As ISA season revs into gear, investors are faced with a very different environment to last year. Most observers are forecasting an interest rate decline at some point in the next year, while inflation is coming down. Here, we examine the landscape for UK income at this time.

After a troubled couple of years, the economic picture is slowly improving. Global data points, like unemployment and growth, broadly point to a “soft landing”. This means that economies could emerge from the high inflation period with either a shallow recession or none at all. However, this outcome is not guaranteed. Further, economists and markets generally agree that interest rates are likely to remain higher than they have been over the last decade and a half.

This environment should favour The City of London Investment Trust’s chosen investments –companies that have strong, established positions in their industries. These companies tend to hold enough cash to cover crises. This means they won’t have to take out loans or debt at high interest rates if times get tough.

Examples include CTY’s largest two holdings, BAE Systems and RELX. BAE Systems, the defence company, is experiencing growth as the post-Cold War peace consensus breaks down. As governments are its key client, orders are less effected by the economic outlook. Its sales grew 9% in 2023 and it has raised its dividend by 11%.

RELX is a leading global provider of information and analytics for businesses. It is positioned to benefit from using AI in its services. It also has an exhibitions division, which suffered during the Covid lockdowns but has recovered well. It increased its turnover by 7% in 2023 and raised its dividend by 8%.

The recovery in global economies is not always even. In the second half of 2023, the UK officially went into recession, although the fall in GDP was modest – -0.1% between July & September and -0.3% between October & December.

Despite being listed in the UK, the businesses CTY invests in are not necessarily harmed by a weak economy. This is because they make much of their revenue, around 70% on average across the trust’s portfolio, from overseas.

At the same time, UK-listed shares tend to be cheaper than those listed elsewhere. Look at the price-to-earnings ratio – a measure of how “expensive” a stock based on the amount of the money the company brings in – of the major indexes. The FTSE 100 currently has an average ratio of 14.4, while the US S&P 500 sits at 22.2. Part of this difference is due to the much larger number of technology stocks in the US stock market, but it does not explain it all.

When investing in a UK-listed company that sells a lot of its products or services overseas, investors can benefit from these revenues more cheaply than they would in other markets. Examples of companies that fit this mould are Shell and Unilever, both of which operate globally.

The ultimate halo effect of the UK income segment is its dividends. As previously mentioned, valuations in the UK are relatively low. Comparatively high pay-outs from companies go some way to compensating investors while they wait for share prices to rise.

CTY is the leader for longevity of dividend payments among investment trusts, having increased its dividend for 57 consecutive years. At the year ended 31 December 2023, its dividend yield sat at 4.9%, above both its FTSE All Share benchmark at 3.8% – the index that it measures itself against – and the AIC UK Equity Income peer group at 4.7%.

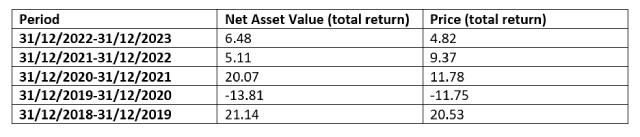

Discrete performance

As at 31/12/2023. Source: Morningstar. Past performance does not predict future returns.

Click here for more information on The City of London Investment Trust

Glossary

Dividend

A variable discretionary payment made by a company to its shareholders.

Economic cycle

The fluctuation of the economy between expansion (growth) and contraction (recession), commonly measured in terms of gross domestic product (GDP). It is influenced by many factors, including household, government and business spending, trade, technology and central bank policy. The economic cycle consists of four recognised stages. ‘Early cycle’ is when the economy transitions from recession to recovery; ‘mid-cycle’ is the subsequent period of positive (but more moderate) growth. In the ‘late cycle’, growth slows as the economy reaches its full potential, wages start to rise and inflation begins to pick up, leading to lower demand, falling corporate earnings and eventually the fourth stage – recession.

Inflation

The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures. The opposite of deflation.

Price-to-earnings (P/E) ratio

A popular ratio used to value a company’s shares, compared to other stocks, or a benchmark index. It is calculated by dividing the current share price by its earnings per share. It is calculated by dividing the current share price (P) by its earnings per share (E).

Valuation metrics

Metrics used to gauge a company’s performance, financial health and expectations for future earnings, eg. price to earnings (P/E) ratio and return on equity (ROE).

Yield

The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price. For investment trusts: Calculated by dividing the current financial year’s dividends per share (this will include prospective dividends) by the current price per share, then multiplying by 100 to arrive at a percentage figure.

Disclaimer:

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc