Jay Sivapalan, Head of Australian Fixed Interest explores how investor complacency is masking growing credit vulnerabilities, and making disciplined risk compensation, diversification and active downside protection essential as defaults are likely to rise from historic lows.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

The severity and duration of crude oil price volatility depend upon how the conflict could impact energy infrastructure and/or shipping in the Strait of Hormuz.

An early reaction to military strikes in Iran and the implications for investors.

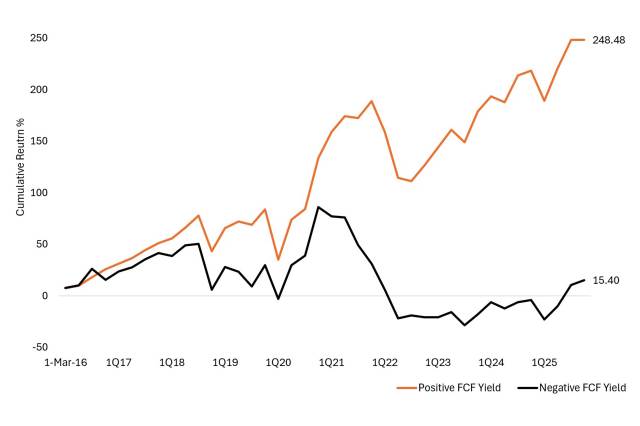

A divergence in performance between positive and negative cash-flow businesses could signal opportunity for investors focused on quality factors.

Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Why active management, fundamental research, and selectivity across sectors are key to identifying opportunities while managing volatility in fixed income.

Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

Where to find climate adaptation investment opportunities in an era of rising physical risks.

Explore our 2026 sustainable investment outlook: AI-driven industrialisation, clean tech momentum, climate challenges, and key trends shaping markets and sustainability.