Paul O’Connor, Head of the UK-based Multi-Asset Team, reviews a momentous first quarter for investment markets worldwide. He discusses the impact of the coronavirus pandemic across asset classes and covers the positive and negative indicators that are guiding his views on market prospects for the remainder of 2020.

Key takeaways

- Global stock markets endured their worst Q1 ever as the anxiety caused by the spread of COVID-19 shattered previously held assumptions about the outlook for 2020.

- While lockdown measures are expected to have a significant short-term impact on global economic activity, extraordinary monetary and fiscal response could lift the

global economy back into expansion in the second half of the year. - Investor sentiment is likely to remain prone to occasional setbacks, given the extraordinary nature of this event. However, high volatility market regimes like this should create many opportunities for active asset allocation to add value to portfolios.

The first three months of 2020 go down in history as the worst Q1 ever for global stock markets. Many measures of market stress reached levels last seen in the Global Financial Crisis and some price moves were on a scale not witnessed since the great Crash of 1929. The surge in market volatility reflects one of the most abrupt adjustments in investor sentiment ever seen, from the carefree complacency of mid‑February, to the deep anxiety of a world overshadowed by the rapidly spreading COVID-19 pandemic.

No roadmap

COVID-19 has changed everything. It has shattered many previously held assumptions about the economic, market and political outlook and has swept in a fog of uncertainty that will take many months to clear. Given the wide dispersion of views among epidemiologists about how COVID-19 could evolve, it is hardly surprising that investors still have little conviction about how the virus will ultimately affect the world economy and financial markets. There is no obvious historical playbook that can help us navigate the road ahead.

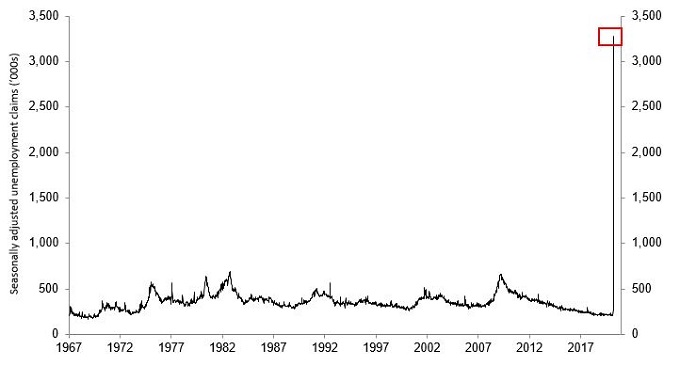

The scale and speed of recent revisions to consensus growth forecasts highlight the challenge of calibrating the economic dimensions of the coronavirus shock. While, just over a month ago, economists were expecting 2020 to be an unremarkable year for the global economy, forecasts are now for a significant decline (perhaps 5-10%) in real GDP in the first half of 2020 in many major economies — a deeper plunge than seen during any similar period in the 2007–09 financial crisis. Unemployment is expected to surge in most countries, with many forecasts predicting high single digit rates for the UK and the US. US weekly unemployment claims have already risen to levels never seen before in the 40-year history of this data series:

Exhibit 1: US initial unemployment claims

Source: Bloomberg, Janus Henderson Investors, June 1967 to March 2020.

Big problem — big solution

As the macro outlook has darkened, equity earnings and dividend expectations have been slashed and credit analysts have swiftly repriced corporate bond default risk. Still, while the ubiquitous comparisons with the Great Depression and the Global Financial Crisis are undoubtedly troubling, we are wary of leaning too hard on these analogies. For one thing, the response of central banks to the unfolding crisis has been unprecedentedly large and swift. Also, governments have responded quickly and forcefully, introducing a wide range of fiscal relief programmes in the major economies. While COVID-19 containment measures are estimated to reduce income in the G20 by about US$1.4 trillion in the first half of 2020, these fiscal initiatives look set to deliver offsetting support worth around US$1.8 trillion.

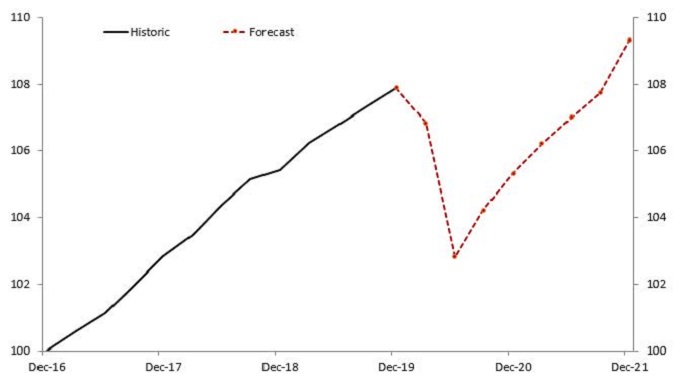

So, while lockdown measures are expected to depress global economic activity by more than anything seen since the Great Depression, the extraordinary monetary and fiscal response is expected to lift the global economy back into expansion in the second half of the year. In fact, most forecasters are predicting that 2020 could see one of the shortest recessions ever. Still, the recovery will undoubtedly be slower than the slump and the global economy seems unlikely to fully recover from the coronavirus until well into 2021.

