The power within: Decarbonisation in high yield bonds

Portfolio managers Brent Olson and Tim Winstone, explore the high yield asset class and demonstrate how its heavier exposure to industrials need not hold it back from decarbonisation.

7 minute read

Key takeaways:

- By its nature, the high yield asset class has a significant exposure to cyclical and industrial areas of the economy.

- Even among bond issuers in the most carbon-intensive sectors, initiatives are taking place that, over time, can reduce costs, lower carbon emissions and offer new sources of revenue.

- The asset management industry can lend its voice to fostering changes that are positive from both a credit fundamentals and an environmental perspective.

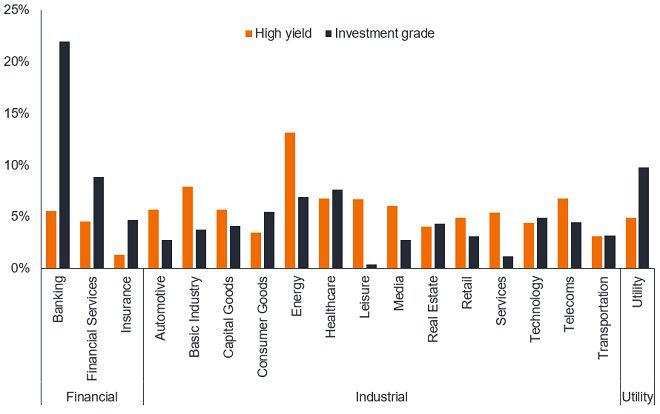

Take a snapshot of the global investment grade corporate bond market and the global high yield corporate bond market and chances are that the high yield bond sector will have a higher weighting to industrials. As Figure 1 shows that rings true today.

Figure 1: Sector weights within global high yield and investment grade corporate bond universe

Source: Bloomberg, Investment grade = ICE BofA Global Corporate Index, High yield = ICE BofA Global High Yield Index, sector weights as at 31 May 2023.

There is some logic to this. First, the high yield market tends to be more exposed to cyclical sectors where greater variability in earnings often leads to credit rating agencies giving a sub-investment grade rating to the company. Second, companies needing to raise finance for big projects tend to take on more leverage, which is again something that can lead to a lower credit rating. Third, companies raising capital for the first time or for new or exploratory projects such as mines or oil fields will often find that they are rated high yield until their operations are more proven.

Today, the industrial sector makes up approximately 85% of the global high yield corporate bond market compared with 55% of investment grade corporates (as at 31 May 2023). Moreover, energy, basic industry, capital goods, automotive and transportation – which comprise some of the most carbon-intensive sub-sectors such as oil and gas, mining, machinery, packaging, and air transportation – constitute around 35% of the high yield universe.1

A pragmatic approach to decarbonisation

Unless a fund has blanket exclusions for specific areas, it is difficult to avoid carbon-intensive borrowers in high yield without heavily narrowing the investment universe. Moreover, many of these companies provide products and services that are either necessary for the global economy to function or will be required through the transition to a low-carbon economy.

In our opinion, a pragmatic approach is to recognise that many of these companies operate in hard-to-abate sectors. Rather than avoiding them we focus on (a) encouraging them to do better through engagement and (b) allocating capital to those that are best managing environmental, social and governance (ESG) risks and opportunities – these companies are best positioned to succeed in the future. It is this practical, research-based and forward-looking approach that treats ESG factors in the same way we do any other fundamental, financially material factor that we believe can help us to identify good credits.

Extracting efficiencies

An example of a company whose bonds we hold and that is making considerable efforts to decarbonise is Fortescue Metals Group (FMG). Its decarbonisation efforts are reflected in our ‘Yellow’ proprietary ESG rating. FMG is a mining company that extracts iron ore. S&P Global Ratings gives the company a credit issuer rating of BB+, while Moody’s similarly applies Ba1, at the top-end of the sub-investment grade credit rating scale.2 While mining is an industry that scores poorly overall from an ESG perspective, we view this company as making demonstrable efforts to address its environmental impact.

