Return of the cost of capital: Back to fundamentals

A higher cost of capital has placed greater emphasis on efficient capital allocation decisions and has created a rich environment for stock picking within the technology sector, according to Portfolio Manager, Richard Clode.

5 minute read

Key takeaways:

- In 2020-2021, pandemic-induced ‘free money’ led to the collapse in cost of capital which facilitated some poor capital allocation decisions.

- Through 2022 and 2023 the global rise in interest rates resulted in a pivot in market sentiment away from ‘growth at any price’ to companies that are demonstrating profitable growth and are well positioned to fund their own growth.

- Greater dispersion in stock price returns creates more opportunity for stock pickers particularly in the rapidly evolving tech sector.

Free money = poor asset allocation and financial turmoil

The pandemic led to the confluence of a pull-forward acceleration of technology growth in many areas and ‘free money’ with zero interest rates and quantitative easing as central banks attempted to repair the damage to economies from lockdowns. The cost of capital collapsed as demand for digital transformation soared, which inevitably led to some poor capital allocation decisions. For context, in its fiscal year 2021 (ending March 2022) the Softbank Vision Fund (SVF) invested $44.3bn into private technology startups1. Bitcoin moved above $60,000 for the first time, and the Morgan Stanley Unprofitable Technology basket peaked after a 343% rally from the March 2020 lows.2 During this time there were 300 SPAC IPOs (Special Purpose Acquisition Company Initial Public Offerings)3 and almost 40% of US-listed technology companies were unprofitable.4

The reopening of economies post pandemic accelerated demand and along with it, ongoing supply constraints – a recipe for inflation necessitating rising interest rates. Rising interest rates were of course detrimental to assets built on free money, exemplified by the 74% drawdown in both the Morgan Stanley Unprofitable Technology basket and Bitcoin. There were only eight SPAC IPOs by Q4 2022 and the Softbank Vision Fund only invested $4bn in the whole of its fiscal year 2022; the fund’s quarterly rate of investment fell by 97%.

The reduced funding pipeline for private companies ultimately led to the demise of Silicon Valley Bank (SVB), which was the ‘go to’ bank for the technology venture capital (VC) industry and startup companies. One of the largest VC companies, Sequoia Capital, held just over $1 billion of cash on deposit at SVB5 and encouraged many of its investee startups to bank with SVB. But once the VC investment cheques dried up and deposits were drawn down, as most of the startups were loss making and burning cash, SVB soon ran into trouble.

Technology sector bifurcation, back to fundamentals

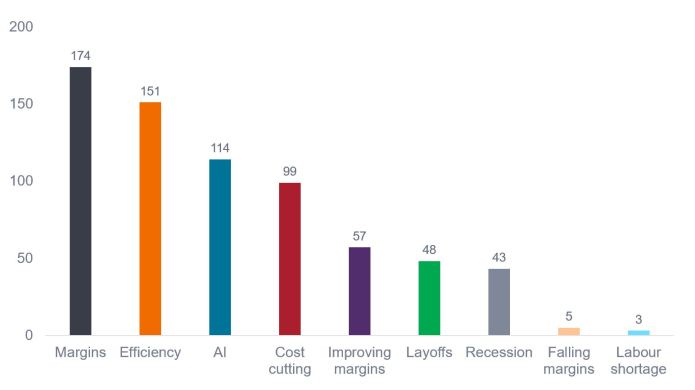

The headlines associated with the demise of unprofitable technology stocks impacted investor sentiment towards the wider technology sector. Investors pivoted away from ‘growth at any price’ towards companies demonstrating profitable growth, cash flows and are able to self-fund. At Morgan Stanley’s flagship technology conference in March, keywords mentioned during company presentations were tracked; margins, efficiency, cost-cutting and layoffs were the most mentioned – figure 1. Mark Zuckerberg coined the term “Year of efficiency” in his letter to employees at Meta earlier this year – (the stock is up by more than 100% year-to-date). 6

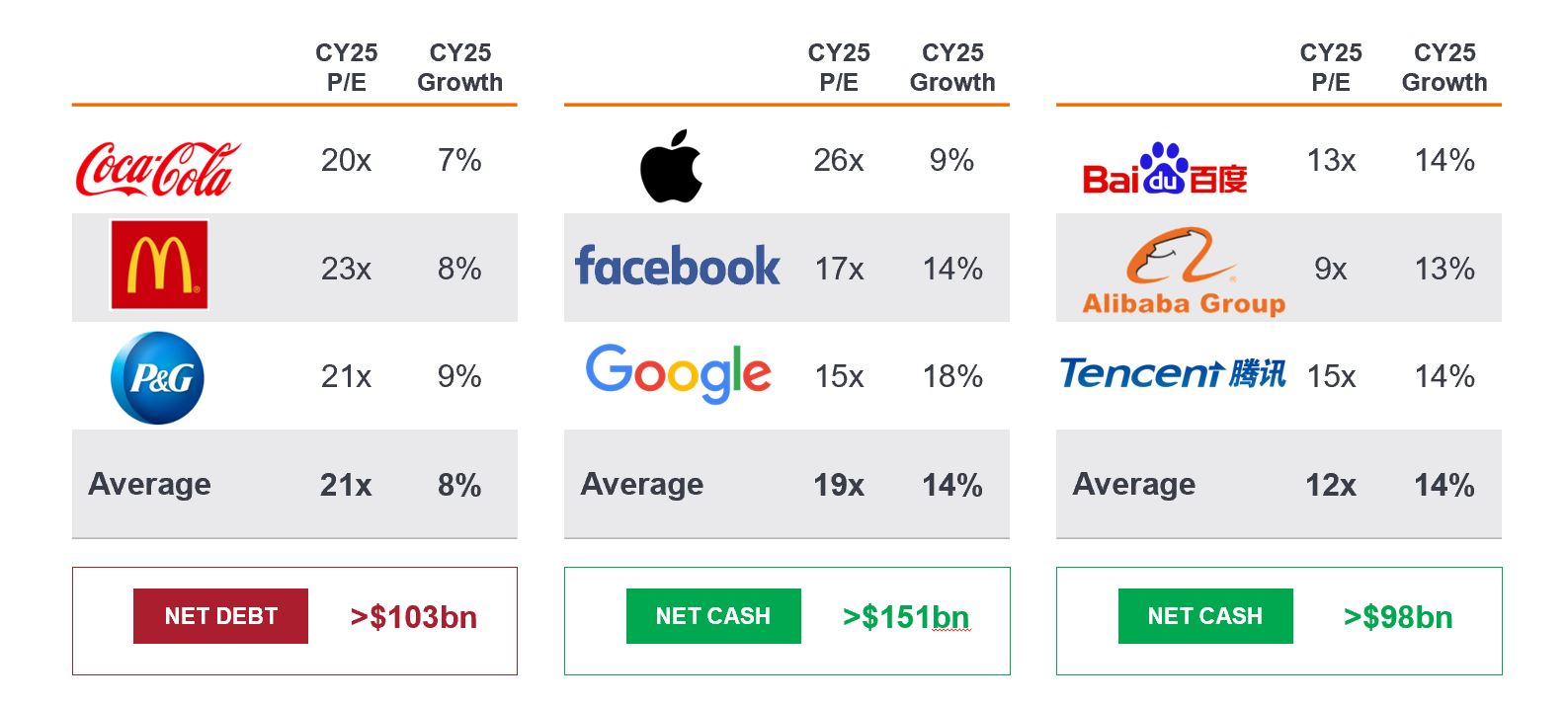

At the same time, balance sheet concerns resurfaced after the mini banking crisis and the strength of ‘big tech’ balance sheets were finally rewarded. In the space of two weeks, Alphabet announced a new $70 billion and Apple a new $90 billion share buyback during the companies’ last results.

Figure 1: Pivot to fundamentals: most referenced keywords

2023 MS TMT Conference – Transcript Count

Source: AlphaSense, Morgan Stanley Research as at March 2023.

Source: AlphaSense, Morgan Stanley Research as at March 2023.

The combination of strong balance sheets, large profits and cash flows enabling self-funding of significant investments into major new technology inflections like artificial intelligence (AI) has been recognised by the market. The term “magnificent 7” was coined to describe an amalgamation of Apple, Alphabet, Amazon, Meta, Microsoft, NVIDIA and Tesla that have dominated stock market returns this year. These companies differ in many ways but what they have in common has been profitable growth, strong balance sheets and in many cases a new commitment to cut costs and expand margins while most have strong positions in AI to boot. This should be an alluring combination to investors in a world where the cost of capital has returned to more normalised levels.

Figure 2: Balance sheets matter in a rising rate environment

Source: Janus Henderson Investors, Bloomberg consensus estimates and Bloomberg Net debt and Net cash, as at 12 July 2023. Data presented is based on forecasts (excluding Net debt and Net cash). For illustrative purposes and not indicative an of any actual investment. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Expertise essential

While the ‘magnificent 7’ have all performed strongly in 2023, they vary widely in terms of valuation and growth potential, and we see greater disparity emerging. We also see a rich depth of opportunities in the sector beyond these names, in companies with strong long-term profitable growth outlooks and reasonable valuations.

We are experiencing a return to fundamental investing where share prices are correlated to positive earnings revisions as they should be, rather than largely pinned on expectations and the latest themes. Greater dispersion in stock price returns creates more opportunity for stock pickers especially in the technology sector as we transition from the mobile internet era that currently dominates, to a future world of AI where new leaders and laggards will emerge. Stock picking based on fundamental analysis is well suited to this environment.

While almost zero interest rates and quantitative easing have been the backdrop since the Global Financial Crisis, investors with a track record of stock picking in a world of more normalised cost of capital, coupled with experience of multiple market and tech disruption cycles are well positioned to navigate this new paradigm.

Footnotes

1 Softbank Group earnings presentation May 2023.

2 Bloomberg, Morgan Stanley Unprofitable Technology Index (MSXXUPT) Index.

3 Statista, Quarterly number of SPAC IPOs worldwide 2022.

4 Janus Henderson Investors, Bernstein, as at 31 March 2023. Unprofitable Technology stocks (# Unprofitable Technology Stocks/Total number of Technology Stocks in Largest 1500 stocks in USA).

5 Bloomberg, FDIC insured billions in deposits for Sequoia, 23 June 2023.

6 Bloomberg, year-to-date returns to 15 August 2023. Past performance is not a guide to future results.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. A strong balance sheet is an indicator of strong financial position for a company. Share buybacks: the repurchase of shares by a company, thereby reducing the number of shares outstanding. This gives existing shareholders a larger percentage ownership of the company. It typically signals the company’s optimism about the future and a possible undervaluation of the company’s equity. QE: an unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system. SPAC: a special purpose acquisition company (SPAC) is a corporation formed for the sole purpose of raising investment capital through an initial public offering (IPO).

IMPORTANT INFORMATION

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.