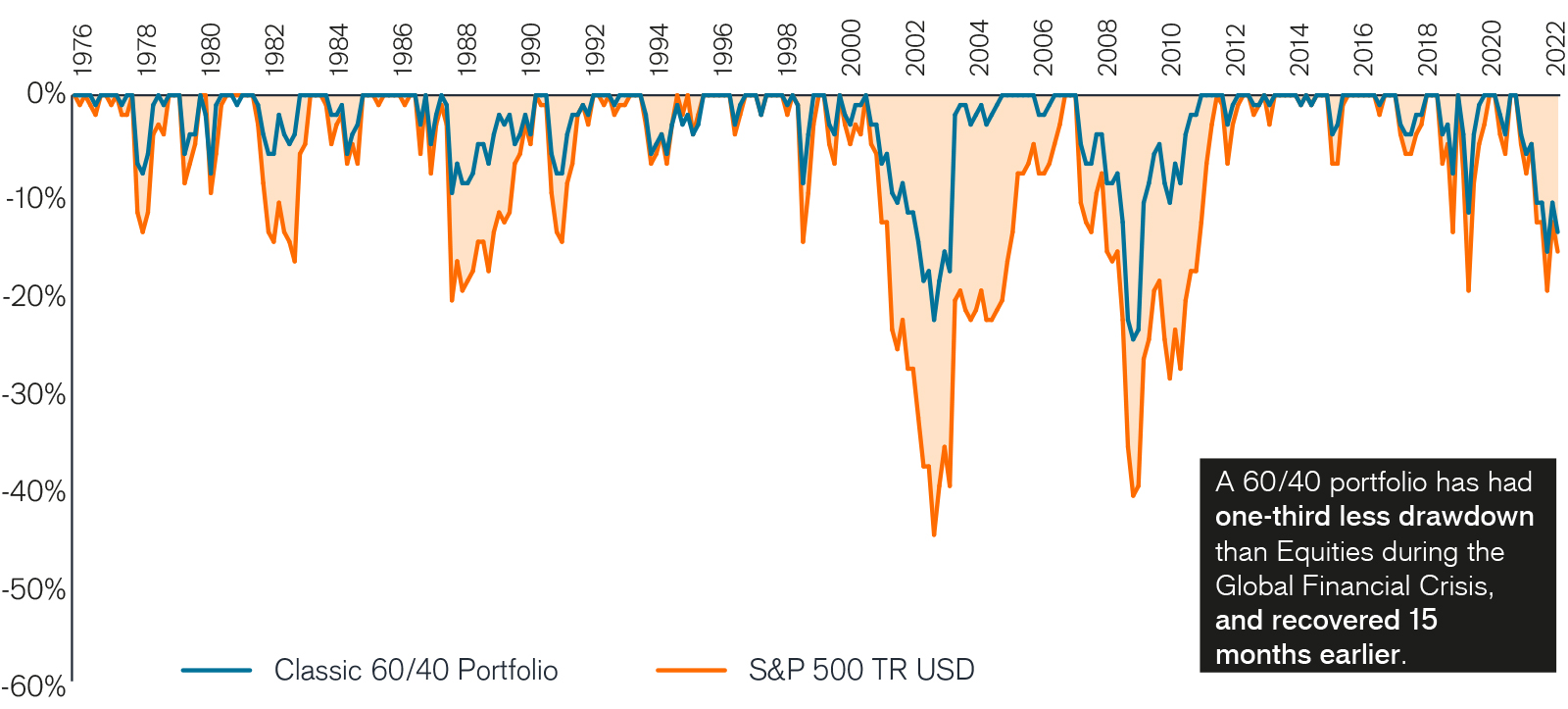

Diversification and risk mitigation: The 60/40 portfolio historically experienced lower drawdowns and faster recoveries

Source: Bloomberg, Portfolio Construction and Strategy, as of 31 August 2022.

Outlook

- The sell-off in both equity and fixed income markets can largely be attributed to the shift from a quantitative easing to a tightening environment, and we believe much of the repricing has already occurred.

- A successful allocation to a balanced fund may help investors manoeuvre these difficult markets by encouraging them to stay the course and avoid the temptation of market timing.

