Over the last 12 months, the global economy and financial markets have been transformed. Inflation has soared, interest rates have been raised by central banks across the world, and equity and bond markets have been volatile.

Maintaining income with the prospects of capital growth in a high inflation and uncertain economic environment are the main challenges facing investors. So, this is a time to look for income stability, fundamental value and a diverse investment portfolio that can weather the years ahead.

The Henderson High Income Trust (HHI) has a track record of delivering exactly this combination of income stability and growth.

The strategy is to invest in a diversified selection of companies capable of delivering a high-income stream, while maintaining the prospect of capital growth. Investments also include a selection of bonds – fixed income investments that bring an extra layer of security against economic uncertainty.

Many of the companies held by HHI are household names – businesses that are deeply embedded in people’s daily lives and well placed to sustain their earnings in an uncertain economic environment. Utilities, healthcare and consumer staples represent a large part of the trust’s investments and HHI’s biggest holdings include the likes of Unilever, AstraZeneca, Tesco, British American Tobacco, and Diageo. These businesses, and others like them, have strong and sustainable cash flows that can deliver dividend income to HHI and its investors.

But it is not sheer size that is most important. The key is to seek out companies that have fundamental strength both as income generators and as a store of potentially rising capital value. HHI also takes a close interest in small and medium sized businesses that share these fundamental qualities.

A strategy for income and capital growth

HHI selects investments that have a robust and straightforward business model, an established position as market leaders in their field, high barriers to entry for potential rivals and, of course, a strong management team.

Company financials must be as robust as the business model, so it looks for sustainable profits, good earnings visibility, and strong cash flows. Alongside those earnings and cash flows, there needs to be a robust balance sheet helping to protect a company and its dividend paying ability in more difficult times.

Finally, it places emphasis on those businesses that continually invest; it’s all very well paying a dividend today, but consistent investment underpins future dividend growth, the key to long term total returns.

Diversifying for security

Investing across large and mid-cap businesses is one dimension of HHI’s diversified investment strategy, but the trust also has the option of investing up to 30% of its assets overseas and up to 40% of its gross assets in bonds.

The trust’s bond investment capability is an important cornerstone of its approach and one that is particularly important in the more uncertain economic time we all face. Coupons from corporate bonds are fixed and so provide an income to the trust and its investors that is more resilient in the event of an economic downturn.

Good performance

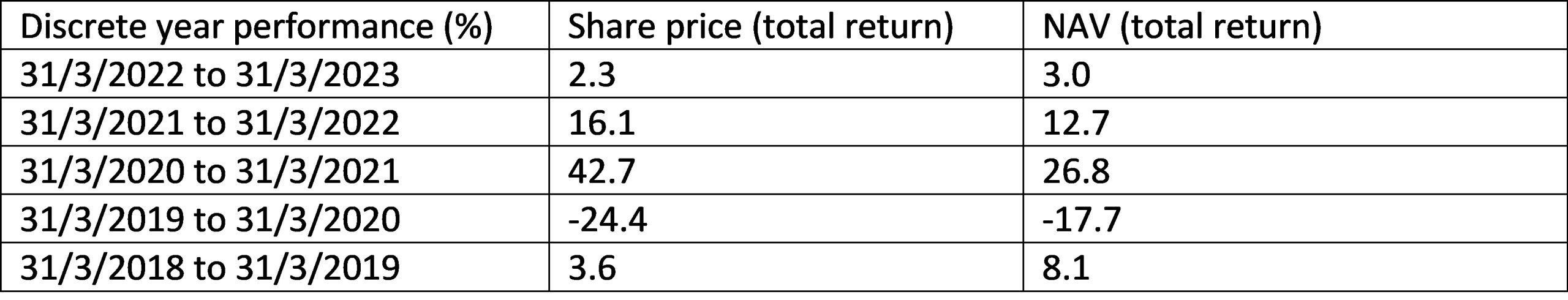

HHI’s strategy of focusing on the most robust cash-generative companies and including an overseas and fixed income element in its portfolio has paid dividends.

Taking a longer-term view, the high starting income yield plus 10 years of consecutive dividend growth has meant a £10,000 invested in HHI ten years ago would have delivered £6,700 in gross income over that period – 50% more than investing the equivalent sum in the FTSE All-Share Index. And there has been capital growth too, with the net asset value of HHI up 107% on a total return basis over the last ten years.

This historic dividend growth track record is why Henderson High Income Trust has been designated a Next Generation Dividend Hero by the Association of Investment Companies.

In the new economic environment, it has never been more important to include a bedrock of income stability into portfolios. With its diversified investments selected for robust fundamentals and resilient cash flows, Henderson High Income Trust could be exactly what investors are looking for.

Past performance does not predict future returns

Glossary

Balance sheet – A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Cash flow – Cash that a company generates after allowing for day-to-day running expenses and capital expenditure. It can then use the cash to make purchases, pay dividends or reduce debt.

Diversification – A way of spreading risk by mixing different types of assets/asset classes in a portfolio. It is based on the assumption that the prices of the different assets will behave differently in a given scenario. Assets with low correlation should provide the most diversification.

Net asset value (NAV) – The total value of a fund’s assets less its liabilities.

Volatility – The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.

Disclaimers:

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson and Knowledge Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Important information

Please read the following important information regarding funds related to this article.

- If a Company's portfolio is concentrated towards a particular country or geographical region, the investment carries greater risk than a portfolio that is diversified across more countries.

- Some of the investments in this portfolio are in smaller company shares. They may be more difficult to buy and sell, and their share prices may fluctuate more than those of larger companies.

- This Company is suitable to be used as one component of several within a diversified investment portfolio. Investors should consider carefully the proportion of their portfolio invested in this Company.

- Active management techniques that have worked well in normal market conditions could prove ineffective or negative for performance at other times.

- The Company could lose money if a counterparty with which it trades becomes unwilling or unable to meet its obligations to the Company.

- Shares can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The return on your investment is directly related to the prevailing market price of the Company's shares, which will trade at a varying discount (or premium) relative to the value of the underlying assets of the Company. As a result, losses (or gains) may be higher or lower than those of the Company's assets.

- The Company may use gearing (borrowing to invest) as part of its investment strategy. If the Company utilises its ability to gear, the profits and losses incurred by the Company can be greater than those of a Company that does not use gearing.

- All or part of the Company's management fee is taken from its capital. While this allows more income to be paid, it may also restrict capital growth or even result in capital erosion over time.