Exhibit 2: US real GDP index (Dec 2016 = 100)

Source: Bloomberg, Janus Henderson Investors, as at 1 April 2020. Projection is based on Bloomberg weighted average of consensus forecasts.

Light at the end of the tunnel

Of course, the global economic situation remains highly fluid and economic forecasting seems more speculative than ever. Most economic projections look sure to see many revisions in the weeks ahead, as perceptions of the coronavirus evolve. Optimistic scenarios might focus on the trajectories that the infection took in China and South Korea, where the virus was contained in a couple of months. Recent developments in Italy – the first European country to be seriously affected by COVID-19 – are also fairly encouraging. While the number of confirmed coronavirus cases in Italy was growing at around 40% a day at the start of March, it ended the month in mid-single-digit growth rates. Other European countries, such as Germany and Spain have also seen infection rates slow significantly in recent weeks.

Of course, it is not hard to find more pessimistic coronavirus developments. In China, for example, there is a clear risk of a second wave of infection, now that over two hundred million migrant workers have travelled back to their places of employment. COVID-19 penetration has generally been low in other emerging economies so far (Brazil aside), but many could face significant financial, social and political strains if infection rates do pick up. The forthcoming winter in South America is a potential key risk factor here. For now, however, the US is the key area of focus, with infection rates surging and questions persisting about the effectiveness of current containment policies. Concern here is not only about the scope for higher infection rates, but also on the ability of a country with an expensive healthcare system and partial healthcare insurance coverage to absorb the unfolding surge in COVID-19 cases.

Beyond these national dynamics, a few other key issues might play a major part in shaping market perceptions about the evolving pandemic. While a few recent press reports have carried claims that therapeutic solutions to COVID-19 are close to being found, the general consensus in the scientific community seems to be that neither these solutions, nor vaccines, are likely to be available in the next year. One positive potential development that seems to be closer is the widespread availability of serological tests. These would evaluate whether individuals had been previously infected by COVID-91, giving insight into overall levels of immunity and identifying who can safely return to work. Many major countries are now racing to get hold of such tests, but there is some uncertainty about when they will be widely available.

Markets remain fragile

Given the speed of COVID-19’s spread and the broad range of epidemiological and economic outcomes, it is hardly surprising that financial market sentiment remains so frail. The forceful policy response from major central banks has dramatically restored liquidity to financial markets, allowing frantic investor deleveraging to proceed in a more orderly way. However, while monetary policy has significantly reduced some systemic risks, it cannot alter the path of the virus, nor meaningfully dispel the uncertainty surrounding its ultimate economic impact. A sustainable improvement in market confidence is likely to require greater clarity that the coronavirus lockdowns are working and a belief that the extraordinary plunge in economic activity is getting close to a bottom.

Central banks rescue defensive assets

In terms of our multi-asset strategies, we have taken two broad steps towards putting cash to work during the recent sell-off. During the middle weeks of March, when everything was for sale, we added exposures where we saw distressed selling in index-linked government bonds, investment grade corporate debt and in gold. We believe that the recent central bank interventions are a game changer for these defensive assets and should restore their defensive characteristics following a few wild weeks in which they got caught up in broad-based multi-asset ‘liquidation’ selling activity.

At the riskier end of the spectrum we have begun to rebuild exposures to equities, encouraged by contrarian readings from a wide range of indicators of investor sentiment and positioning and the impressive policy response on the fiscal and monetary fronts. We are also encouraged by decelerating COVID-19 infection rates in Iran, South Korea and most of the major European countries. We do nevertheless begin Q2 with some firepower kept in reserve, where risk assets are concerned. Even though we have seen many of the classic conditions for a market bottom fall into place in recent weeks, we expect that the extraordinary nature of the challenges currently facing investors will keep the recovery in investor sentiment hesitant, fragile and prone to occasional setbacks.

Opportunity in volatility

Whereas many market crashes have been followed by V-shaped recoveries in asset prices, we expect a more protracted power struggle between bulls and bears this time, until the evidence swings more decisively in one direction. This is an environment in which market volatility will probably be slow to subside, creating many opportunities to both buy dips and to sell rallies. While buy‑and‑hold investing can be an efficient strategy in strongly trending markets, high volatility market regimes like this should create many opportunities for active asset allocation to add value to portfolios.

The second quarter of 2020 begins with solid arguments on both sides of the ledger. Pessimists will have a few months of depression-like economic data to highlight, as well as rising corporate bond default risks — plus sizeable downgrades to corporate earnings and dividend forecasts. They will also be able to point to the threat of a second wave of COVID-19 reinfections in China, as workers return to employment, and to the possibility of further second wave activity elsewhere when winter arrives.

In the nearer term, a continuation of the recent improving trends in COVID-19 infection rates in Europe should certainly help to tilt the scales towards the bull case, as could any progress towards the broad availability of coronavirus testing capabilities. Beyond the virus, while we feel that policymakers in the major economies have played most of their cards, for now, we do still see scope for China to deliver more growth-boosting stimulus measures in the months ahead. Aside from that, developments in the oil sector should be watched closely. The recent collapse in the price of oil initiated a shockwave of volatility that reached many other asset classes. Any signs of stability in oil prices should help to ease volatility across markets more broadly.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.