Over the past decade, and arguably for most of the 21st Century thus far, risk assets have been rallying, with any pullback providing an opportunity to load up with more purchases (‘buying the dip’), effectively taking advantage of central banks’ put option. Concurrently, diversification through a balanced portfolio of equities and bonds has benefited from low or negative correlation between these two asset classes. This has fed through to a long and durable bull run in both equity and bond markets.

This ‘buy the dip’ era and the bond/equity powerhouse of strong returns and low correlations were a manifestation of an ever-lower interest rate environment, minimal inflationary pressures and loose fiscal policy post the Global Financial Crisis. However, if you go back further, to the period that spanned the late 1960s to the turn of the century, this negative correlation was reversed – ie. correlation between equities and bonds was strongly positive.

Every market paradigm has a lifespan

From our view, we now appear to be shifting towards a very different world, where the trend of onshoring, self-interest and a higher r* (R-star) rate of interest prevail. This is leading to concerns about the risk of higher inflation, the path of interest rates and global growth, with consequent impacts on corporate decisions, from freezes on recruiting to pauses in capital spending.

Just consider senior management Q4 earnings calls’ outlook statements, with many companies removing forecasts altogether:

Mention of tariffs jumped:

“And whatever tariff we cannot mitigate, we view that as an input cost. And as our input costs go up, it may require us to adjust prices.” Jeff Clarke, COO, Dell Technologies Inc., February 28, 2025

CEOs increasingly discussed uncertainty:

“And maybe there are some pockets in some industries where some aspects of the policy uncertainty that we might be facing are making them a little bit more cautious than they otherwise would be about what they’re executing in the near term.” Jamie Dimon, CEO, JPMorgan Chase & Co, 15 January, 2025

In addition, we see concerns about the ability of governments to fund their staggering long-term debt obligations, with yields on longer duration bonds rallying recently – more so since US President Trump’s “Big, Beautiful, Bill” received approval. The US dollar is no longer seen as the safe haven asset it used to be (the Trade-Weighted US Dollar Index has fallen steadily from its peak in early January).

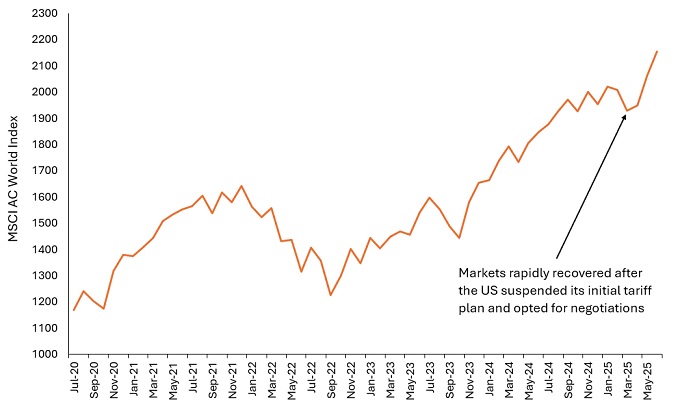

At the same time, the move to private, more opaque markets, is increasing, just as the pioneers of that trend – Yale and Harvard for example – are selling down their positions. Given such indecision and uncertainty, it seems appropriate to consider the future path for risk assets, particularly at a time when the MSCI All Country World Index is setting all-time highs (Exhibit 1), following its pull back in April, despite continued tariff uncertainty.

Exhibit 1: Global equities have rebounded from tariff uncertainty to hit record highs

Source: Bloomberg, Janus Henderson Investors, 9 July 2020 to 8 July 2025. Past performance does not predict future returns.

However, behaviour takes time to catch up. ‘Buying the dip’ has been the cornerstone of some investors’ entire careers. It also seems to be driving the herd mentality in some retail areas – note the rally in the S&P 500 following President Trump’s “buy equities now” call. The need to wean investors off this addiction of doubling down is now urgent, as the confidence interval around any forward-looking economic indicators or market outlook is wider than ever.

The need for the investment management industry to promote diversification in client portfolios is paramount to help secure their financial futures. Investors have arguably over-earned through this glorious period for risk assets. The need to re-invest those excess returns in asset classes that demonstrate a robust as well as lowly correlating return is more important than ever.

Why now?

This recent period of market volatility and investor uncertainty has generally been a positive one for liquid alternative strategies, and the landscape continues to improve:

• While implied volatility spiked sharply on ‘Liberation Day’ – positive for diversifiers as the bellwether VIX fear gauge reached an intraday high of 60.3 in April, its highest level in eight months. It has since collapsed to nearer 16.0. The cost of option protection against market volatility has also normalised. These mean that the cost of protection against market volatility spikes has reduced.

• When providing liquidity to trading markets, such as block trades and secondary offerings, discounts have widened, leading to the potential for price pressure strategies to deliver higher returns as risk premia is now wider.

• An orderly Initial Public Offering (IPO) market looks to be resurfacing, with companies performing strongly on their debut. This should unlock private equity supply as they seek to monetise their inventory and return capital to investors.

• Convertible new issuance is increasing as Chief Financial Officers (CFOs) realise they can pay cheaper coupons than with straight debt, which they are having to issue to refinance maturing loans that were originally issued in a lower interest rate environment.

• Regulation is easing for mergers and acquisitions (M&A), which should lead to increased opportunities for event-based strategies.

Strategies for a changing market

The term ’alternatives’ encompasses a wide range of non-traditional assets, with differentiated drivers of performance, capable of flourishing in a wide range of distinctive market conditions. Trend-following and commodities strategies, for example, have historically been two areas that do well during periods of higher inflation.

Alternatives offer investors a rich environment of potential tools (strategies) that can add meaningful diversification to a broader balanced strategy, potentially critical at a time when formerly reliable market dynamics are breaking down, and the relationships between asset classes are changing. This is the kind of environment where investors are going to be looking for areas that differentiate themselves from the mainstream.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

MSCI All Country World IndexSM reflects the equity market performance of global developed and emerging markets.

R-star: The neutral rate of interest, also known as the long-run equilibrium interest rate, is an estimated level at which interest rates are neither expansionary or contractionary, if the economy were at full employment and with stable inflation. It is used to help guide central banks’ assessment of whether interest rates are stimulating or impeding growth in the economy.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Trade-Weighted US Dollar Index: This index measures the value of the US dollar against a basket of 26 other currencies.

VIX: The short-form name for the Chicago Board Options Exchange’s CBOE Volatility Index, a commonly used indicator of the stock market’s expectations for volatility over the following few weeks.

IMPORTANT INFORMATION

Alternative investments include, but are not limited to, commodities, real estate, currencies, hedging strategies, futures, structured products, and other securities intended to be less correlated to the market. They are typically subject to increased risk and are not suitable for all investors.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Private credit refers to direct lending or debt financing outside of traditional banking, typically involving non-publicly traded companies, and comes with increased risk including limited liquidity, reliance on the borrower’s financial health, and less regulatory oversight compared to traditional bank lending.

Initial Public Offerings (IPOs) are highly speculative investments and may be subject to lower liquidity and greater volatility. Special risks associated with IPOs include limited operating history, unseasoned trading, high turnover and non-repeatable performance.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall. High yielding (non-investment grade) bonds are more speculative and more sensitive to adverse changes in market conditions.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- SPACs are shell companies set up to acquire businesses. They are complex and often lack the transparency of established companies, and therefore present greater risks to investors.