Specifically, FMG’s strategy is to transition to a global green energy and metals company. To meet this objective, it has undertaken a strategic review of its entire power plant operations (through investment in renewables, energy storage and transmission, it is seeking to displace the diesel and gas-fired power generation at its mines). Executive long-term incentive plans are linked to emission reduction targets, including carbon neutrality across its operations (net zero Scope 1 and 2 emissions) by 2030. The company has committed to Science Based Targets Initiative (SBTi) emissions targets (to be approved). It is shifting its haulage fleet towards zero emissions vehicles with Liebherr and is developing the world’s first ‘infinity train’ that will capture enough energy on the loaded downhill journey not to require additional charging for the return trip.

It has also created a subsidiary, Fortescue Future Industries (FFI), which is working on developing technologies to help decarbonise and is building a portfolio of green hydrogen and green ammonia projects. The company’s initiatives make economic sense and should allow it to achieve operating cost savings through the elimination of diesel, natural gas, and carbon offset purchases from its supply chain. Furthermore, they should make FMG more resilient to climate transition risks (regulatory, legal and reputational), which ought to reduce medium-to-long term credit risk.

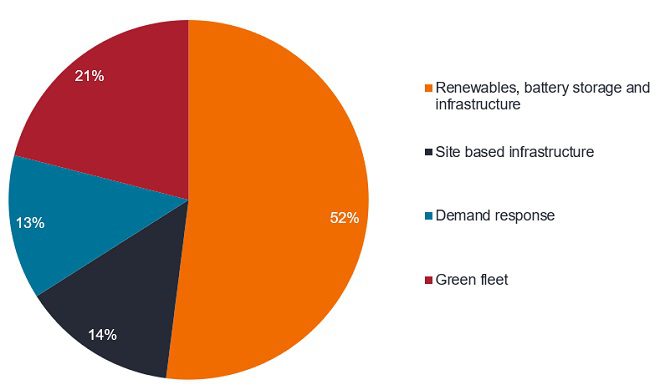

Over the period of (largely) 2024-2028, FMG expects to invest about US$6.2bn split across different initiatives as shown in Figure 2.

Figure 2: Capital investment breakdown by type

Source: Fortescue Metals Group, Macquarie, November 2022.

Oiling the wheels of change with carbon capture

Like mining, the oil sector is a high carbon emitter. The war in Ukraine refocused interest on the oil and gas industry as countries increasingly seek to balance sustainability, affordability and energy security (the energy ‘trilemma’ as it is often known). To give an example from the oil and gas industry, an oil company whose bonds we held in some of our high yield portfolios until recently was Occidental Petroleum (Oxy). Its credit fundamentals were improving, with high oil prices allowing it to pay off around a third of its outstanding debt in 2022.3

As part of our engagement work with the issuers in high ESG risk sectors, we engaged with Oxy in March 2023 regarding its initiatives to decarbonise, with a focus on Direct Air Capture (DAC). This removes C02 from the air and converts it to a liquid to be sequestered (stored away) or used as a feedstock. The economics of DAC are driven by carbon credit buyers and its first plant is set to start in 2025, offering a potentially new source of revenues for the company. Overall, whereas this project alone is not sufficient to change Oxy’s ESG risk profile (our proprietary ESG rating for the company is ‘Red’, signifying material ESG risks), we will continue to monitor the company’s progress in using innovation to aid its decarbonisation initiatives and we will conduct ongoing engagements with the company.

The company is rated sub-investment grade by S&P, but investment grade by Moody’s.4 On 16 May 2023, Fitch upgraded its rating on the company to BBB-, the effect of which was to propel Oxy up into investment grade from high yield in most indices from 1 June 2023. The upgrade was not insignificant as it removed US$15bn of bonds from the ICE BofA US High Yield Index, leaving the energy sector within US high yield at its lowest percentage weight (10.1%) since 2008.5 Its bonds have also exited the ICE BofA Global High Yield Index. As much of the credit improvement was now priced in and to avoid holding too much investment grade within a high yield mandate, we sold our holding in Occidental Petroleum.

Taken together, we see these as representative examples of how companies in hard-to-abate sectors such as mining and oil and gas are rising to the challenge of decarbonisation. Change is happening from within as companies respond to stricter environmental legislation and shifting consumer opinion. As suppliers of debt (and equity) capital, we can also lend our voice to change that makes sense from both a long-term credit and ESG perspective. The latter needs to be looked at thoughtfully and to recognise that decarbonisation in higher-emitting industries is a long-term journey. Through our active engagement with companies, we seek to ensure we have a thorough understanding of how companies are managing climate mitigation and to play an important role as credit investors in the ultimate success of companies in this crucial transition.

Footnotes

1Source: Bloomberg, sector weights for high yield relate to ICE BofA Global High Yield Index and for investment grade ICE BofA Global Corporate Index, as at 31 May 2023

2Source: Refinitiv Eikon, ratings correct as at 20 June 2023.

3Source: Oxy 2022 Annual Report, page 48. Oxy repaid US$10.5 billion, reducing the face value of its debt to less than US$18 billion by 31 December 2022.

4Source: Refinitiv Eikon, ratings correct as at 20 June 2023.

5Source; Morgan Stanley, Energy Credit Research, 22 May 2023.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Credit risk: The risk that a borrower will default on its contractual obligations to investors, by failing to make the required debt payments. Anything that improves conditions for a company can help to lower credit risk.

Corporate bonds: A debt security issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue.

Cyclical stocks: Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Decarbonisation: The process of reducing the amount of carbon, mainly carbon dioxide (C02), sent into the atmosphere.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due. The default rate is a measure of defaults over a set period as a proportion of debt originally issued.

ESG rating: Third parties provide ratings that score companies according to their commitment to ESG factors. Janus Henderson additionally operates a proprietary ESG rating framework. This classifies companies according to the materiality of ESG risks and whether they are on a positive trajectory. ‘Green’ are issuers that are not materially exposed to ESG risks or for which ESG is a strength. ‘Blue’ are issuers with emerging ESG challenges that are not yet material but could become so if not addressed. ‘Yellow’ are issuers facing material ESG risks but have a credible action plan to manage these risks. ‘Red’ are issuers exposed to significant ESG risks which we believe are not being adequately managed. ‘Dark red’ are issuers where ESG risks are too elevated for us to hold the credit.

Hard to abate sector: Those sectors for which the transition to net zero is either technologically or financially difficult.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

ICE BofA Global Corporate Index tracks the performance of investment grade corporate debt publicly issues in the major domestic and eurobond markets.

ICE BofA Global High Yield Index tracks the performance of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or eurobond markets.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Leverage: The level of debt at a company.

Net zero: A state in which greenhouse gases, such as Carbon Dioxide (C02) that contribute to global warming, going into the atmosphere are balanced by their removal out of the atmosphere

Ratings/credit ratings: A score assigned to a borrower, based on their creditworthiness. It may apply to a government or company, or to one of their individual debts or financial obligations. An entity issuing investment grade bonds would typically have a higher credit rating than one issuing high yield bonds. The rating is usually given by credit rating agencies, such as S&P Global Ratings: within high yield bonds, for example, a bond rated BB is deemed higher quality than a bond rated B, which is deemed higher quality than a bond rated CCC or below.

SBTi: Science Based Targets Initiative defines and promotes best practice in emissions reductions and net zero targets in line with climate science.

Scope 1 emissions are greenhouse gas emissions that a company makes directly such as running a vehicle. Scope 2 emissions are indirect emissions from the generation of purchased energy.

Yield: The level of income on a security, typically expressed as a percentage rate. For a bond this is calculated as the annual coupon payment divided by the current bond price.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.