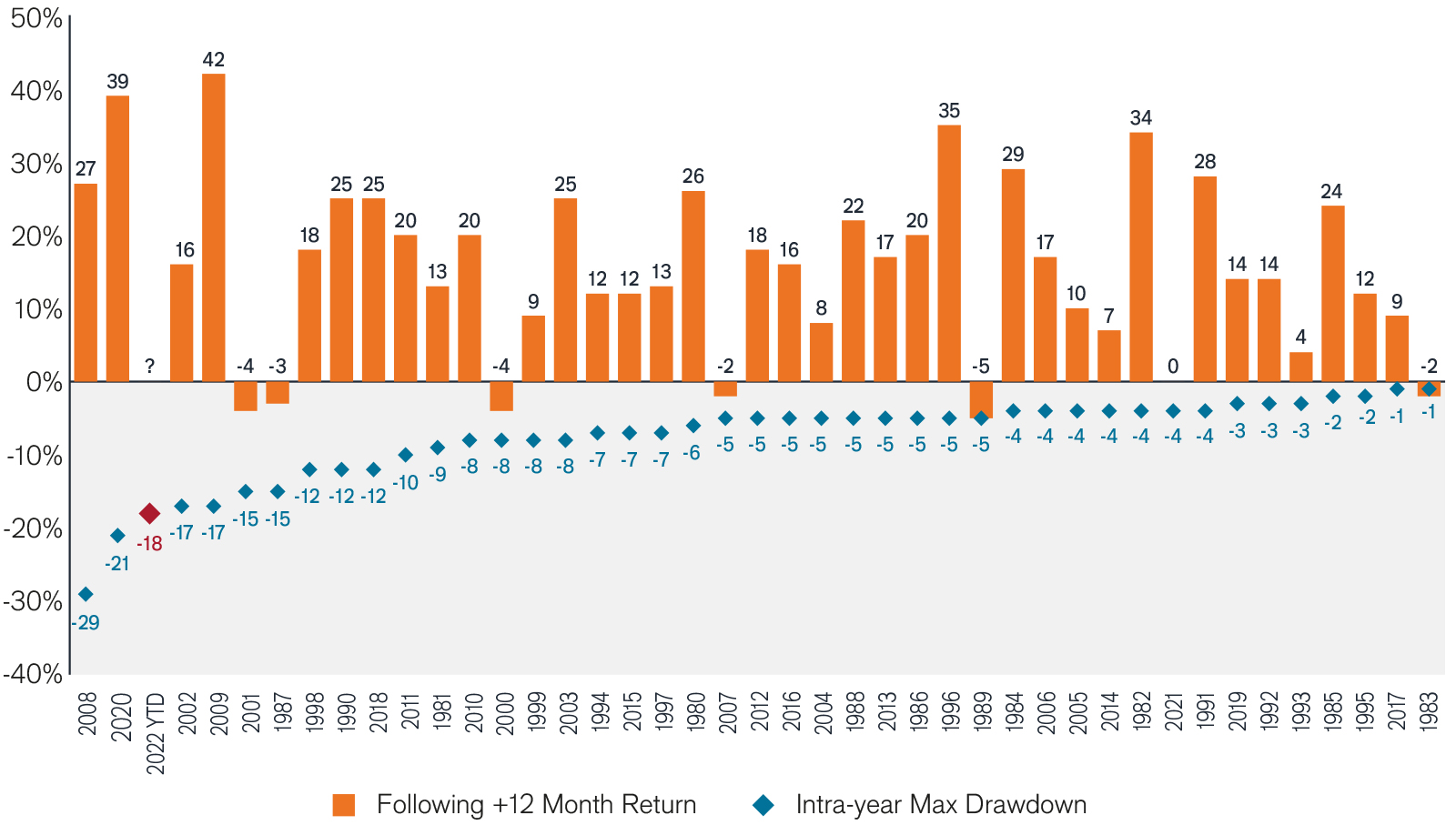

- Although returns have been painful, a double-digit decline in a 60/40 portfolio is not uncommon. History shows us that investors who were patient with their portfolios during corrections were often rewarded with a rebound within the 12 months following a bear market.

The 60/40 portfolio intra-year declines in perspective

Source: Morningstar, Portfolio Construction and Strategy, as of 31 August 2022.

PCS Perspective

- Balanced strategies comprise a large, diverse category of managers that can be primarily used in three different ways, with three different risk considerations:

- To outsource an entire portfolio: Consider pairing differentiated managers to reduce idiosyncratic risk

- As a core portfolio: Counter intuitively, seek out managers with higher correlations to a typical 60/40 allocation, indicating high core and lower satellite exposures, but with solid alpha generating credentials.

- As a tactical overlay: Avoid managers categorised as merely “static” or “dynamic” and focus on “flexible” (i.e., largely unconstrained) managers to maximise

- A successful 60/40 “balanced” allocation needs a clear intention as to its role in the broader portfolio, including risk behaviour, time horizon, and objective, as well as a thorough due diligence of its regional, sector, and asset class exposures.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Comunicazione di Marketing.