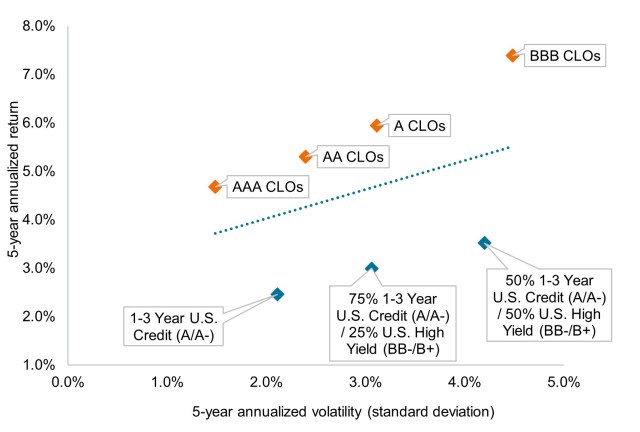

In den letzten fünf Jahren haben Collateralized Loan Obligations (CLOs) einige der besten risikobereinigten Renditen erzielt, die auf den Anleihenmärkten verfügbar sind.

Unsere Markteinblicke

Unsere aktuellsten Ideen zu den für die Anlagelandschaft von heute wichtigen Themen vorstellt. Entdecken Sie zeitnahe Updates, vierteljährliche Beiträge und ausführliche Analysen direkt von unseren Anlageexperten.

Europa steht vor Herausforderungen, doch die zunehmende Reformdynamik und strukturelle Rückenwinde verändern seine Investitionsaussichten.

Die breite Streuung im Jahr 2026 schafft ein starkes Umfeld für selektive Global Small Caps-Anlagen.

Eine Debatte über Wertsteigerungschancen bei Unternehmensanleihen, besicherten Kreditschuldverschreibungen und Hypotheken und warum es 2026 entscheidend sein wird, jeden Kredit wirklich zu verstehen.

Aktiv oder passiv? Wie ein gemischter Ansatz bei globalen Aktien besser funktionieren könnte

Da die Trump-Regierung bereits in ihr zweites Jahr geht, liegt der Schwerpunkt auf der Erschwinglichkeit von Aktien, sodass sich Anleger überlegen müssen, was die jüngste Politik des Präsidenten für die Märkte bedeuten wird.

Die Spannungen zwischen den USA und der EU eskalieren, da neue US-Zölle die europäische Einheit stärken und die Risiken einer Markteskalation erhöhen.

Wird die Halbleiterindustrie im KI-Überschwang zur notwendigen „Stimme der Vernunft“?

CLOs mit BBB-Rating vereinen Ertrags-, strukturelle Widerstandsfähigkeit- und Diversifizierungsvorteile und bieten damit eine alternative Möglichkeit, das Kreditengagement für ein spätzyklisches Umfeld enger Kreditspreads umzugestalten.

Greg Wilensky erläutert, warum er nach einem außergewöhnlichen Jahr für den gesamten Anleihemarkt im Jahr 2025 für das kommende Jahr optimistisch ist. Er konzentriert sich dabei jedoch eher auf die Einnahmeerträge als auf eine erhebliche Spread-Kompression.

Welche Auswirkungen hat der Sieg von Donald Trump auf die Risikobereitschaft, die Schwellenmärkte und die Geopolitik?